Now, I reckon there’s a spectacle unfolding over yonder at Tesla, a company that once aimed to simply move folks about without the stink of petrol. Seems Mr. Musk, a man with more notions than a field of dandelions, has decided building electric carriages isn’t quite enough. He’s taken a fancy to robots, sun-catchers, and driverless buggies, all at once. A fella could get whiplash just keepin’ track of it.

The talk in Davos, Switzerland – a place where the well-to-do gather to discuss the troubles of everyone else – was all about this “shift to an autonomous future.” Mr. Musk, bless his optimistic heart, described it as an “infinite money glitch.” Sounds like a conjurer’s trick to me, though whether it’ll pull rabbits or ruin folks is yet to be seen. He speaks of billions flowin’ like a spring flood, but a wise man remembers that floods often leave a mess in their wake.

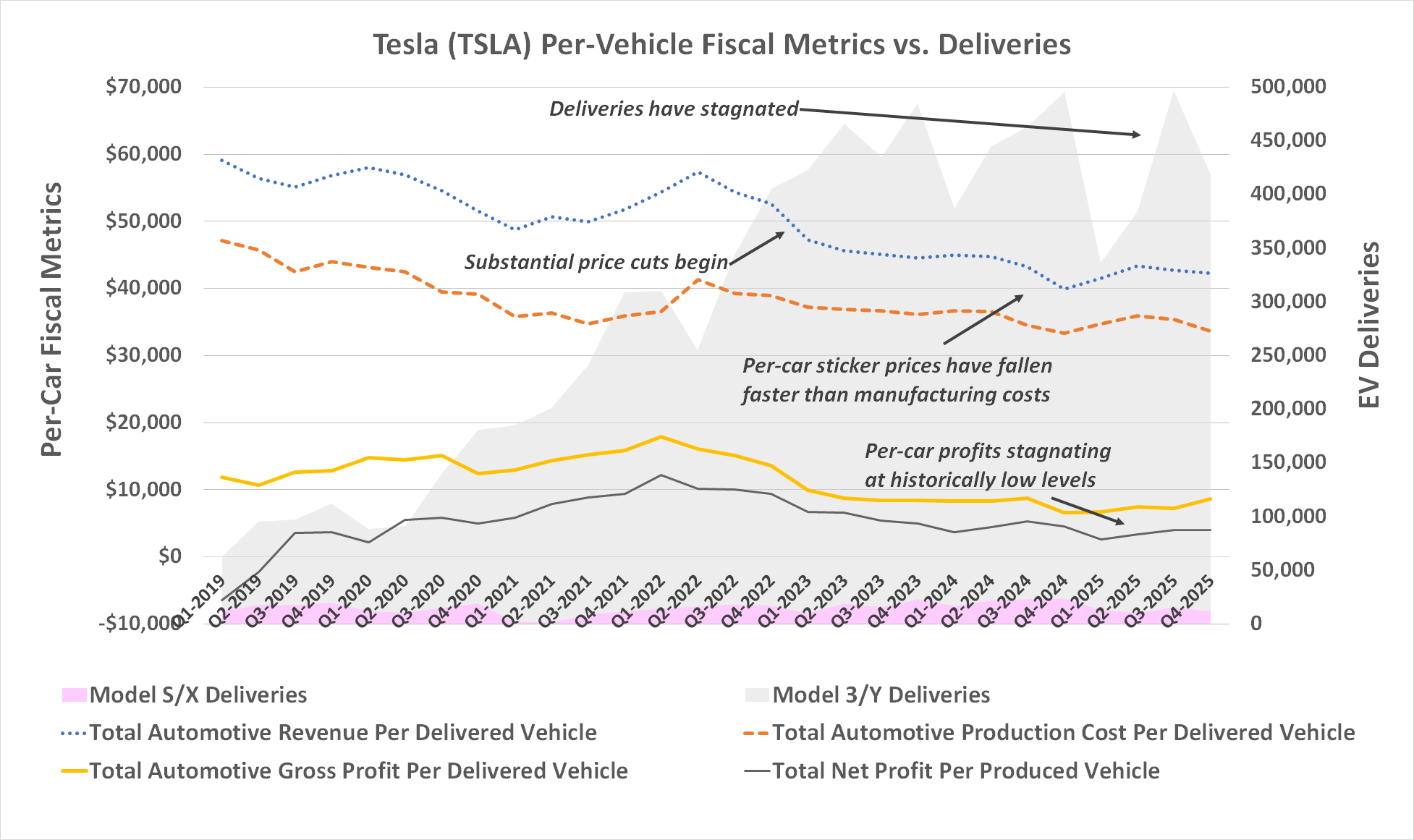

Now, some might say this flurry of new ventures is a sign of a restless genius. I, however, suspect it’s a bit like a gambler doubling down when his cards are lookin’ poorly. The electric carriage business, it appears, ain’t quite the gold mine it once was. Profits are shrinkin’ faster than a shirt in a hot wash. Seems Mr. Musk may be divin’ headfirst into these new ventures not because he wants to, but because he needs to. And that, my friends, is a different kettle of fish altogether.

Tesla’s Carriages Stuck in the Mud

Let me lay it out plain. Even though Tesla’s been makin’ more of those affordable Model 3 and Model Y carriages, the cost of buildin’ ’em hasn’t fallen fast enough to keep the profits flowin’ like they used to. They’re clearin’ a paltry four thousand dollars per carriage now, compared to over ten thousand not long ago. A fella can’t build a fortune on that kind of margin, no sir.

Competition, you see, has arrived. Folks in China, Europe, and right here in America are buildin’ electric carriages too. And they’re takin’ a share of the market. It seems the brand that once made electric carriages “cool” ain’t quite as cool as it used to be. Fixin’ that, I reckon, is a tall order, and Mr. Musk might not even bother tryin’.

And that’s a concern, because those carriages still account for the lion’s share – over seventy percent – of Tesla’s revenue. A fella can’t build a future on shaky ground.

Meet the New Tesla (Same as the Old?)

