As a seasoned analyst with over two decades of experience under my belt, I can’t help but feel a sense of deja vu when it comes to the case of Frank Richard Ahlgren III. It seems that no matter how far we advance technologically or geographically, human nature remains remarkably consistent. In this instance, Mr. Ahlgren chose to join the ranks of those who thought they could outsmart the taxman by manipulating their crypto profits.

Frank Richard Ahlgren III, a resident of Texas, was sentenced to spend two years in prison due to submitting fraudulent tax documents.

The tax filings misrepresented the capital gains he earned from selling $3.7 million in Bitcoin.

A Case Falsifying Crypto Profits

The court documents showed that Ahlgren, who was among the initial Bitcoin investors, submitted false tax documents from 2017 to 2019. Instead of accurately reporting or including the earnings from selling $4 million in Bitcoin, these filings either understated or failed to mention them entirely.

In the United States, it’s necessary for taxpayers to report all transactions involving cryptocurrencies, be they profits or losses, when filing their yearly tax returns, as mandated by federal tax laws on cryptocurrency.

As a researcher delving into the realm of digital currencies, I recently noted that this sentencing signifies the initial criminal prosecution in the United States focusing solely on tax evasion through cryptocurrency. This case underscores the Internal Revenue Service’s proficiency in monitoring and pursuing investigations related to cryptocurrency-based tax evasions.

Based on available information, Ahlgren started buying Bitcoin back in 2011. By the year 2015, he had accumulated approximately 1,366 Bitcoins through Coinbase. The peak price of a Bitcoin that year was roughly $495 per Bitcoin.

Back in October 2017, he converted 640 Bitcoin into approximately $3.7 million, with each Bitcoin fetching around $5,808. This sum was then utilized for the acquisition of a property in Utah.

In essence, Ahlgren knowingly presented incorrect data to deceive his tax accountant when filing his 2017 taxes. He artificially inflated the cost basis of his Bitcoins to minimize reported gains. Remarkably, these manipulated figures surpassed the actual market value of Bitcoin during that period.

Over the following years, Ahlgren continued to sell more Bitcoins valued above $650,000 each year, yet failed to declare these sales in his tax returns for 2018 and 2019.

To hide what he was doing, he transferred money via numerous electronic wallets, engaged in face-to-face cash trades, and employed cryptocurrency tumblers to make the specifics of his transactions less clear on the blockchain.

Crypto Taxation Remains A Growing Concern

Ahlgren’s situation underscores the increased attention being given to cryptocurrency taxation in the U.S. Notably, well-known individuals such as Roger Ver, often referred to as “Bitcoin Jesus,” are currently dealing with significant tax issues.

The U.S. government alleges that Ver has failed to pay $48 million in taxes associated with the sale of cryptocurrencies valued at approximately $240 million and tax obligations related to his relinquishment of American citizenship in 2014. U.S. authorities are working towards extraditing Ver, a process that is currently under review by a Spanish court.

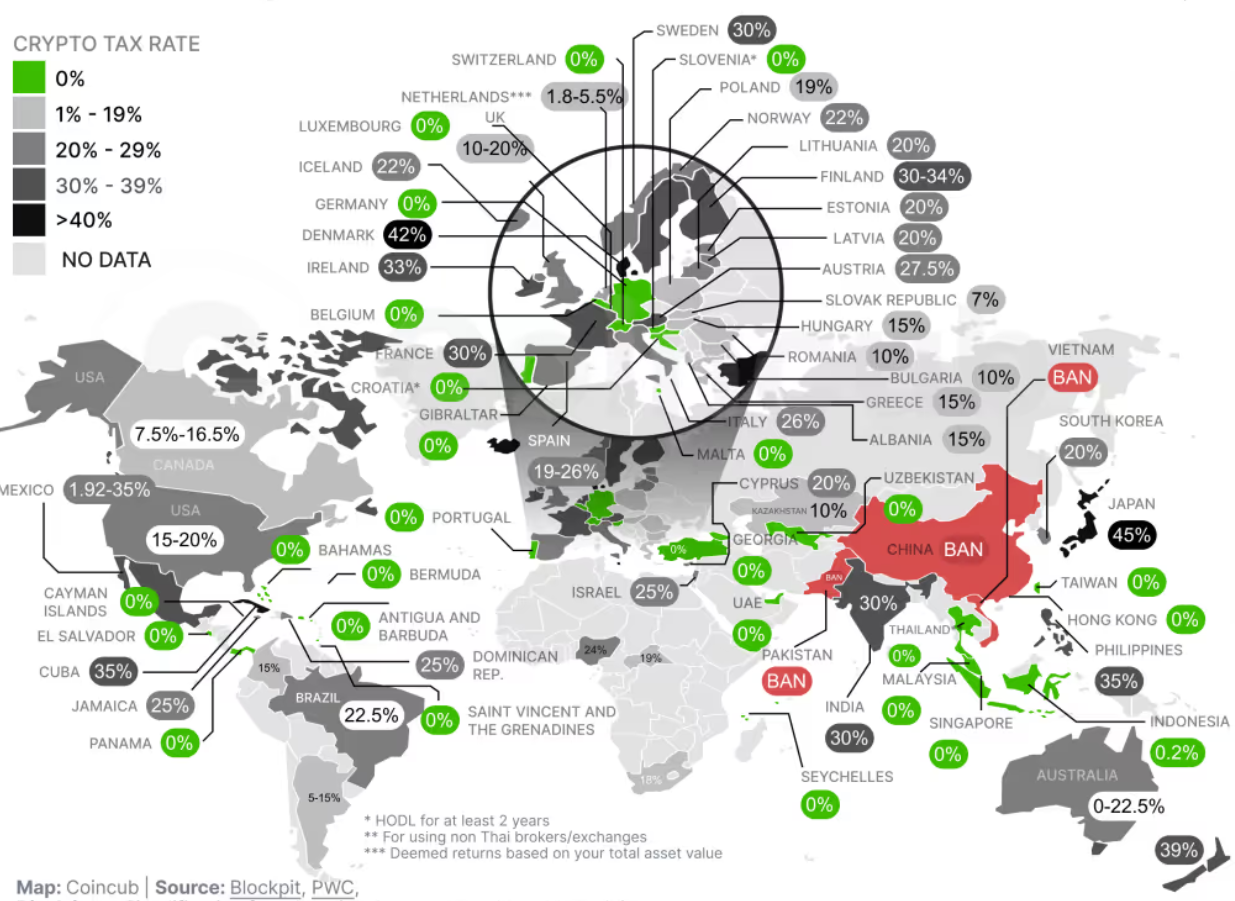

As the United States intensifies its control over taxation of cryptocurrencies, other nations are loosening their regulations. For instance, the Czech Republic has proposed a move to abolish capital gains taxes on cryptocurrency holdings that have been kept for more than three years. Moreover, transactions under an annual value of $4,200 will no longer necessitate reporting in this country.

In Russia, cryptocurrencies have been reclassified as a type of property within the revised tax laws. This means that cryptocurrency transactions are now VAT-exempt, and any income derived from them will be taxed together with other securities earnings. Notably, the personal income tax on crypto-related earnings is limited to a maximum rate of 15%.

These advancements showcase varying strategies for cryptocurrency taxation across different countries, as they strive to maintain control through regulation while encouraging growth within the blockchain marketplace.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

2024-12-14 03:27