In the labyrinthine world of financial systems and their ever-expanding technological infrastructures, few companies have spiraled as rapidly into the grasp of power and influence as Nvidia (NVDA). Once a humble supplier of graphics chips for a dwindling niche of video gamers, it now stands at the precipice of transforming the very way we comprehend computing, ushering in an era dominated by artificial intelligence (AI). The transformation is as much a reflection of our societal desires as it is a quiet testimony to the cold, unforgiving nature of technological evolution.

Indeed, Nvidia’s stock no longer responds simply to news of its hardware, but to the fickle demands of AI infrastructure, an elusive, expanding universe that continuously churns beyond human comprehension. In just three years, Nvidia’s meteoric rise has placed it squarely at the apex of market valuations, as the very measure of progress within the computing sector. Yet, what exactly lies beneath the surface of this ascent? What intricate gears of capitalism are set into motion when Nvidia’s share price trembles at the whispers of AI development?

Could this latest investment be the final step in Nvidia’s inevitable march toward becoming the first $10 trillion company? A company, perhaps, shackled by its own growing monstrosity?

Why Nvidia’s Partnership with OpenAI Matters

In the murky waters of strategic partnerships, Nvidia’s recent decision to supply OpenAI with 10 gigawatts of computing infrastructure reads like a bureaucratic decree: more of the same, yet on a scale previously unimaginable. The deal, announced on September 22, is a declaration that OpenAI – in its pursuit of “superintelligence” – requires vast, unyielding quantities of GPU clusters to train its growing array of large language models. And Nvidia, with its hand firmly entrenched in the machinery of AI, stands ready to oblige.

Building a Moat Against AMD and Hyperscalers

But the narrative, of course, is never so straightforward. As Nvidia consolidates its hold on the GPU market, competition, that ever-present specter, continues to stir. Advanced Micro Devices (AMD) offers lower-cost alternatives, while hyperscalers like Microsoft, Alphabet, Amazon, and Meta Platforms are steadily constructing their own custom-built AI accelerators, each trying to break free from the gravitational pull of Nvidia’s dominance. Yet, as absurd as it seems, this new agreement with OpenAI – which could easily be described as a calculated strategic moat – reaffirms Nvidia’s unyielding position in the AI infrastructure market.

The deal, when viewed through the lens of modern capitalism, is a metaphor for something deeper: the symbiotic, almost grotesque, relationship between industry giants. Nvidia is not just supplying hardware. It is securing long-term demand, creating an inescapable network of revenue, and fostering an ecosystem so tightly woven that escape would be impossible for any of its competitors. A quiet vertical integration, not of products, but of entire industries. In this vast, ever-expanding machine, Nvidia is not merely a participant; it is the system itself.

The Path to a $10 Trillion Valuation

And yet, as with any great behemoth, Nvidia’s true value remains just out of reach, hidden behind the opaque curtains of private investment. OpenAI, for instance, remains a mysterious entity, its true valuation impossible to determine with certainty. Media reports suggest that the company could generate upwards of $20 billion in annual recurring revenue by December – an estimate that some say could soar to $125 billion by 2029. A future this distant, however, remains an elusive specter, clouded by mounting competition from the likes of Perplexity, Anthropic, xAI, and Gemini, all of whom threaten to unsettle the market’s equilibrium.

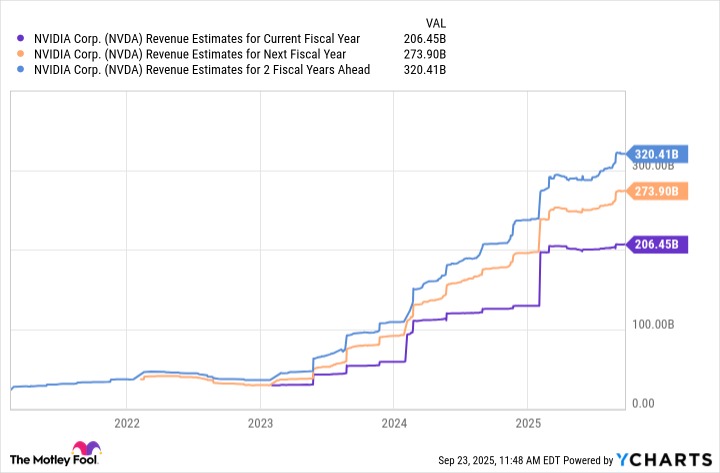

More pressing, however, is Nvidia’s increasing entanglement with OpenAI. With its continued expansion, OpenAI’s infrastructure needs will demand nothing short of astronomical processing power. This is where Nvidia, acting as both supplier and creator of the very backbone of AI, secures its position as an irreplaceable player in the game. Wall Street, in its unflinching calculations, predicts that Nvidia’s annual revenues will hit $320 billion by 2027. Yet, with the Intel and OpenAI deals already in play, such projections appear to be not only outdated but naive.

If Nvidia were to capture even 30% of OpenAI’s projected annual recurring revenue, it would add nearly $40 billion in incremental revenue each year – an expansion so vast that it seems incomprehensible. But what does it all mean? What is the true cost of such rapid, uncontrollable growth? Perhaps the most chilling aspect of this situation is the fact that, by securing OpenAI’s future infrastructure needs, Nvidia has effectively cemented its status as the standard bearer for AI development. A status so pervasive that it becomes impossible to imagine a world where Nvidia does not reign supreme. This could very well propel Nvidia’s revenues well beyond the current projections, perhaps into the realm of $500 billion by 2030. And, applying Nvidia’s current three-year average price-to-sales ratio of 28, the market cap could easily exceed $10 trillion.

In the end, perhaps it is not the specific numbers, nor the deadlines, that matter most. What remains paramount is the realization that Nvidia’s trajectory is as inevitable as it is terrifying. A stock so deeply intertwined with the AI revolution, it is now nearly impossible to envision a future where Nvidia is not central to the unfolding technological narrative. For investors seeking exposure to the AI megatrend, this is the opportunity – the only opportunity – that remains. But even in this monumental rise, one cannot help but wonder: what is the cost of such relentless ascent? What is left behind in the wake of such ceaseless, all-consuming expansion? Perhaps, we will never know. 🌀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-28 16:05