But what if Mr. Musk can conjure up a future with robots, sun-catchers, and driverless buggies? Well, sun-catchers are a fine idea, no doubt. The world needs more power, and the sun’s a mighty generous supplier. And driverless buggies? They might come to pass, though I’ll believe it when I see it. They say the robotaxi business could be worth a tidy sum by 2034, nearly 190 billion dollars. A fella could get rich on that, if it ever materializes.

The real question mark, though, is that robot of theirs. A machine to do chores around the house. There’s nothin’ quite like it on the market, so we can only guess how much money it’ll bring in. Mr. Musk says it’ll be a key part of that “infinite money glitch,” but a wise man remembers that promises are like pie crusts – easily made, easily broken.

Now, Tesla ain’t the only one playin’ in these new fields. There are other companies buildin’ robots, too. And they’ve been at it a while. It remains to be seen if Tesla can thrive in these crowded spaces.

And then there’s Mr. Musk’s habit of overpromisin’ and underdeliverin’. Remember the Hyperloop, that high-speed train? Or the plan to send folks to Mars by 2021? Those dreams, it seems, are still driftin’ in the clouds.

A Risky Gamble

Here’s the rub for investors. Tesla’s stock is already priced for perfection, tradin’ at over 200 times this year’s earnin’s. Even if the company does better than expected, it’s still askin’ investors to believe in a future that may or may not come to pass. It’s a mighty high price to pay for a dream.

And to add to the mix, Mr. Musk is busy mergin’ SpaceX and xAI, two other companies he leads. A fella can only spread himself so thin.

It appears Tesla is movin’ away from its bread-and-butter carriage business to chase after a handful of uncertain opportunities. Diversifyin’ ain’t a bad thing, mind you. But with so many changes happenin’ so quickly, it wouldn’t be crazy to suspect a bit of panic is drivin’ the decision. That’s not what you want to see from the leader of a company you’re considerin’ investin’ in.

Despite all the talk of robots, sun-catchers, and driverless buggies, the analyst community ain’t swayed. They still reckon Tesla’s stock is only worth around $422 per share, a hint that the company’s carriage business is runnin’ into headwinds. A wise man might heed that warnin’.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

- The Most Anticipated Anime of 2026

2026-02-15 14:12