In the grand theater of financial folly, where numbers dance like marionettes and fortunes rise and fall with the whims of the market, a new act has taken the stage. The venerable stablecoin issuer and fintech platform, Tether, has deigned to cast its gaze upon the humble Bitcoin-backed loanmaker, Ledn. Ah, the irony! The titan of stability embracing the volatility of Bitcoin-a union as unexpected as a peasant inheriting a nobleman’s estate. 🏰✨

This partnership, announced with great fanfare in a press release dated November 18, comes as Tether continues its relentless march across the financial landscape, leaving no stone unturned in its quest for dominance. Ledn, for its part, has had a banner year, originating over $1 billion in loans, with a staggering $392 million issued in the third quarter alone. Truly, a tale of two worlds colliding-one of stability, the other of ambition. 📈💼

Paolo Ardoino, the esteemed CEO of Tether, proclaimed with the gravitas of a philosopher that this alliance would expand global access to credit without forcing individuals to part with their cherished digital assets. “This approach strengthens self-custody and financial resilience,” he intoned, as if bestowing upon the masses a gift from the heavens. One cannot help but marvel at the grandeur of such statements, though they are as laden with promise as a politician’s campaign speech. 🗣️🌍

Cross-domain crypto cooperation

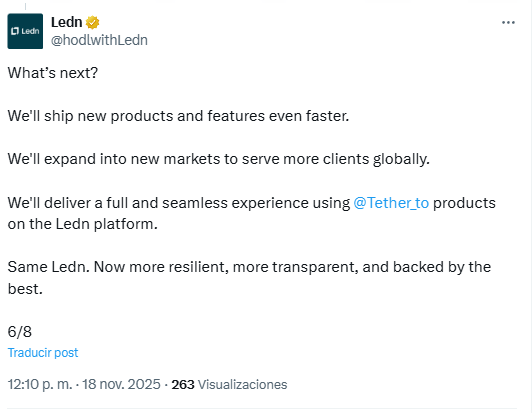

The sum of this strategic investment remains shrouded in mystery, a secret guarded as closely as a family heirloom. Yet, a cryptic post on Twitter hinted at Ledn’s intentions: to launch new products, expand into uncharted markets, and seamlessly integrate Tether’s offerings into its platform. Ah, the intrigue! The suspense! One can only imagine the behind-the-scenes machinations, as if a novel by Dostoevsky were unfolding in the world of finance. 🐦🔍

Ledn announcement | Source: X.com

Ledn, ever the industrious bee in the crypto hive, offers high-interest savings accounts that support USDC, USDT, and Bitcoin. Coupled with its lending services, which allow individuals to borrow against their holdings, the firm presents itself as a one-stop shop for crypto growth. How quaint! A financial Swiss Army knife for the digital age. 🌱💰

Tether, meanwhile, continues its relentless expansion, a juggernaut of investment and partnership. As reported by Coinspeaker on November 15, the company is considering a $1.16 billion investment in the German AI-powered robotics firm Neura, valuing it at a staggering $12 billion. And let us not forget its alliance with KraneShares and Bitfinex Securities to create blockchain infrastructure for tokenized securities. Truly, Tether’s ambitions know no bounds, though one wonders if such rapid growth is sustainable or merely a house of cards waiting to tumble. 🤖🏗️

In this grand tapestry of finance and technology, where every move is scrutinized and every partnership dissected, one cannot help but ponder the deeper meaning of it all. Are these alliances the building blocks of a new financial order, or merely the latest chapter in a never-ending saga of greed and ambition? Only time will tell. Until then, we watch, we wait, and we marvel at the spectacle. 🎭⏳

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-11-19 03:15