As a seasoned crypto investor with a keen eye for regulatory developments and market trends, I find Tether’s USDT’s approval as an Accepted Virtual Asset (AVA) within the Abu Dhabi Global Market (ADGM) to be a significant milestone. This move not only signifies Tether’s compliance with regional standards but also opens up opportunities for its inclusion in licensed financial services, aligning with the UAE’s vision to modernize its financial sector and promote diversification.

The Financial Services Regulatory Authority (FSRA) in Abu Dhabi Global Market (ADGM) has given its approval to Tether’s USDT stablecoin, categorizing it as an Accepted Virtual Asset (AVA). This means that financial institutions under the FSRA jurisdiction can now offer services related to USDT without prior approval.

A Major Regulatory Boost for Tether’s USDT

The endorsement of USDT in ADGM signifies that it adheres to the local regulatory norms, opening up possibilities for its integration into regulated financial services. This action is consistent with the UAE’s initiatives aimed at updating its financial system and fostering economic diversity.

In November, Tether added approximately $5 billion to the market. On November 6 alone, they produced over a billion USDT, a move that aligned with Bitcoin‘s price surge.

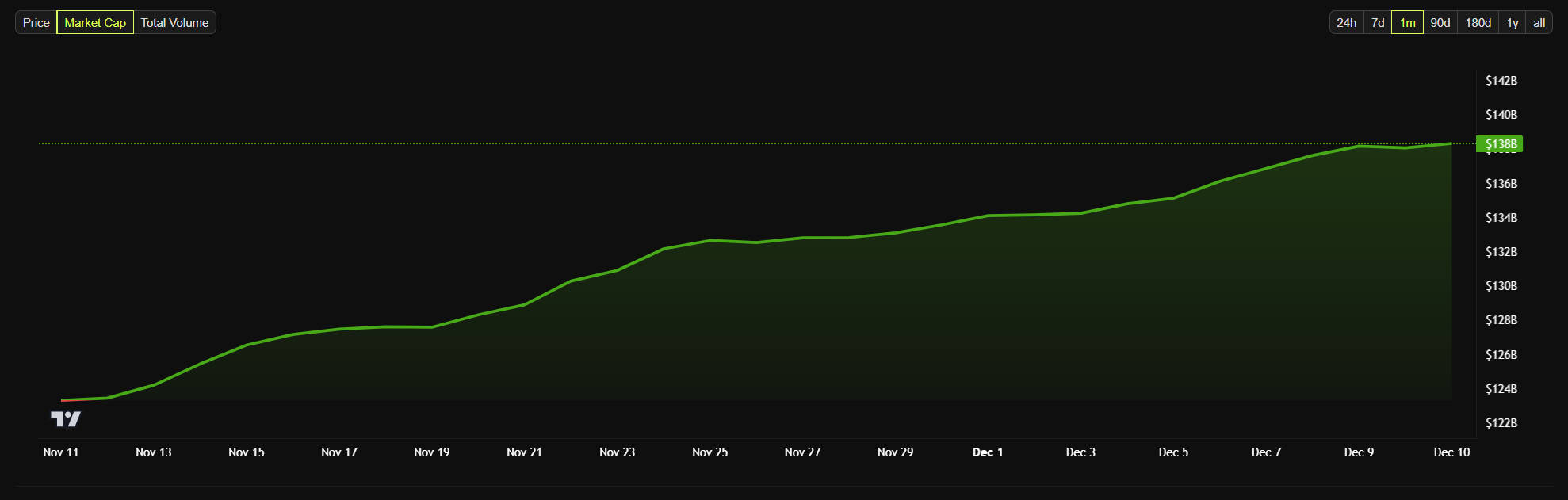

In the past seven days, Tether added another 2 billion USDT to its circulation, raising the total issued since November to a whopping 19 billion. Following the regulatory nod given by ADGM on December 10th, the market cap of USDT skyrocketed to an impressive $138 billion.

Our CEO, Paolo Ardoino, stated that the innovative strategy of the UAE in regulating virtual assets serves as a model for the world, and he is pleased that USDT can contribute significantly to economic advancement and digital evolution within the region.

In Q3 of 2024, Tether announced remarkable profits amounting to $2.5 billion, bringing its yearly earnings to a staggering $7.7 billion. The company’s quarterly report underscored its impressive financial strength within the crypto industry with total assets valued at approximately $134.4 billion.

The entity responsible for producing stablecoins is considering broadening its horizons beyond the cryptocurrency market. Notably, Tether has recently finalized its inaugural crude oil transaction in the Middle East, successfully executing a $45 million deal involving 670,000 barrels of oil using USDT.

The company is also exploring lending opportunities for international commodities traders. Tether is particularly looking into developing markets, leveraging its substantial profits and industry connections.

Although Tether has garnered significant accomplishments, it continues to face examination from U.S. regulatory bodies. Previous reports from the Wall Street Journal suggest that the Manhattan District Attorney’s Office is looking into the firm, exploring possible instances where its platform was utilized for illegal activities.

On the contrary, Tether’s CEO, Paolo Ardoino, refuted these allegations. He asserted that the company has found no evidence suggesting a federal probe is underway.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2024-12-10 19:43