The analyst, Mr. Rosner, speaks of figures. Two hundred and fifty billion, by 2035. A sum that feels…optimistic. One imagines the spreadsheets, neatly arranged, each cell a tiny hope. Tesla, of course, is accustomed to such projections. It is a company built on the promise of tomorrow, a tomorrow that seems to perpetually recede.

The core of this calculation, it appears, rests on the Robotaxi. A fleet of self-propelled carriages, silently gliding through our cities, delivering passengers and, presumably, profits. A pleasant vision. Though one can’t help but recall the countless innovations that promised to revolutionize transportation, only to fade into obscurity. The market, it is said, will split – thirty percent autonomous, seventy percent driven by fallible hands. A generous allocation for the unproven. Tesla, they expect, will capture half. A bold assumption, considering the competition, the regulations, the inherent unpredictability of human behavior.

The Allure of a Distant Revenue Stream

Two hundred and fifty billion. The number hangs in the air, shimmering like a mirage. It is based, as these things are, on a price per mile. One dollar. A modest sum, one might think, for entrusting one’s life to a machine. But it is the scale that matters. Millions of miles, countless journeys. A constant, humming revenue stream. The problem, of course, is that it is a revenue stream that exists only in projections. A phantom limb of the balance sheet.

One should not dismiss it entirely. There is a certain logic to the idea. Autonomous vehicles, if they can overcome the inevitable technical and logistical hurdles, will undoubtedly play a role in the future of transportation. But to assume that Tesla will dominate this market, to assign it such a substantial share, feels…premature. The road is long, and littered with the wreckage of good intentions.

The Shadows Beneath the Promise

There are, naturally, risks. Mr. Rosner acknowledges them, in his way. Financial models, he points out, are sensitive creatures. They respond to the slightest breeze of uncertainty. And there is a great deal of uncertainty surrounding the Robotaxi. The technology is still in development. The regulatory landscape is unclear. And the consumer, that most fickle of creatures, may not embrace this innovation as quickly as the optimists predict.

Then there is the matter of cost. Billions of dollars are being poured into research and development, into capital expenditures. A considerable investment, with no guarantee of return. It is a gamble, of course. All innovation is a gamble. But some gambles are more prudent than others. And the market, one suspects, is beginning to demand a more tangible return on its investment.

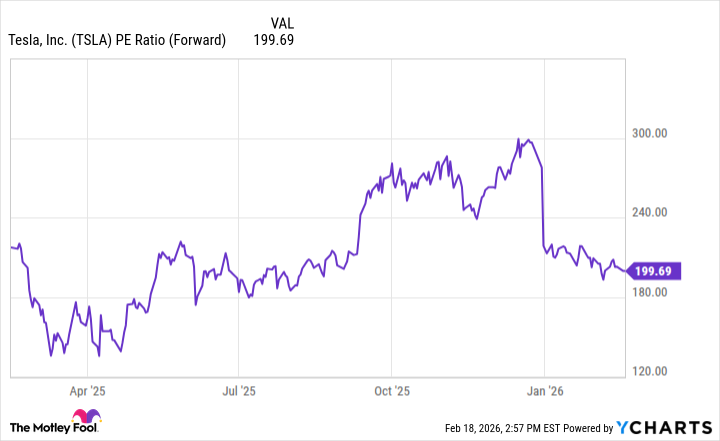

A price-to-earnings ratio of two hundred. It is a valuation that suggests a great deal of hope is already baked into the stock. Hope, as any seasoned trader knows, is a dangerous commodity. It can inflate prices to unsustainable levels. And when reality inevitably intrudes, the consequences can be…unpleasant.

Alphabet’s Waymo, meanwhile, is already completing rides, generating revenue. A small detail, perhaps, but a significant one. Progress, it seems, is not always linear. And sometimes, the tortoise wins the race.

The Robotaxi may, in the long run, prove transformative for Tesla. Autonomous vehicles may indeed become a new source of sales and profits. But one should not hold one’s breath. The market is a capricious mistress. And she often rewards patience more than exuberance. For now, a period of consolidation seems more likely. A gentle correction. A quiet acknowledgement that even the most ambitious dreams require a solid foundation. The stock will likely drift, a quiet hum in the background, as the world waits for the future to arrive. It will continue to move, but slowly. As all things do.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Exit Strategy: A Biotech Farce

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

2026-02-21 18:12