The air shimmers with the promise of artificial spring. Two giants, Alphabet and Microsoft, stand as the orchards of this new season, each tending its rows in a manner distinct as the turn of a hand. To choose between them is not merely to select a stock, but to discern which garden will bear the more enduring fruit. The question is not simply what they grow, but how they cultivate the future.

Both offer a compelling harvest, yet one feels… more rooted. The market, as always, rushes toward the visible bloom, but a true investor looks to the strength of the unseen root system.

Microsoft: The Careful Gardener

Microsoft does not, it seems, aspire to be the rain itself, but rather to channel its flow. They have wisely chosen to nourish the seedlings grown by others – OpenAI, in particular. A substantial stake, yes, but a holding, not a complete immersion. It is a strategy of leverage, a calculated restraint. They are the estate manager, not the original sower.

This approach grants a breadth of possibility. Azure Foundry, their cloud platform, is a sprawling marketplace of generative models – Grok, Claude, R1 – a diverse ecosystem. They are the curators of intelligence, not solely its creators. A prudent course, perhaps, avoiding the immense capital expenditure of birthing a new consciousness. It is a position of influence, a gentle steering of the current.

Alphabet, in contrast, has chosen the path of direct creation. Gemini, once a fragile sapling, now strives for the sun. It is a bold undertaking, a gamble on internal innovation. To forge the algorithm itself requires immense resources, but also grants absolute control. They are the architect of the intelligence, shaping it to their will.

Furthermore, Alphabet possesses a wealth of inherited knowledge, gleaned from the countless interactions within their ecosystem – the whispers of email, the murmurs of YouTube. This intimacy allows for a tailoring of the algorithm, a personalization that could prove invaluable. The cost is substantial, of course, but a true orchardist understands that the finest fruit demands the greatest investment.

Alphabet’s ambition has indeed propelled it to a larger stature, a more imposing presence in the market. But does size alone guarantee a richer harvest?

Growth, Measured in Sunlight

Both companies have demonstrated a remarkable vitality, a flourishing even amidst the complexities of the present. Microsoft’s revenue rose a robust 17%, earnings per share surging 60% – a testament to the power of leverage and the burgeoning value of its OpenAI investment. Though the full bloom is somewhat obscured by accounting, the underlying growth remains undeniable.

The true measure of Microsoft’s progress lies in the expansion of Azure, a window into the investment in artificial intelligence. A 39% increase in revenue speaks volumes, a clear indication of a thriving ecosystem. It is a quiet strength, a steady accumulation of resources.

Alphabet, however, has not been idle. Revenue increased by 18%, earnings per share by 31%. A comparable performance, yet the true brilliance lies in the growth of Google Cloud. A 48% increase – a veritable explosion of vitality – outpacing Azure and signaling a shift in the landscape. This is where the true potential lies, in the ability to cultivate a cloud that surpasses all others.

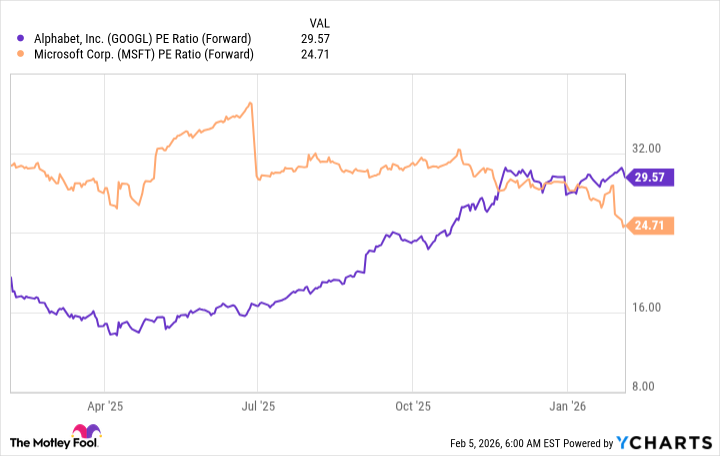

Yet, valuation remains the decisive factor. Microsoft, following a recent correction, offers a more accessible entry point. A shrewd investor recognizes the opportunity in a temporarily undervalued asset. It is a moment to acquire strength at a reasonable price.

Both stocks represent an excellent investment, poised to benefit from the inexorable rise of artificial intelligence. But in this particular season, Microsoft offers the more fertile ground – a balance of growth, value, and the promise of a bountiful harvest. It is a choice not merely of profit, but of participating in a future that is unfolding with the inevitability of spring.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-09 11:53