In the fevered throes of modernity, humanity clutches at artificial intelligence as a savior, though its true nature remains a riddle wrapped in silicon. The University of Pennsylvania’s Penn Wharton Budget Model whispers of a 1.5% global productivity surge in the next decade-a paltry figment, perhaps, compared to the infinite voids left by our collective yearning for progress. Yet governments and corporations, driven by some primal hunger, now kneel before this altar of algorithms, their hands trembling as they draft contracts for cloud infrastructure that outstrip the stars in their ambition.

The titans-Amazon, Microsoft, Oracle, Google-stand as modern-day Gogols, their ledgers brimming with obligations that defy reason. What madness compels them to lease capacity they cannot yet deliver? Is it hubris, or perhaps the desperate hope that, in this age of entropy, one might yet defy the laws of supply and demand? The answer lies in the hearts of those who dare to dream of a world where data centers bloom like cities in the desert.

A Backlog of Sins and Salvation

These cloud colossi, in their infinite wisdom, have chosen to outsource the burdens of hardware to their customers, sparing them the agony of ownership. Yet this charade has birthed a backlog so vast it eclipses the imagination-a $1 trillion ledger of unfulfilled promises. Is this not the very essence of capitalism’s paradox? To promise salvation through efficiency while drowning in the weight of one’s own ambition?

The Chip Stocks: Instruments of Divine or Diabolical Will?

As the titans expand their data centers, their capital expenditures soar to $364 billion in 2025-a sum that could build cathedrals or feed nations. The demand for AI-capable chips, those modern-day philosopher’s stones, is expected to reach $600 billion. Here lies the investor’s crossroads: to chase the glow of TSMC or Nvidia, or to question whether such a path leads to paradise or perdition.

Taiwan Semiconductor Manufacturing (TSM), that quiet architect of silicon, sits at the nexus of this chaos. Its revenue, rising 37% year over year, is a testament to the feverish growth of AI. Yet at 24 times forward earnings, is this not a bargain for the damned? Or a fleeting illusion, as fragile as the dreams of those who built it?

Nvidia (NVDA), the market’s golden calf, commands a 92% share of data center GPUs. Its recent $90.8 billion revenue surge, achieved despite geopolitical tempests, is a hymn to its dominion. Yet what of the $100 billion pact with OpenAI? Is this a covenant of salvation-or a Faustian bargain that will one day unravel?

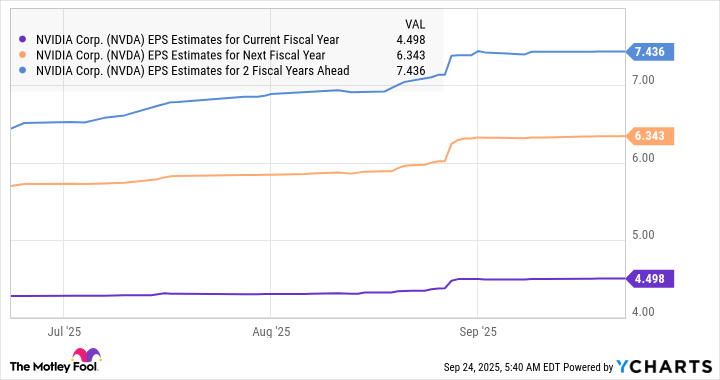

Investors, like Hamlet clutching the skull of Yorick, must ask: What is the cost of this progress? At 40 times forward earnings, Nvidia’s valuation feels less a promise and more a dare. And yet, in the shadow of the U.S. tech sector’s 51x average, it whispers of untapped potential, a siren song for those who dare to leap.

In the end, the market remains a labyrinth without an exit. To invest in AI is to stake one’s soul on the premise that humanity will not destroy itself before the algorithms do. But then again, what is capitalism if not a grand experiment in faith? 🌑

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2025-09-27 20:33