The market, it seems, suffers from a particularly acute form of amnesia. One week it’s chasing the phantom of artificial intelligence, the next it’s recoiling as if bitten by a rabid wolf. The spending, however, continues. A quiet, insistent rain of capital falling upon the silicon fields. We’ve had glimpses of the 2026 projections from the usual suspects – the hyperscalers, as they’re so blandly called – and the figures are, shall we say, robust. One might almost suspect a collective delusion, a fever dream of exponential growth. But no, the numbers are there, staring us in the face. The buildout is far from concluded; it’s merely entering a more… expensive phase.

This compels a certain optimism, naturally. A portfolio manager is, after all, a creature of habit, and habit dictates a pursuit of value. And within this swirling vortex of skepticism, two names present themselves with a certain… solidity: Nvidia (NVDA 1.70%) and Broadcom (AVGO 3.38%). Both are positioned to benefit handsomely from this ongoing expenditure, and appear, at present, to be rather… reasonably priced. Though reason, one must admit, is a commodity in short supply these days.

The Appetite of the Machine

Let us consider the scale of this… indulgence. Amazon, Alphabet, and Meta Platforms. These are not merely companies; they are digital leviathans, each with an insatiable appetite for computing power. They are building not just infrastructure, but cathedrals of data, monuments to the algorithm. Amazon anticipates spending some $200 billion, Alphabet up to $185 billion, and Meta a mere $135 billion. Combined, that’s over half a trillion dollars. One begins to suspect they are attempting to recreate the universe itself, byte by byte. And let us not forget Microsoft, who also participates in this… grand game.

There are others, of course, countless smaller players, each contributing to the overall frenzy. The reality is that AI spending isn’t diminishing; it’s accelerating. Investors may fret about excess, about unsustainable valuations, but that doesn’t invalidate the underlying demand. To ignore the profit potential of companies supplying this demand – Nvidia and Broadcom, specifically – would be akin to refusing a glass of vodka at a winter festival. A peculiar choice, to say the least.

Nvidia, naturally, is the established player. Their graphics processing units (GPUs) have become the standard currency of the AI revolution, much like samovars were to 19th-century Russia. They’ve built a complete ecosystem, a self-contained world where everything you need can be purchased from a single source. It’s a rather… efficient arrangement, if somewhat lacking in poetic charm.

Broadcom, however, operates on a different principle. Instead of attempting to conquer the entire landscape, they’ve chosen to specialize. They partner directly with the hyperscalers, designing custom chips tailored to their specific needs. Alphabet and Broadcom’s Tensor Processing Unit (TPU) is a prime example – a wildly popular design, and a source of considerable revenue for Broadcom. As Alphabet’s spending soars, so too will their demand for TPUs. It’s a rather… elegant solution, really. A quiet partnership, free from the vulgarity of mass production.

And there are others, of course. Other hyperscalers, each seeking to diversify away from Nvidia’s dominance. They are turning to Broadcom, seeking a reliable alternative. It’s a rather… predictable development, really. A healthy dose of competition is always welcome. Though one suspects Nvidia will not relinquish its crown without a fight.

Both companies stand to benefit, naturally. But they are also, quite simply, good buys. At present, they offer a compelling value proposition.

The Illusion of Cheapness

Wall Street analysts anticipate 52% revenue growth for both Broadcom and Nvidia this fiscal year. A rather… optimistic projection, to be sure. But it’s based on solid fundamentals. The AI boom is far from over. And yet, the market seems determined to ignore this success. It’s as if they are deliberately looking for reasons to be pessimistic. A curious habit, to say the least.

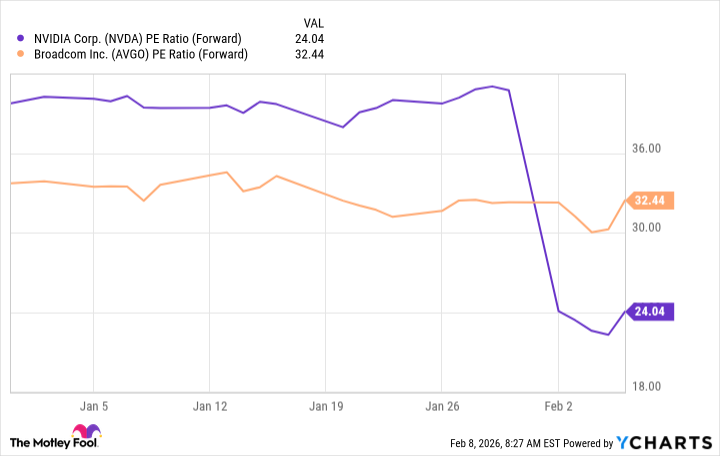

Nvidia, at 24 times forward earnings, appears to be the cheaper of the two. Broadcom, at 32 times, is more expensive, but its success is less certain. It’s heavily reliant on a handful of clients. Still, I find myself leaning towards Nvidia. It’s the more established player, with a more diversified revenue stream. A slightly safer bet, if one is inclined towards such things.

With this immense capital flowing into AI hardware, one would expect Nvidia and Broadcom’s stock prices to be soaring. And yet, they are falling. A rather… perplexing situation, to say the least. An opportunity, perhaps? A chance to acquire two of the most promising growth stocks of our time at a discounted price? One can only hope. The market, after all, is rarely rational. It’s a capricious beast, prone to fits of hysteria and bouts of melancholy. But for those willing to look beyond the noise, there are still opportunities to be found. And in the grand scheme of things, that’s all a portfolio manager can ask for.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-02-13 00:33