In the annals of modern alchemy, where silicon is the philosopher’s stone and venture capitalists guard their ledgers like dragons hoard gold, we find ourselves at the crossroads of dividends and destiny. Here, the Guild of Alchemists and Venture Capitalists¹ has crowned a new High Magus: Jensen Huang, the gilded sorcerer of Nvidia, who whispers secrets to the silicon spirits that power our age.

Huang, a man whose mind operates on a plane where differential equations dance with tea leaves, does not merely “understand” artificial intelligence. He communes with it, as one might commune with a particularly argumentative ghost in a steam-powered calculating engine.²

Yet beyond Huang’s crystalline foresight looms another figure: Mark Zuckerberg, the Archmage of Meta Platforms, whose tower now bristles with freshly hired wizards of machine learning. Rumors swirl that these recruits were lured from rival covens—OpenAI, Alphabet, and Apple—with golden sigils worth a hundred million dollars.³

At the All-In Summit, a gathering where billionaires consult their profit oracles, Huang offered cryptic blessings upon Zuckerberg’s quest. But let us not mistake a polite nod for a royal charter.⁴

The Oracle’s Ambiguous Blessing

lesser-known covens that built rival models with similar numbers, like apprentice wizards outdoing their masters.

But heed the footnotes of history: OpenAI, a private sect, keeps its coffers locked tighter than a dwarven vault. Yet whispers suggest their annual recurring revenue has doubled—a feat akin to turning lead into twice-as-much-lead, only shinier.⁵

The Unseen University of Coders

Meta’s new Superintelligence Labs, one might argue, resembles the Unseen University of old—where wizards debated metaphysics while ignoring the small matter of reality. But in this realm, the stakes are higher: competing against incumbents with first-mover advantages sharper than a goblin’s dagger.

Huang’s words, while warm as a hearthfire, stop short of an endorsement. He praises the strategy, not the certainty of victory. A subtle distinction, like the difference between a dividend yield and a lottery ticket.⁶

The Dividend Hunter’s Dilemma

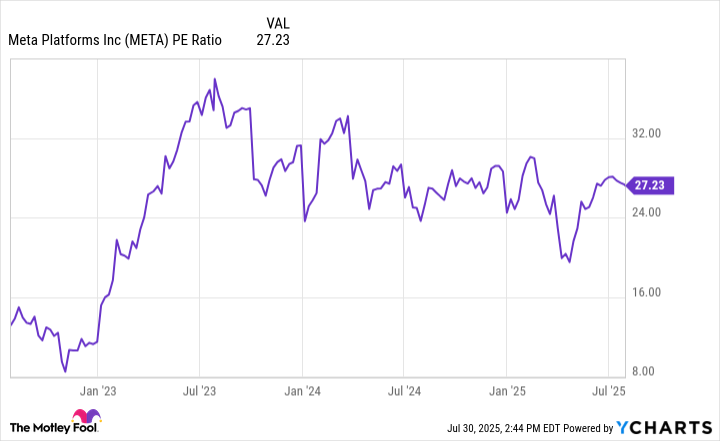

Meta’s valuation, once inflated like a balloon at a noble’s feast, has deflated considerably. The market, that fickle beast, seems to have forgotten the seeds Zuckerberg planted years prior—when coins were diverted from the metaverse’s bottomless pit into AI’s shimmering well.

Yet herein lies the paradox: A company poised to harness AI’s golden goose trades at a price that assumes the goose has been eaten by wolves. Or perhaps the wolves are eating the goose. The metaphor grows murky.⁷

For the dividend hunter, the calculus is simple: When does potential outweigh doubt? Meta’s current valuation suggests the market believes Zuckerberg’s wizards will fail to conjure revenue from AI’s cauldron. But history favors the bold—or at least those who bought low before the alchemical breakthroughs.

In conclusion, Meta’s stock appears less a gamble and more a foregone certainty, assuming the wizards succeed. And if they fail? Well, at least the dividend yield will grow like mold in a damp crypt until someone notices it again. 🏦

¹ A guild where alchemists attempt to transmute base metals into gold, and venture capitalists attempt to transmute base startups into unicorns. The results are similarly dubious.

² Rumors that Huang’s office contains a time-traveling typewriter are unconfirmed, but plausible.

³ One wonders where they found the gold. Probably buried under a mountain, like proper dragons.

⁴ The summit’s official beverage: $500-per-glass kombucha brewed from the tears of failed entrepreneurs.

⁵ Economists debate whether recurring revenue constitutes “real” money or merely a particularly convincing illusion.

⁶ Huang’s neutrality is so precise it could balance on a quill. In a windstorm.

⁷ The author apologizes for the metaphor’s collapse. The market is a cursed labyrinth, and we are all Minotaurs within.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-02 23:24