Right, let’s talk Tesla. Look, it’s been a good run, hasn’t it? A really good run. Shareholders are practically building monuments to Elon at this point. But honestly? I’m starting to feel a bit… uneasy. It’s like watching a magician attempt a trick they haven’t quite rehearsed. All the flash, but a nagging feeling something’s about to fall on someone’s head. They’re trying to morph from car company to robotics overlords, and frankly, it feels… ambitious. Like, “borrowing your neighbour’s yacht” ambitious.

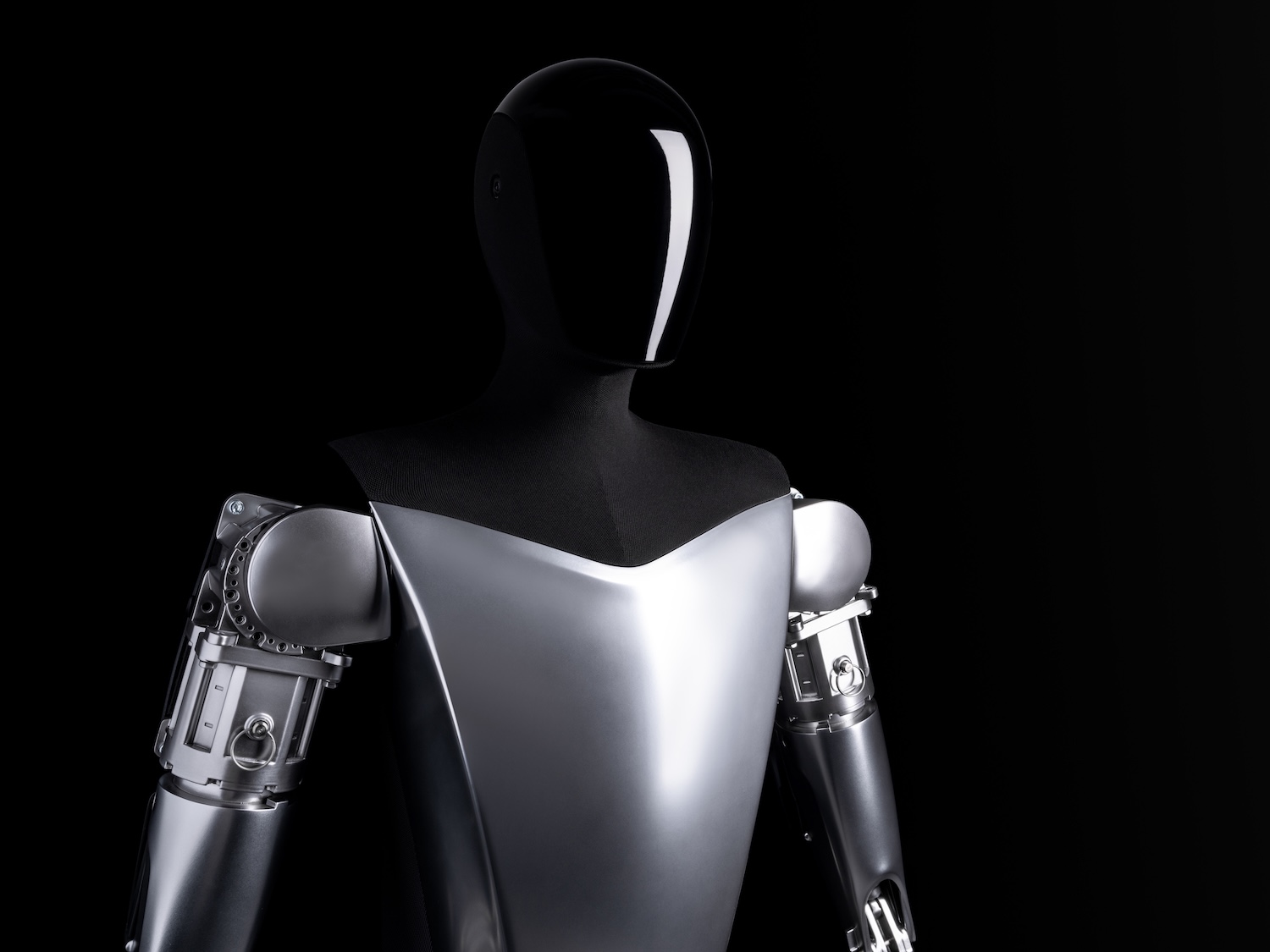

And here’s the thing. I’m not against ambition. I encourage it. But I also like to see a solid business plan. A safety net. Something other than sheer willpower and a Twitter account. While they’re dreaming of robotaxis and Optimus (seriously, that name), the core EV business is… well, it’s wobbling. Sales down, costs up. It’s the financial equivalent of trying to juggle chainsaws while riding a unicycle. Not a good look.

Last quarter, revenue fell. Fell. And operating expenses? Up nearly 40%. It’s like they’re actively trying to burn through cash. They’re forecasting another $20 billion in capital expenditures this year. That’s… a lot of robots. A truly unsettling amount. And the P/E ratio? 390. Let that sink in. You could buy a small island for that kind of premium. I’m starting to suspect they’re relying on the sheer force of personality to keep the whole thing afloat. Which, admittedly, is a powerful force, but not exactly a sustainable investment strategy.

So, Where’s the Smart Money?

Look, I get the hype. Autonomous vehicles could be a $1.4 trillion market. Humanoid robots, a staggering $5 trillion. But those are projections, aren’t they? Future possibilities. I deal in present realities. And right now, the reality is that Micron and Taiwan Semiconductor are looking rather… sensible. I know, “sensible” isn’t exactly a thrilling word, is it? But sometimes, you need a bit of stability. A little grounding.

TSMC, for example, controls about 70% of processor manufacturing. 70%! They’re basically the kings of the chip world. And Micron? They make the memory chips that power all those AI data centers. The demand is insane. Their Executive VP of Operations recently said the shortage is “unprecedented.” Unprecedented! That’s a word I like. It suggests opportunity. It suggests profit. It suggests I might actually get a decent night’s sleep.

Both companies are actually growing. Micron’s revenue jumped 56% last quarter, earnings up 167%. TSMC? Sales up nearly 26%, earnings up 35%. It’s almost… boring. But in the world of high-stakes investing, boring can be beautiful. And Nvidia is estimating that AI infrastructure spending will reach $3 to $4 trillion by 2030. That’s a lot of data. A lot of chips. A lot of potential.

Oh, and the best part? They’re actually reasonably priced. Micron’s P/E ratio is just 39. TSMC’s is about 33. Compared to Tesla’s stratospheric valuation, it’s like finding a five-pound note in an old coat. It’s not going to change your life, but it’s a welcome surprise. Look, I’m not saying ditch Tesla entirely. But maybe, just maybe, it’s time to diversify. To spread the risk. To invest in something that doesn’t feel like a high-wire act performed during an earthquake. I’m just saying. It’s just a thought. And honestly, I need a drink.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-09 15:42