When the tide rises, even the most decrepit of vessels find themselves afloat-a phenomenon not unlike the current state of the crypto markets. The total market capitalization has now surpassed $4 trillion, an achievement both impressive and faintly absurd. One might say it is as if the world’s financiers have collectively decided that alchemy was simply ahead of its time.

But let us pause for a moment to consider the gravity of this spectacle. Money flows in, as it always does when hope outpaces reason. Yet, for those of us who seek growth rather than mere gambling, the pertinent question remains: Are these forces propelling prices upward built upon sturdy foundations or merely gilded scaffolding? If they endure, there may yet be opportunity aplenty; if not, one must wonder whether we are witnessing the prelude to a correction-or worse, a crash.

A Closer Look at the $4 Trillion Mirage

To begin with a truth many investors seem determined to ignore: Bitcoin (BTC), that digital sovereign of speculation, still reigns supreme. It accounts for more than half of the sector’s value, boasting a market cap of approximately $2.4 trillion. Truly, it is the sun around which all other cryptic planets revolve-or perhaps orbit would be too dignified a term.

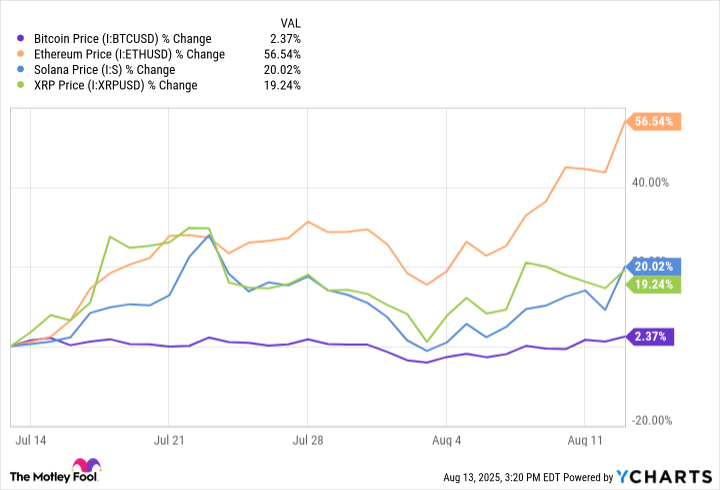

Beyond Bitcoin, three familiar names shoulder much of the remaining burden. Ethereum (ETH), ever the dutiful understudy, contributes roughly 13% of the market’s worth, buoyed by its role as the default smart contract platform and newfound accessibility via spot exchange-traded funds (ETFs). Solana (SOL), having matured from fledgling curiosity to formidable contender, commands a respectable $100 billion market cap-modest compared to its elders but no less ambitious. And then there is XRP (XRP), recently valued near $193 billion, riding high on narratives of international adoption and institutional interest. Ah, narratives-the lifeblood of markets and the opiate of investors.

In essence, Bitcoin serves as the engine of this locomotive, driven by its halving-induced scarcity and insatiable institutional demand. Meanwhile, Ethereum, Solana, and XRP act as auxiliary pistons, each powered by their own peculiar catalysts. Together, they create a tailwind so strong that even the most skeptical observer might feel compelled to buy a ticket aboard this runaway train.

Can This Farce Persist?

There are reasons aplenty to believe the crypto carnival will continue its march higher-for now. Cryptocurrencies, like any good drama, thrive on liquidity, and presently, global liquidity is abundant. Central banks, those august arbiters of fiscal prudence, have begun loosening their purse strings once more. The U.S. Federal Reserve whispers promises of rate cuts, while the European Central Bank and the Bank of England have already taken steps toward monetary easing. One might almost think they conspired to make risk assets irresistible.

Of course, easy money alone does not guarantee success-it merely lowers the bar for entry. Still, regulatory clarity in the United States has removed some of the thornier obstacles, encouraging financial institutions to embrace crypto with open arms. The Securities and Exchange Commission (SEC) has expanded its toolkit for crypto exchange-traded products (ETPs), allowing in-kind creations and redemptions-a development that reduces costs for large investors. Coupled with the Trump administration’s pro-crypto stance, it is little wonder that prices ascend like Icarus toward the sun.

And yet, there is more. Corporate treasuries, those erstwhile bastions of conservatism, have emerged as unlikely patrons of the crypto arts. Companies dedicated solely to acquiring Bitcoin, Solana, Ethereum, and XRP abound, hoarding coins like misers guarding gold. For investors, such behavior naturally restricts supply, thereby supporting price. As Oscar himself might observe, “To accumulate wealth without purpose is the pastime of fools-but to accumulate cryptocurrency? That is the sport of visionaries.”

All told, these tailwinds suggest that the rally may persist for some time. But beware, dear reader, for optimism untempered by caution is the surest path to ruin. Liquidity can evaporate, politics can pivot, and ETF inflows can reverse with alarming speed. Crypto remains volatile, a creature of extremes, and no amount of regulatory goodwill can shield it from its own nature.

Assuming central banks do not abruptly tighten their policies and assuming U.S. regulators maintain their current restraint, the uptrend may indeed endure. But remember: Assumptions are the mother of all mistakes. Should either condition falter, the entire edifice could crumble faster than you can say “blockchain.”

So tread carefully, invest wisely, and never forget that fortune favors the bold-but only until she grows weary of their antics. 😊

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- The Weight of First Steps

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-08-18 11:34