Tesla (TSLA) investors have spent 2025 navigating a minefield of misfortunes-declining sales, aging cars, Musk’s political jousting, and the sudden disappearance of federal tax credits. It’s been a year where even the most bullish analysts might’ve considered investing in a llama for emotional support. Yet here we are, clutching a crumb of optimism like a stranded astronaut gripping a half-eaten scone. (Assuming scones exist in space. They probably don’t. But the sentiment remains.)

Vehicle as a Platform? Or a Very Priced Teapot?

Gone are the days when cars were merely “vehicles.” Welcome to the era of software-defined vehicles (SDVs), where your car updates itself like a particularly smug social media profile. This isn’t just about streaming your favorite cat videos (though that’s still a concern for insurers). It’s about critical systems-brakes, steering, energy optimization-being rewritten mid-journey. Imagine your car learning to drive itself while you’re stuck in traffic, muttering, “Ah yes, I’ve always been a fan of existential dread.”

Tesla, as per Gartner’s Pedro Pacheco, is currently 80-85% “SDV-ready,” which is about as close as one can get to a fully functional SDV without a time machine and a very patient customer. For context, this is roughly the automotive equivalent of baking a soufflé while holding your breath. Most competitors are still trying to figure out if their infotainment system counts as “software.”

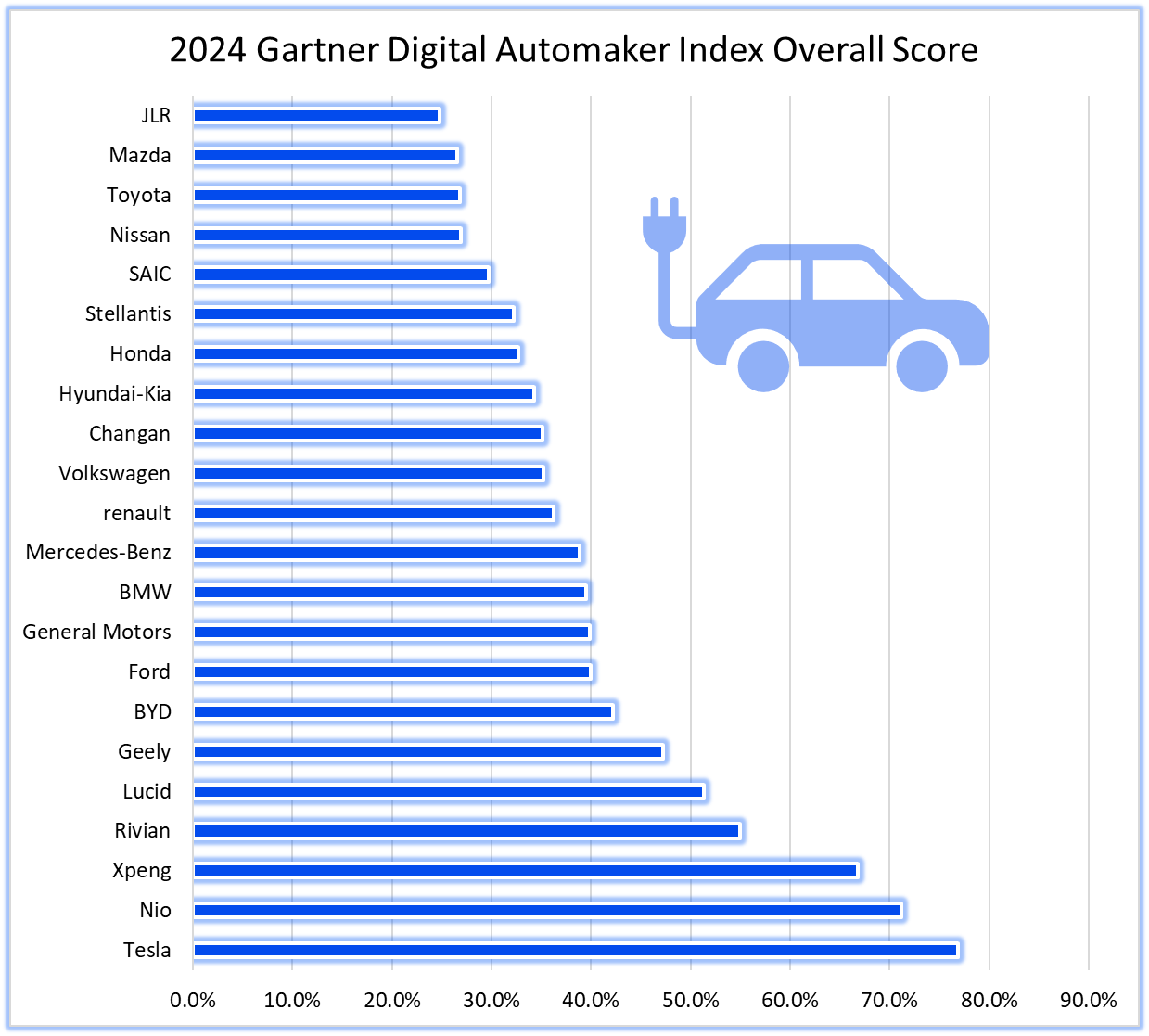

The SDV leaderboard, per Gartner’s 2024 Digital Automaker Index, reads like a who’s-who of overambitious startups and legacy automakers with very aggressive rebranding strategies. Nio and Xpeng trail Tesla closely, while Rivian and Lucid lurk in the mid-pack like hopefuls at a networking event where everyone’s dressed as a spreadsheet. Here’s the breakdown, because nothing says “confidence” like a chart titled “Digital Automaker Index”:

The Future: Soon, Probably

Accenture, that paragon of corporate futurism, claims full SDVs could arrive by 2026. By 2030, software will be the automotive industry’s primary revenue driver. This is the same company that once predicted fax machines would “reshape global commerce.” Take it with a grain of salt-or, better yet, a 401(k) allocation.

For Tesla, this isn’t just a technical achievement; it’s a financial portal to new revenue streams. Imagine licensing its SDV software to traditional automakers, who are currently spending more time in boardroom meetings than on R&D. Rivian’s $5.8 billion VW partnership proves this isn’t science fiction-it’s just fiction with more Excel sheets.

As a trader, one can’t help but notice the asymmetry here: Tesla’s SDV leadership could either be a $3.5 trillion golden goose (Accenture’s 2040 forecast) or a cautionary tale about overhyping “over-the-air updates.” The company now sits at a crossroads, trying to decide if it’s an automaker, a robotaxi service, or a sentient AI with a midlife crisis. (Elon’s Twitter history suggests all three.)

Investors, meanwhile, are left recalibrating their theses like a GPS in a parallel universe. Tesla’s future might not just be about cars-it could be about monetizing the very concept of “mobility,” whatever that means. For now, though, take this sliver of good news as a cosmic wink, not a guarantee. After all, in the grand scheme of things, we’re all just tourists in a universe that forgot to include a map. 🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-16 11:42