Right. So, the Magnificent Seven. It’s a rather grand name, isn’t it? Suggests swashbuckling heroes, when really it’s just a group of tech companies spending a frankly terrifying amount of money on… well, everything. Specifically, artificial intelligence. Which, let’s be honest, mostly feels like a very sophisticated way to get targeted ads. But the spending! Oh, the spending. It’s enough to give anyone palpitations.

Units of Cryptocurrency Lost: 12. Hours Spent Watching Charts: 9. Number of Panicked Texts to Friends: 24. It’s a cycle, really. I convince myself I need to understand the macro trends, then I get overwhelmed by the numbers, then I buy something ridiculous, then I regret it. Repeat ad nauseam.

The latest figures are… substantial. Apparently, they’re collectively planning to spend over $680 billion on capital expenditure, mostly on this AI stuff. It’s like a tech version of the Cold War, only instead of missiles, it’s data centers. And everyone’s desperate not to be left behind. Amazon is leading the charge, up to $200 billion this year. Alphabet (Google) is not far behind, almost doubling their spending. Microsoft, well, they’re already halfway through their fiscal year and have already spent a truly horrifying amount. Meta, surprisingly, seems to be getting some actual benefit from this, which is… encouraging. Tesla is throwing money at robotaxis and humanoid robots. Optimus. Honestly. It sounds like a science fiction film. And Apple? They’re lagging, which is either sensible caution or a recipe for disaster. It’s hard to say.

Nvidia, of course, is different. They’re not spending so much as facilitating the spending, selling the chips that make it all possible. It’s a brilliant business model, really. Like selling shovels during the gold rush. Much less risky.

The thing is, last year, news like this would have sent these stocks soaring. Now? It’s… muted. Meta got a boost because they actually showed how this AI spending is translating into revenue. But Microsoft? They reported 15 million paying Copilot customers, which sounds impressive, until you realize that’s only a tiny fraction of their total Microsoft 365 customer base. Suddenly, all that spending looks a bit… desperate. Like trying to impress someone with a very expensive hat while forgetting to brush your hair.

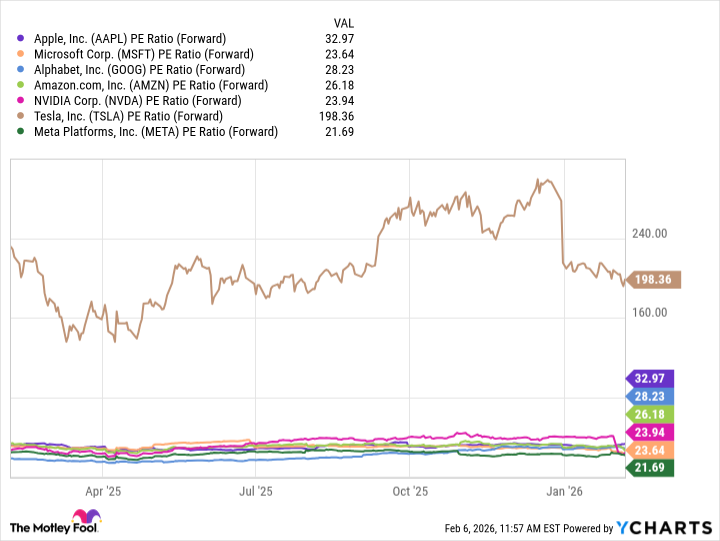

Everyone is looking at price-to-earnings ratios now. Trying to figure out if these valuations are justified. Are we paying for growth that will actually materialize? It’s all so… uncertain. I keep telling myself I should be a long-term investor, but then I see a slightly worrying headline and immediately want to sell everything. It’s exhausting.

Meta, at the moment, seems like the least bad option. At least you can see the revenue growth. Apple, too, is reasonably positioned – they haven’t gone completely mad with spending. Tesla… well, that’s a gamble. Robotaxis and humanoid robots. It could be huge, but it could also be a spectacular flop. And if it flops, and the stock is trading at 200 times forward earnings? Let’s not even think about that.

I’ve decided, for the moment, to focus on companies that are actually making money. It’s a radical concept, I know. But it feels… responsible. And frankly, after a week of staring at charts and reading analyst reports, I need something to calm my nerves. Perhaps a large glass of wine. Or possibly a complete withdrawal from the stock market. Decisions, decisions.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-12 03:22