Many years later, as they sifted through the digital ruins of forgotten portfolios, investors would remember the autumn of 2025 as the season when the streaming colossus first whispered its quarterly riddles through the silicon winds of October. The date-October 21-loomed like a celestial conjunction, a day when the veil between present earnings and future fortune would momentarily thin.

Beneath the ochre glow of Los Gatos’ streetlights, where the company’s headquarters stood sentinel like a temple to algorithmic divinity, the air hummed with the static of 300 million simultaneous dreams. Here, in this nexus of fiber-optic veins and server-farm incense, Netflix prepared to unveil its third-quarter auguries-a ritual as old as commerce itself, yet rendered novel by the alchemy of bytes and bandwidth.

The Oracle of Accelerating Curves

By the banks of the Mississippi of data streams, where content flowed like liquid amber, Netflix had become a cartographer of human attention. Its advertising tier-a siren song at $7.99-had seduced half the newcomers in its dominion, each signup a lotus blossom blooming atop a monetization engine. The math defied Euclid: subscribers multiplied like enchanted coins, their collective gaze transforming ad slots into golden chalices.

When Q2’s $11.1 billion cascade materialized-a 15.9% surge over ancestral quarters-the numbers danced a waltz only Wall Street’s astrologers could interpret. Management’s prophecy for Q3 ($11.5 billion, +17.3%) hung in the air like incense smoke, its scent mingling with the metallic tang of server farms. To question the trajectory was to doubt the moon’s pull on tides.

The Necromancy of Content Spending

With $10.2 billion in annual net income clinking like pirate treasure in its vaults, Netflix had become the Midas of Mithras-its touch transmuting scripts into spectacles, actors into demigods. The $18 billion war chest for content creation wasn’t mere expenditure; it was a blood pact with the Fates to conjure phantoms like the NFL’s Christmas Day spectacles, where 30 million souls once gathered to witness touchdowns as divine omens.

Live sports, that most ancient of entertainments, now glowed neon on screens worldwide-a digital Colosseum where Canelo Alvarez and Terrence Crawford drew 41 million spectral witnesses. Each streaming hour became a thread in the Loom of Engagement, weaving ads into the subconscious like forgotten lullabies.

To Buy or Not to Buy: The Delphic Riddle

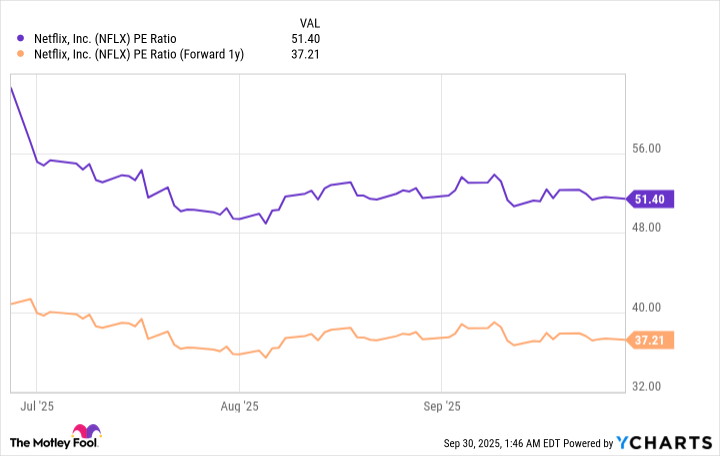

The stock’s 51.4 P/E ratio loomed like the Sphinx’s riddle-impenetrable to short-term scribes scribbling in the margins of quarterly scrolls. Compared to the Nasdaq-100’s 32.6, it seemed the fever dream of a numerologist. Yet analysts, those modern soothsayers, prophesied $32.39 EPS by 2026-a forward P/E of 37.2 that demanded a 38% ascent just to maintain equilibrium.

For those who could wait out the storm-investors with patience as deep as the Mariana Trench-the calculus shifted. Time became an alchemist, transmuting today’s price into tomorrow’s parable. The earnings call on October 21 wasn’t merely a report; it was the opening of a time capsule, its contents destined to become legend.

And so, as the digital clock ticked toward the prophesied hour, the question dissolved into its own answer-a truth as self-evident as the moon’s phases: All investments are parables, and Netflix, dear reader, is currently writing chapter seventeen. 🎬

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Opendoor’s Stock Takes a Nose Dive (Again)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-10-02 13:00