Ah, gentle reader, dwell a moment on this universal truth: every enterprise, no matter how grand or humble, must inevitably navigate turbulent waters. The key inquiry, then, is not whether tribulation will befall it, but how it chooses to respond to the storm. Shall it rise like a mythic phoenix from the embers, or wallow like a soggy specter beneath the oppressive weight of its own missteps?

Allow me to present a juxtaposition of our protagonists: Target (TGT) and Walmart (WMT). Consider them akin to two colossal beasts in a wrestling match, each quite certain of its own magnificence while underestimating the frailty that pervades corporate existence.

The Merchants of Plenty: What do Target and Walmart Do?

We find notable parallels and divergences between these titans of retail. Both have erected their towering edifices, enticing the weary shopper with promises of all manner of goods. Groceries nestle in their aisles, yet Walmart, indulging in its omnivorous ambition, also presides over grocery-only sanctuaries. In the grand bazaar of America, they are ferocious competitors, though Walmart’s appetite extends into foreign realms, where it cavorts with globalization at large.

Nevertheless, they remain, as lovers often are, somewhat ill-matched. Walmart struts about, boasting of low, everyday prices, while Target dons the garb of the chic nouveau riche, offering an experience of elevated selection that dances elegantly around the notion of affordability. Target fashions itself a curator of trends, yet such caprice can render it vulnerable to the fickle whims of consumer favor. In stark contrast, Walmart, with its sensible appeal, enjoys a steady patronage-humans always require bread, after all.

Target: A Ship Afloat in Turbulent Seas

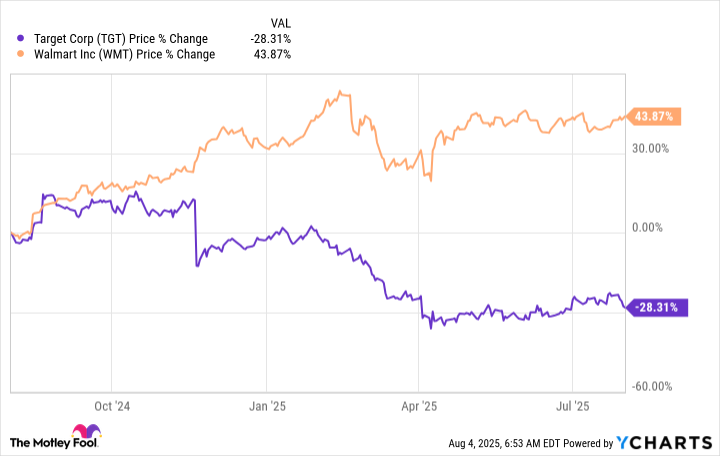

And so, dear reader, we gaze upon the tale of their stock performance. Walmart, in a splendid feat of resilience, has seen its fortunes swell-a staggering increase of 40% over the past year! Meanwhile, poor Target flounders, a mere 30% decline casting a heavy pall over its retail majesty. A disparity of approximately 70 percentage points-nearly the difference between a hearty meal and a small crumb of stale bread!

Despite this, one must not overlook the ascendant dividends that both retailers bestow upon their faithful shareholders. Target, that proud trendsetter, boasts a slightly longer legacy of increasing dividends than its rival-yet what does it matter if one bears jewels upon a tattered robe? In June, it mustered the strength to declare a modest raising of its dividends, a gesture akin to a humble nod in the presence of more established peers. News buzzes of a leadership overhaul-a classic maneuver of a beleaguered company attempting to brush off the dust of disfavor.

Yet, here, the intrigue intensifies! Target currently flaunts a staggering 4.5% dividend yield, while Walmart languorously clings to a skeptical 1%, a pitiful figure by any historical measure. By such calculations, dear investor, Target presents us with the shimmering allure of opportunity while Walmart demands a princely sum for its measure-a premium far too steep for such a mundane affair.

The Paradox of Contrarian Wisdom

The paradox stands stark: to be a contrarian, one must often embrace the absurdity of seizing opportunity amidst despair. To invest in a beleaguered company like Target involves a leap-a romantic embrace of the unknown. Yet, history tells us that a Dividend King, when battered, often finds its way back toward vibrancy. Beneath the lowly veil afforded by Wall Street lies the gilded potential of recovery. True, Walmart garbles its successes with the air of unassailable confidence, but it obliges investors to surrender an exorbitant tribute for access to its kingdom.

Thus the question hovers-a specter in the market-at a time when others may turn their back, would you not rather wander the less-trodden path, veering toward the whispers of possibility? The absurdity of the financial world reminds us: investing is often less about the grandeur of the present and more about savoring the dissonance of the future. Let us, then, revel in the irrepressible absurdity of it all-may we find fortune in the folly of waiting! 🐜

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Banks & Shadows: A 2026 Outlook

2025-08-11 05:08