The S&P 500, that most steadfast of long-term wealth builders, has averaged an 8% annual return since 1928—a figure that, while respectable, pales in comparison to the meteoric rise of certain enterprises. To transform $1,000 into $1 million at such a rate would require a patience bordering on asceticism, a virtue few possess. Yet, as the fabled unicorns of the market, these rare beasts—companies that defy the median—have achieved such feats with a swagger that beggars belief.

Consider, if you will, two titans of commerce, their names now synonymous with the very fabric of modern life. They began as mere cogs in the vast machine of consumerism, yet their trajectories ascended with a fervor that defies the ordinary. Their stories, though etched in triumph, are not without their peculiarities.

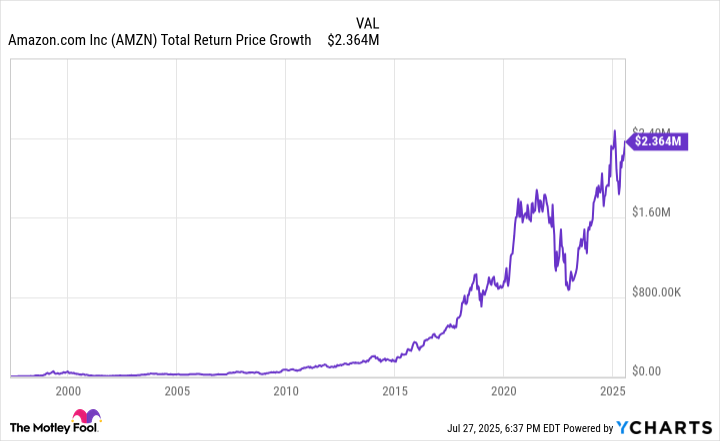

1. Amazon

Amazon, that paragon of e-commerce, began as a humble online bookseller, a mere whisper in the annals of retail. By 1997, its IPO marked the dawn of a new era—a time when $1,000 invested would now command over $2 million. Yet, unlike the dividend-obsessed, Amazon chose to reinvest its spoils, a decision as audacious as it was prudent. Its empire now sprawls from cloud computing to streaming, a testament to its relentless pursuit of growth, though one might question whether such expansion is a virtue or a vice.

Today, Amazon’s market cap eclipses all but the most storied of conglomerates. Its dominance in e-commerce is but a footnote in its broader saga. The cloud, once a niche, now fuels its profits, while artificial intelligence looms as both a promise and a peril. One wonders if such scale, once a blessing, has become a burden—a company too vast to be truly agile, yet too vital to ignore.

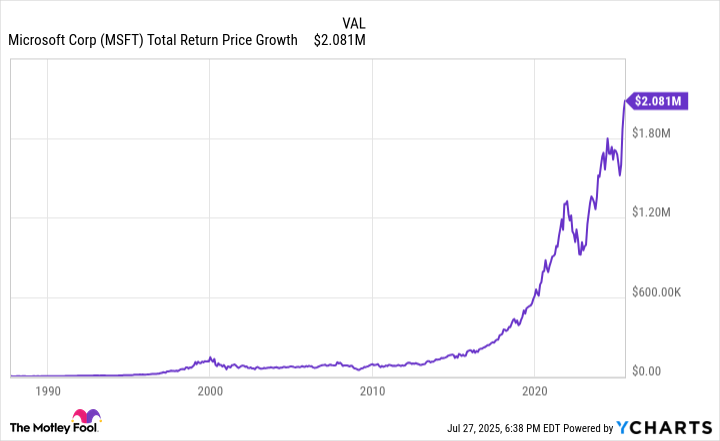

2. Microsoft

Microsoft, that venerable titan of technology, has long since transcended its origins as a purveyor of operating systems. Since 1985, its stock has transformed $1,000 into a fortune, a feat achieved not through reckless speculation but through a steady, almost monastic, dedication to innovation. Its products, from Word to Azure, now form an ecosystem so entrenched that to dislodge them seems as futile as challenging the sun’s arc.

Microsoft’s financial might is matched only by its cultural influence. It pays dividends, a rarity among tech giants, and has sustained them for 23 years—a streak that speaks to both prudence and a certain disdain for the ephemeral. Yet, even here, the specter of hubris lingers. The company’s foray into smartphones, a misstep as glaring as it was costly, serves as a reminder that even the most disciplined can falter.

For the value investor, these tales are both inspiration and caution. They underscore the importance of addressing markets of staggering size, of fostering cultures that prize innovation, and of recognizing the power of network effects. Yet they also whisper of the perils of overreach, of the fine line between empire and excess. In the end, the lesson is simple: seek companies that grow not for the sake of growth, but for the quiet conviction that they are indispensable.

🧠

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Gay Actors Who Are Notoriously Private About Their Lives

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of Choice: Chipotle and Dutch Bros

2025-07-30 11:11