As an analyst with over two decades of experience in the financial industry and a keen observer of the digital economy, this strategic move by Tether into Rumble is not only intriguing but also strategically sound. The surge in Tether’s earnings this year, reaching $10 billion, clearly demonstrates their financial muscle and appetite for growth.

Leading stablecoin provider Tether is investing a strategic $775 million into Rumble, an emerging video-platform contender that presents itself as a decentralized option to YouTube.

This substantial financial commitment is made during a period when Tether’s profits have skyrocketed, exceeding $10 billion in earnings this year.

Tether Eyes Media Disruption With Rumble Investment

On December 20th, it was announced that the company behind USD Tether made a strategic investment worth $775 million in Rumble, a video-platform that holds Bitcoins and also provides cloud services.

As per the statement, the deal grants an initial investment of $250 million in cash to Rumble, with an additional option to purchase up to 70 million shares at $7.50 each, totaling approximately $775 million. However, it’s important to note that Chris Pavlovski, Rumble’s Chairman and CEO, maintains a controlling stake in the company.

Paolo Ardoino, the CEO of Tether, stated that their investment signifies a shared dedication by both companies to decentralization, transparency, and individual liberties. He highlighted Rumble’s function as a dependable platform that contests the conventional media landscape, which has been struggling with waning trust.

According to Ardoino, Tether strongly upholds the core principles of free expression and financial autonomy. Investing strategically in Rumble clearly demonstrates Tether’s commitment to backing technologies and businesses that promote human empowerment, fostering self-reliance and robustness within our society.

In essence, Pavlovski sees the funding as a means to challenge YouTube head-on. It’s important to note that YouTube is currently the leading global video-sharing platform, boasting around 2.5 billion monthly active users by March 2024.

“YouTube, lookout. I’m coming for your monopolistic market share, globally,” Pavlovski stated.

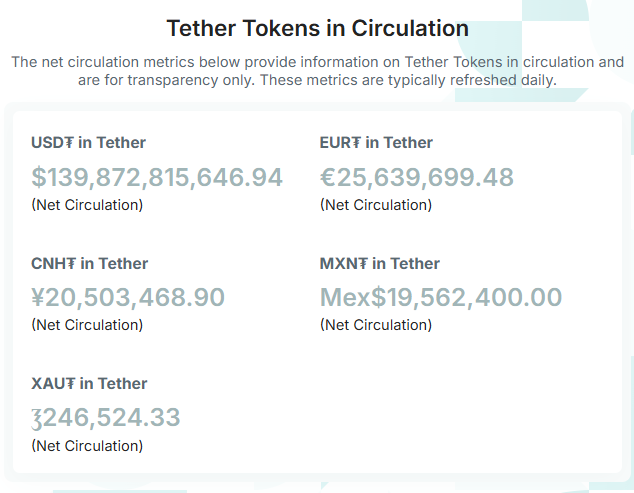

This year, Tether, well-known for its USDT stablecoin worth approximately $140 billion, has diversified its investment holdings considerably. The firm has delved into multiple areas such as agriculture, cryptocurrency mining (specifically of Bitcoin), artificial intelligence, and education.

As a crypto investor, I’m thrilled to share that Tether recently announced they’re wrapping up the year with profits surpassing $10 billion. Not only that, but more than half of these earnings have been strategically reinvested to bolster their presence in the stablecoin market. This includes recent commitments to European stablecoin initiatives like StablR and Quantoz.

As a crypto investor, I’m excited about the future plans of my investment. Recently, Ardoino announced that they will be investing their earnings into artificial intelligence (AI) technology. On platform X, our CEO shared this news, mentioning that we aim to launch our AI platform in early 2025. This move is designed to expand Tether’s technological influence and tap into new growth possibilities within emerging markets, which I find truly promising.

Ardoino recently received a preliminary design for Tether’s AI platform. It’s set to launch later this year, aiming to go live by the last quarter of 2025.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-21 17:27