Oh, the tempestuous dance of human ambition and technological progress! The stock of CoreWeave (CRWV), that enigmatic purveyor of cloud artificial intelligence infrastructure, has ascended like Icarus toward the sun in its brief public existence-only to falter under the weight of its own hubris. What a spectacle it is to behold, this rise and stumble! In five short months, the shares soared an astonishing 133%, only to retreat by half from their zenith on June 20. Is this not the eternal tragedy of markets? To soar too high, only to be pulled back by the invisible hand of profit-taking, disappointing results, and the expiration of lock-up periods?

Yet, dear reader, let us pause and reflect upon the psychology of such movements. Is it not the nature of investors to chase after windmills, mistaking them for giants, only to realize their folly when reality intervenes? CoreWeave’s recent decline-attributed to its planned acquisition of Core Scientific, a wider-than-expected quarterly loss, and the inevitable unlocking of insider shares-is but a fleeting shadow cast by the light of opportunity. For those who possess the wisdom to look beyond immediate turmoil, here lies a chance to acquire a stake in what may yet become a colossus.

The Unyielding Hunger for AI Infrastructure

What drives CoreWeave forward, you ask? It is nothing less than the insatiable hunger of humanity for computational power-a hunger so vast, so unrelenting, that it borders on madness. This company, with its data centers brimming with top-of-the-line graphics processing units from Nvidia, stands as both architect and beneficiary of this frenzy. Customers clamor for access to its resources as though seeking salvation itself, and still, CoreWeave cannot keep pace. Its backlog-a staggering $30 billion at the end of Q2-is testament to this imbalance between supply and demand.

Consider, if you will, the existential irony of this situation. CoreWeave secures contracts faster than it can fulfill them, much like a man who promises treasures he cannot deliver. Yet who could blame it? The global cloud infrastructure-as-a-service (IaaS) market looms large, projected to swell from $190 billion in 2025 to over $712 billion by 2032. Companies desperate to develop and deploy AI applications grasp at whatever capacity they can find, and CoreWeave, ever the opportunist, scrambles to expand its dominion.

CEO Michael Intrator speaks of scaling capacity as though it were a sacred mission, and perhaps it is. By year’s end, CoreWeave aims to increase its active power capacity to 900 megawatts, nearly doubling its current figure. And its contracted capacity? A formidable 2.2 gigawatts. These numbers are not mere statistics; they are symbols of ambition, of a relentless drive to conquer the future. Consider also its partnership with Nvidia, through which it will offer the GB300 NVL72 system-a marvel said to multiply reasoning model inference output fiftyfold. Such innovations are not born of reason alone but of something deeper, darker, more primal: the desire to dominate.

A Vision of Gains Amidst Chaos

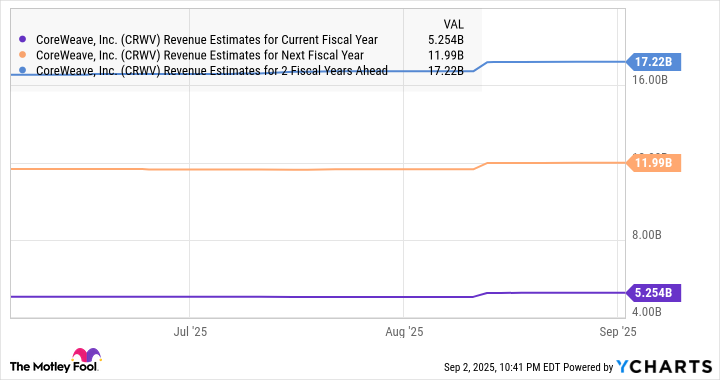

And so we arrive at the question that haunts every investor’s mind: Where will CoreWeave stand in five years? Analysts, those modern-day prophets, foresee tremendous growth, their expectations inflating like soap bubbles before our eyes. Already, CoreWeave’s backlog ensures revenue streams for years to come, while the boundless potential of the AI infrastructure market beckons like a siren song.

Even under conservative assumptions-a mere 20% annual growth rate in 2029 and 2030-CoreWeave’s revenues could approach $25 billion within five years. Should its valuation align with the Nasdaq Composite’s price-to-sales ratio, its market capitalization might reach $125 billion, nearly tripling its present value. Ah, the intoxicating allure of such projections! But beware, dear reader, for the market is a capricious beast, as prone to irrational exuberance as it is to despair.

Thus, I leave you with this thought: CoreWeave is not merely a company but a reflection of our collective aspirations and anxieties. To invest in it is to gamble on the unpredictable interplay of greed and ingenuity, of reason and chaos. And so, as we peer into the abyss of the future, let us do so with both trepidation and hope, knowing full well that the line between triumph and ruin is thinner than we dare admit. 🌌

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR UAH PREDICTION

2025-09-05 14:00