As a researcher with a keen interest in the cryptocurrency market, I find myself constantly intrigued by the moves of giants like Tether. The recent transfer of 7,629 BTC, worth approximately $700 million, to its Bitcoin reserve is indeed an impressive addition to its strategic reserves. This move aligns with Tether’s decision in 2023 to allocate up to 15% of its profits to Bitcoin, reflecting their commitment to diversification amid increased USDT issuance.

What strikes me the most is not just the sheer volume of this transaction but also the consistency in Tether’s strategy. They’ve been steadily growing their Bitcoin reserves since 2024, and it seems they’re not slowing down anytime soon. It’s like watching a well-oiled machine at work.

However, I can’t help but wonder if Tether is playing a game of crypto chess while the rest of us are still learning the rules. With their vast resources and strategic moves, they seem to be one step ahead of the competition, even in the face of regulatory hurdles.

As for the EU’s stance on US debt, I guess we’ll have to wait and see how this plays out. But as a researcher who’s seen more than a few financial storms pass by, I can’t help but chuckle at the idea of anyone questioning Tether’s trust in US Treasuries. After all, they hold $102 billion in them – that’s about as solid as a digital fort Knox!

In jest, I sometimes like to think of Tether as the Titanic of stablecoins – unsinkable and always moving forward, no matter what the market throws at it. Only time will tell if this comparison holds true!

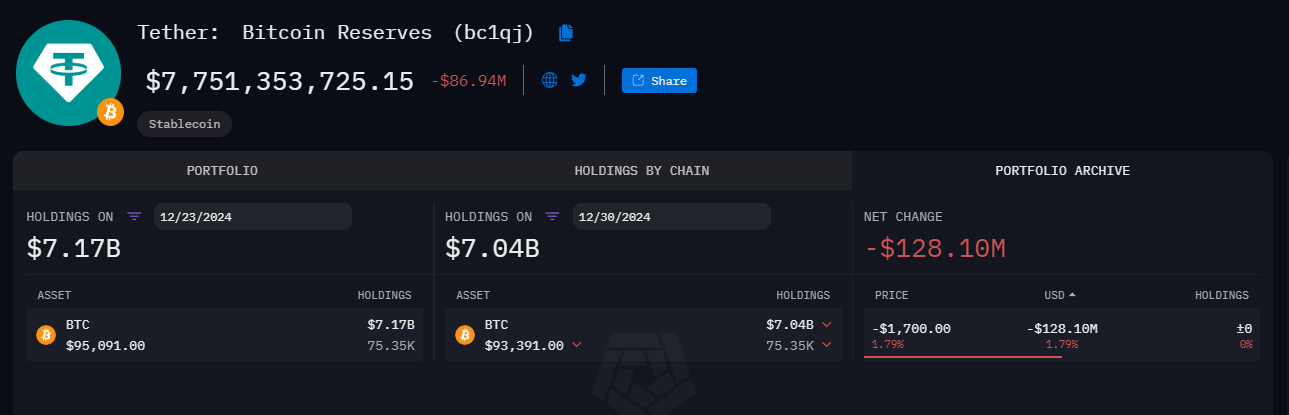

On December 30th, Tether moved nearly 7.6 million dollars’ worth of Bitcoin (around 7,629 BTC) into its storage address. This transfer was initiated from Bitfinex’s active wallet early in the day.

This is the biggest increase in Tether’s strategic Bitcoin holdings since March 2024, which saw a transfer of 8,888.88 Bitcoins.

Tether’s Bitcoin Reserves Continue to Grow

On December 31, 2023, another identical transfer took place, as suggested by on-chain data. As reported by Arkham, Tether’s reserves now contain approximately 82,983 Bitcoins, which were purchased for a total of $2.99 billion at an average price of roughly $36,125 per coin.

Tether’s recent action follows their 2023 plan to invest up to 15% of their earnings into Bitcoin. The company already has over $7.6 billion worth of Bitcoin, and these Bitcoin purchases are part of a strategy to diversify during times when there is an increase in USDT issuance.

Tether’s main stablecoin, USDT, is predominantly collateralized with U.S. Treasury bonds and similar financial instruments. The income earned from these assets has been used to fund ventures in innovative fields such as artificial intelligence, Bitcoin mining operations, and advanced communication networks that operate without a central authority.

2024 marked a significant expansion for the company, venturing into renewable energy and telecommunications sectors, demonstrating their diverse investment horizons.

A Strong Financial Year Amid Regulatory Hurdles

2024 proved to be a financially prosperous year for Tether, bolstered by a robust cryptocurrency market. By the third quarter, the company’s total assets surpassed $134.4 billion, with approximately $120 billion in circulation as USDT.

Moreover, on December 6, Tether produced an extra 2 billion USDT units, adding to a grand total of 19 billion USDT minted since November. This increase indicates the rising need for USDT as the bull market continues to grow.

In the European Union, Tether is encountering difficulties due to the implementation of MiCA regulations. In response, several EU exchanges have removed USDT from their listings in anticipation of these new rules.

As a seasoned financial analyst with years of experience in global markets, I have always kept a close eye on the dynamics between different economic powerhouses. Recently, I find myself intrigued by Martin Folb’s take on the EU’s stance towards Tether and stablecoins.

Martin highlights that Tether, holding $102 billion in US Treasuries, is not being recognized as collateral by the EU. This, according to him, sends a strong message of distrust in the US debt from the European Union. The EU’s demand for stablecoin issuers to back their coins with 60% fiat held in EU banks seems like a deliberate move to me.

Personally, I believe there are political motivations behind this apparent charade. This could be an attempt by the EU to assert its influence and gain control over the rapidly growing stablecoin market. However, it remains to be seen how this will play out in the long run, as such actions may have unintended consequences for both parties involved.

Ultimately, I fear that this move might not serve the best interests of the EU. The global financial landscape is complex and interconnected, and attempts to isolate oneself from certain markets can often backfire. As always, it’s essential to tread carefully when dealing with such sensitive matters.

Additionally, the firm has stopped releasing its Euro-tied EURT digital currency, giving holders a full year to withdraw their assets. The intensifying competition has placed more pressure on Tether’s market leadership.

Recently, Ripple introduced its RLUSD stablecoin globally, whereas Circle, the company behind USDC, has been forming strategic alliances to capitalize on Tether’s regulatory challenges.

In the face of these hurdles, Tether continues to prioritize bolstering its reserves and investigating fresh avenues, thereby preserving its status as a significant player within the stablecoin market.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All 6 ‘Final Destination’ Movies in Order

- 10 Shows Like ‘MobLand’ You Have to Binge

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

2024-12-31 01:16