Ah, what a day it has been! Aptos has decided to unlock a staggering 11.31 million APT coins, worth around $51 million. A brilliant move for some, I suppose-especially those who thrive in markets brimming with uncertainty.

With this newfound surge in supply, coupled with the ever-declining market conditions, traders seem to be scrambling like ants on a sugar trail, eager to make a quick buck. Naturally, this leads to an avalanche of selling pressure, and poor APT is caught in the crossfire of it all. Buckle up!

Aptos Price Takes a Dive: The Rise of the Sellers

Currently, APT is trading at $4.58, down 2% in the last 24 hours. But hold your horses, the real kicker is that its trading volume has surged by 10%. Yes, more people are getting rid of their holdings than ever before. Not the kind of volume you’d want in your investment portfolio.

For token TA and market updates: Want more timely insights into tokens like APT? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter-before your portfolio looks like APT!

When an asset’s price is in free fall while the trading volume climbs, it’s a big red flag. This signals that more people are running for the exit doors than jumping on the bandwagon. Clearly, the sellers are in charge, pushing APT deeper into the abyss.

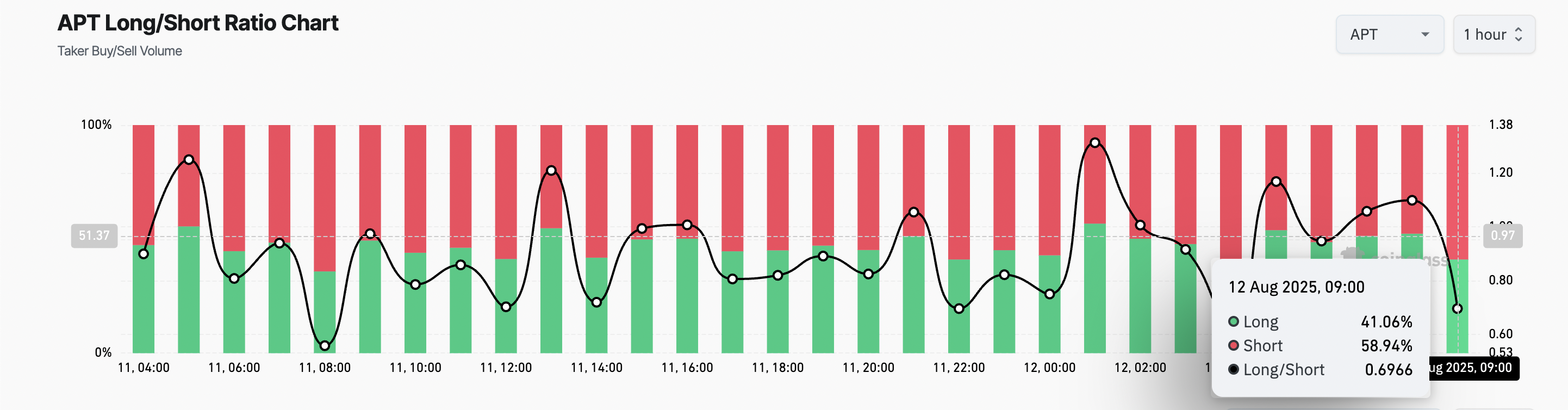

Additionally, APT’s declining long/short ratio-now sitting at 0.69-reinforces the gloomy sentiment. Yes, this isn’t exactly the bullish signal you want to see on your chart.

The long/short ratio, by the way, is the trader’s way of telling you if the market is leaning bullish or bearish. Above 1, and traders are hoping for a price rise. Below 1, and it’s like a room full of people betting on the price to drop. Guess which way APT is heading?

Traders are clearly positioning themselves for a bumpy ride, betting on the price to fall further. It’s a short-seller’s dream. 🏴☠️

Can Aptos Hold the Line, or Is It Doomed?

Looking at the daily chart, APT is currently flirting with its 20-day Exponential Moving Average (EMA). This could be a turning point-either the market falls apart, or we get a nice little bounce back. Place your bets, my friends!

The 20-day EMA is like the market’s mood ring, reflecting the average price over the last 20 trading days. If the price rises above it, it’s a sign of potential hope. If it dips below-well, we’re looking at an all-out panic. 😬

If APT’s price tumbles below the 20-day EMA, expect the bears to take over, dragging APT’s price under $4.52 faster than you can say “stop-loss.”

On the other hand, if the EMA holds steady, APT could see a resurgence. Imagine it: a glimmer of hope. Maybe buyers will swoop in and push APT back over $5.01. Who knows? The market is nothing if not full of surprises.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-08-12 23:37