Tether’s New Audit Man 🕵️♂️

Tether, that stablecoin behemoth, has announced the appointment of Simon McWilliams as its new Chief Financial Officer (CFO).

One might say it’s about time. With Simon McWilliams’ expertise in financial auditing, it appears that Tether is hoping he can conduct a comprehensive financial audit. The company is aiming to become more transparent about its reserves as regulatory pressure mounts – or perhaps it’s just tired of the whispers questioning their financial shenanigans 🤔.

Simon McWilliams Becomes Tether’s New CFO

According to the latest announcement, Tether has appointed Simon McWilliams as its new Chief Financial Officer (CFO). With this appointment, Tether aims to strengthen the trust of users, regulators, and institutional partners while solidifying its dominant position in the $232 billion stablecoin market.

“Simon’s expertise in financial audits makes him the perfect CFO to lead Tether into this new era of transparency. With his leadership, we are moving decisively toward a full audit, reinforcing our role in supporting US financial strength and expanding institutional engagement,” wrote Paolo Ardoino, CEO of Tether.

Simon McWilliams brings over 20 years of experience in financial management. He has previously guided large investment firms through rigorous audits. One hopes he’ll be able to do the same for Tether, a company whose history is about as transparent as a brick wall 🧱.

His appointment marks a significant step for Tether, especially given the ongoing skepticism regarding the legitimacy and transparency of its reserves. It’s about time they start playing by the rules!

Challenges Tether Faced Under CFO Giancarlo Devasini

Following McWilliams’ appointment, Tether’s former CFO, Giancarlo Devasini, will transition to the role of Chairman. In this new position, Devasini will now focus on macroeconomic strategy, steering Tether toward becoming part of the US financial system and promoting the global adoption of digital assets. One wonders if he’ll be steering it towards a proper audit too? 🤔

Under Devasini, Tether consistently faced criticism for lacking a comprehensive audit. From 2022 until now, the company relied solely on quarterly attestation reports from the accounting firm BDO.

These reports are considered to lack the detail that a comprehensive audit would require. One might say they’re about as useful as a chocolate teapot ☕️.

This lack of transparency has been creating many doubts, particularly after a 2021 settlement with the New York Attorney General (NYAG). The NYAG investigation revealed that Tether had misrepresented that USDT was backed 1:1 by the U.S. dollar.

Furthermore, Tether and Bitfinex, a closely affiliated company, denounced the amended price manipulation lawsuit.

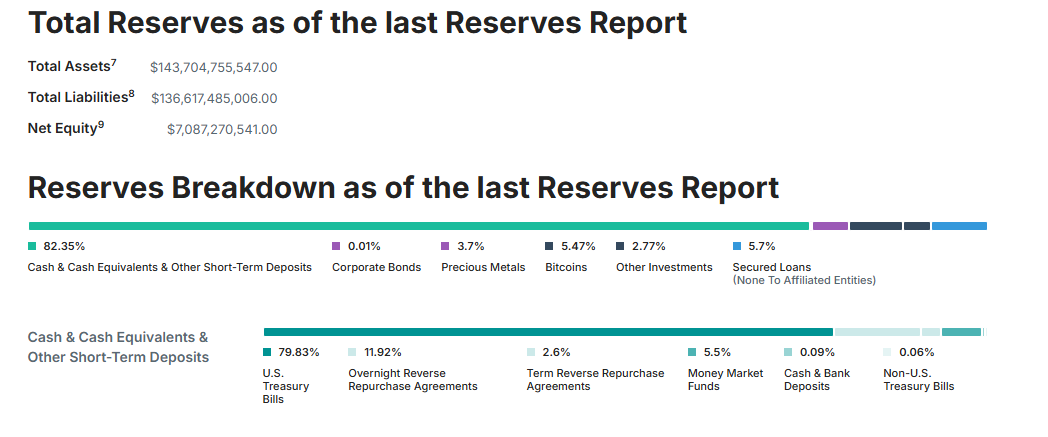

Although Tether has made efforts to disclose its reserves, 82.35% consist of Cash, Cash Equivalents, and Other Short-Term Deposits. Nearly 80% of them are in

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-03-03 23:13