As a seasoned analyst with over two decades of experience in the financial industry, I have witnessed the rise and fall of many market giants. The recent $1 billion USDT minting by Tether is not surprising, given its dominant position in the stablecoin market. However, the potential partnership between Binance and Circle could shake things up significantly.

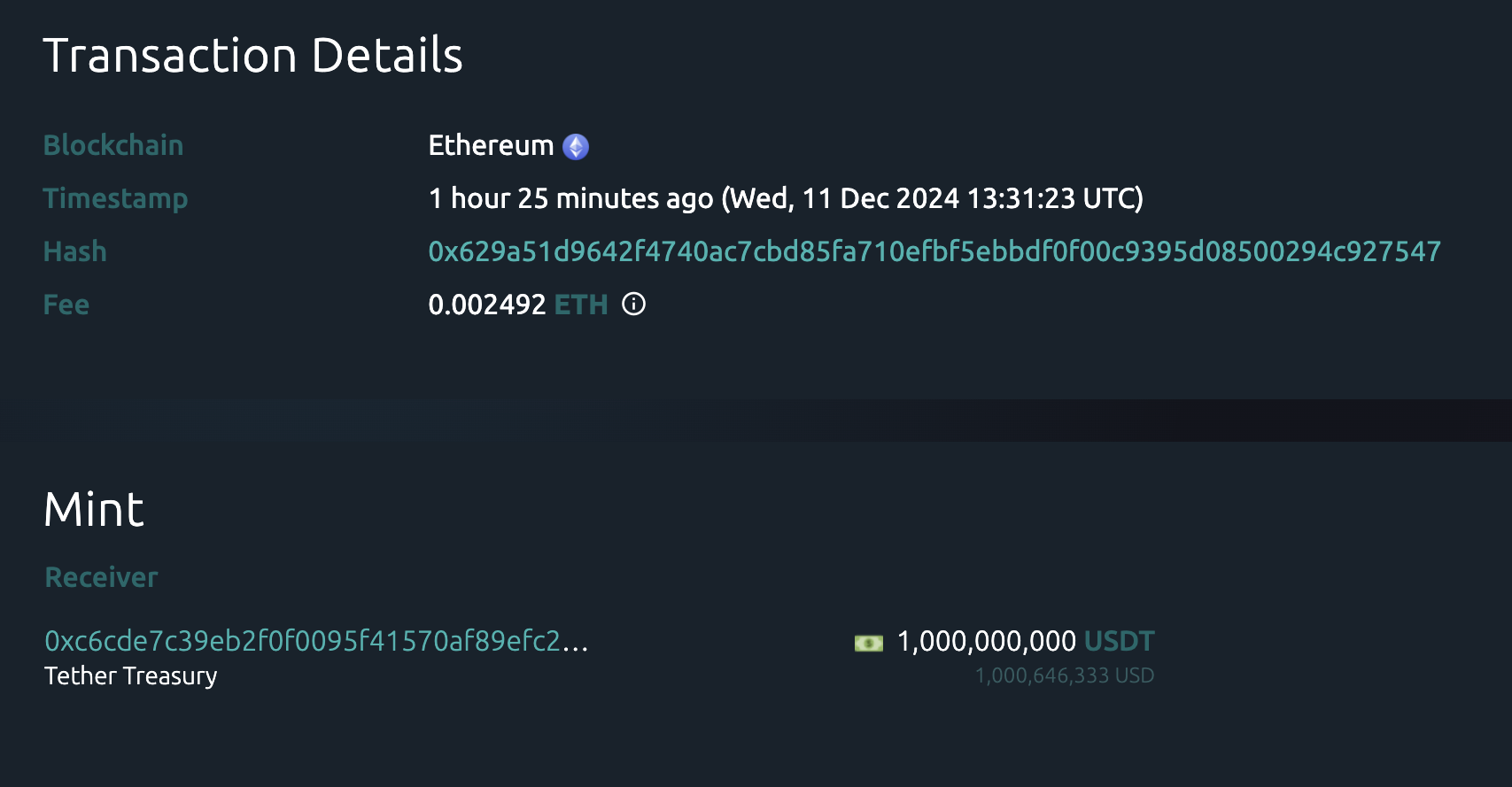

As per the latest blockchain information, Tether has generated a billion USDT tokens. Notably, the firm has been producing these tokens in large quantities as evidenced by their substantial earnings reported in Q3 of 2024.

Today, Binance and Circle have entered into a partnership that could challenge Tether’s dominance in the stablecoin market, potentially making them a significant new competitor.

Tether Mints Huge Volumes of USDT

According to on-chain reports from December 11, a significant amount of new USDT tokens were created. Yet, this isn’t surprising for one of the world’s leading stablecoins as Tether has been minting unusually high amounts of USDT recently. For instance, over 2 billion USDT were minted on December 6, and approximately 19 billion in the past month.

In summary, the company has thrived during this ongoing bull market, maintaining its strong position within the stablecoin sector. Notably, its Q3 2024 earnings report showcased unprecedented success, as demand for USDT skyrocketed and resulted in exceptional profits.

Furthermore, this achievement also includes regulatory triumphs. Just recently, the Abu Dhabi Global Market granted approval for USDT to be recognized as an Accepted Virtual Asset.

Despite these efforts, Tether may still encounter obstacles leading up to its token minting, as Coinbase is set to remove Tether from the European Union market by December due to compliance issues with the newly implemented MiCA regulations. Tether has made attempts to minimize its impact within Europe.

Simultaneously, rivals such as Robinhood and Revolut are exploring the possibility of introducing new stablecoins to capitalize on the drop in Tether’s influence within the EU market. In the U.S., Ripple has been given regulatory approval to debut its RLUSD stablecoin.

Despite some speculation on social media linking this minting event to a larger potential issue for the company, reports indicate that Binance and Circle have formed a partnership. This collaboration aims to use USDC, a stablecoin co-owned by Circle, as a means to challenge Tether’s market dominance. Interestingly, Coinbase is also involved with Circle’s USDC token, signifying an alliance between two significant exchanges that have historically had a competitive relationship.

Kash Razzaghi, Circle’s Chief Business Officer, stated that Binance has experienced a significant business transformation and, in due course, we both felt it was logical to link one of the world’s most reliable and regulated stablecoins.

Despite the recent partnership and the fact that Tether has been producing unusually large amounts of USDT for the last month, it’s too soon to tell if this signals a new competition. At this point, there isn’t enough concrete data to predict the direction Tether might be heading in the future.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2024-12-11 20:11