Nvidia, a name now whispered with the reverence once reserved for icons and slightly mad inventors, currently holds the dubious honor of being the most… substantial company in the world. Its market capitalization, a figure so large it threatens to destabilize the very foundations of numerical logic, stands at $4.5 trillion. They manufacture slivers of silicon, these Nvidia people, and upon these slivers rests the fate of artificial intelligence. One might even say they’ve captured a sort of digital soul, though whether that soul is benevolent or merely calculating remains, thankfully, a matter of conjecture. They have partnerships, naturally. A vast, sprawling web of agreements, each one meticulously documented in triplicate and bound in a shade of blue that suggests both authority and a profound melancholy.

However, I suspect this reign is…temporary. A fleeting moment of silicon supremacy. The crown, I predict, will soon rest upon a different brow. Not that Nvidia is inherently flawed – far from it. It is merely…vulnerable. And the challenger? Alphabet. Yes, that Alphabet. The one that began with a search engine and has since accumulated a portfolio of projects so diverse it resembles the cluttered workshop of a particularly eccentric artisan.

The Undervaluation of Everything, or, Why Investors are Often Mistaken

There was a time, you see, when the investment community regarded Alphabet with a sort of…pitying amusement. They questioned its ability to navigate the treacherous waters of artificial intelligence. They feared, quite rightly, that a poorly designed chatbot could unravel years of carefully constructed search dominance. Bard, the initial attempt, was…a learning experience. A digital fledgling, stumbling and squawking, prone to delivering pronouncements of dubious accuracy. It was, one might say, a reflection of the human condition itself.

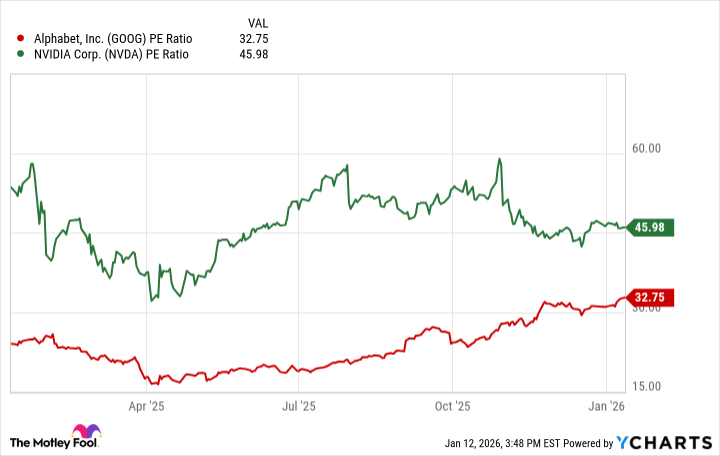

But Alphabet, like a determined beetle, persisted. And now, we have Gemini. A chatbot that, while not entirely free of eccentricities, is proving capable of holding its own against the digital gladiators of the AI arena. The core business, meanwhile, continues to hum along, generating revenue with the relentless efficiency of a well-oiled automaton. And investors, belatedly, are beginning to recognize the value that lies within. The price-to-earnings multiple, while rising, remains, shall we say,…reasonable. Compared to Nvidia, it is almost…modest. A quiet, unassuming sum, as if Alphabet were deliberately attempting to avoid attracting undue attention.

Nvidia’s Predicament, or, The Perils of Unsustainable Growth

Alphabet’s relative undervaluation is not the whole story, of course. Nvidia, while undeniably impressive, faces challenges of its own. Its dominance, you see, is predicated on a single, rather precarious assumption: that it can continue to grow at an impossible rate. The latest earnings report, with a sales increase of 62%, is…remarkable. But such growth is unsustainable. It is like attempting to build a tower to the heavens – eventually, the foundations will buckle.

The competition, naturally, is not standing still. Other tech companies, emboldened by the prospect of capturing a share of the AI pie, are developing their own chips. Alphabet, among them. This, inevitably, will erode Nvidia’s market share. It is the natural order of things. A constant, relentless struggle for survival. Like a swarm of locusts descending upon a field of wheat.

Any sign of weakening demand, any hint that the AI boom is slowing, could send Nvidia’s stock into a tailspin. It appears cheap, yes, trading at 24 times future earnings. But that valuation is based on optimistic projections. Projections, I might add, that are becoming increasingly…tenuous. If the market for AI chips falters, if tech companies begin to tighten their belts, Nvidia will be among the first to suffer. Alphabet, with its diversified business, is better positioned to weather the storm. It is like a ship with multiple anchors, securely fastened to the seabed.

The Algorithm and the Alphabet: A Matter of Value

Both companies, of course, are solid investments. If your goal is to buy and hold for the long term, you could hardly go wrong. However, Alphabet, in my estimation, offers a more attractive value proposition. Its valuation is more reasonable, its business is more diversified, and its growth opportunities are plentiful. It is, quite simply, the safer bet. The more…sensible investment.

If investors had not underestimated Alphabet’s potential, if they had recognized its inherent value sooner, it would likely already be the most valuable company in the world. And as the year progresses, I believe that outcome is inevitable. With a market capitalization of around $4 trillion, it is already breathing down Nvidia’s neck. The algorithm, it seems, is beginning to favor the Alphabet.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top 15 Insanely Popular Android Games

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2026-01-16 08:02