Behold, the iron steed of Tesla, TSLA, whose stock hath galloped to double-digit heights in the year 2025, despite a wretched start as bleak as a Siberian winter. With a market cap of 1.3 trillion rubles, the sages of finance ponder: how much further may this chariot ascend? Some prophets of the bourse whisper that by 2026, Tesla may swell to 2 trillion, though the path is strewn with thorns as sharp as a bureaucrat’s pen.

The Price of Prestige: Tesla’s Gilded Cage

The greatest peril to Tesla lies in its gilded valuation, a price-to-sales ratio of 16, as if the company were a nobleman’s carriage while rivals like Lucid and Rivian ride in humble carts. These latter two, with sales multiples of 3 to 7, are but shadows compared to Tesla’s 100% to 400% premium. Yet their market caps, mere pittances of under 20 billion, suggest longer roads ahead-though the road to riches is often paved with the bones of the overambitious.

To pay such a price is not folly, provided the enterprise grows as swiftly as a weed in a czar’s garden. A 16x multiple might halve if revenues doubled, yet Tesla’s sales are forecast to fall 5% this year, a calamity as dire as a drought in the Volga. Meanwhile, Lucid and Rivian shall see their revenues swell by 61% and 6%, respectively-a paradox as befuddling as a priest preaching atheism.

Thus, Tesla’s shares, though steep, are justified only if its growth rivals the feverish pace of a drunk serf. Yet even next year’s 20% growth pales beside Lucid’s 93% and Rivian’s 33%. A conundrum! The noble Tesla, with its brand as mighty as a Cossack’s sword, trades at a premium to rivals who, though less renowned, may yet outpace it in the race to the horizon.

What sorcery is this? Perhaps the competitors lack the scale of Tesla, yet their growth runways are longer than a peasant’s stride. The difference lies not in current might, but in the promise of robotaxis-a realm where Tesla’s vision is as grand as a tsar’s dream, yet as fragile as a spider’s web in a storm.

The Robotaxi: A Vision as Vast as the Steppe

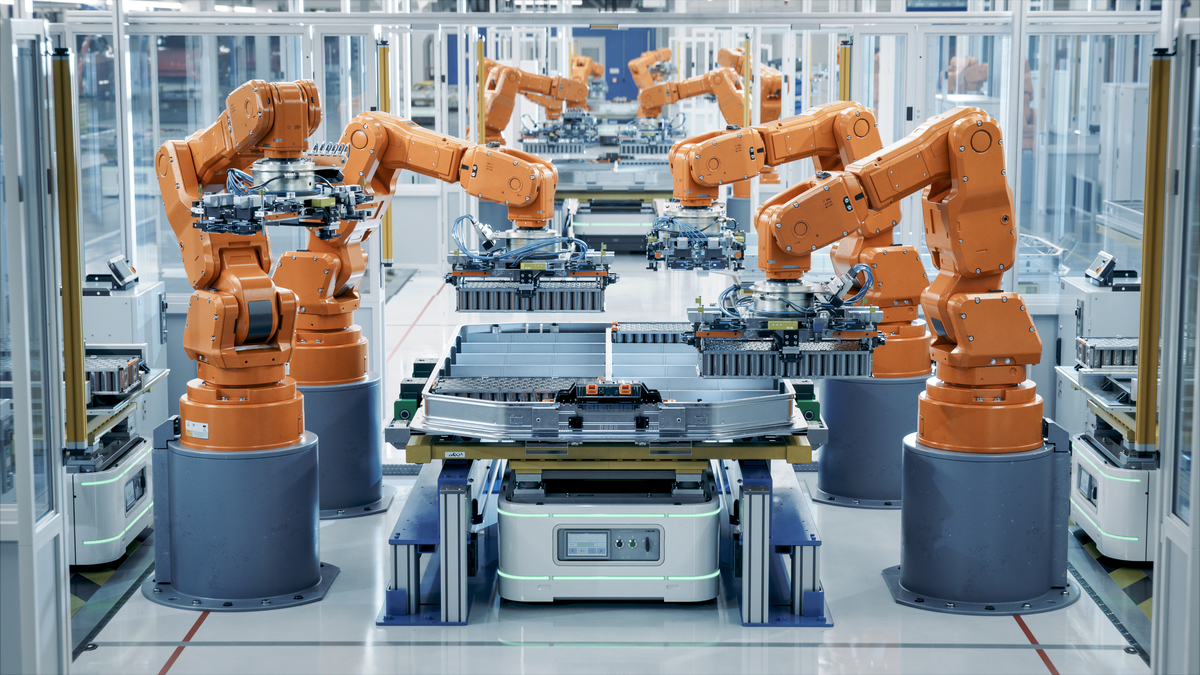

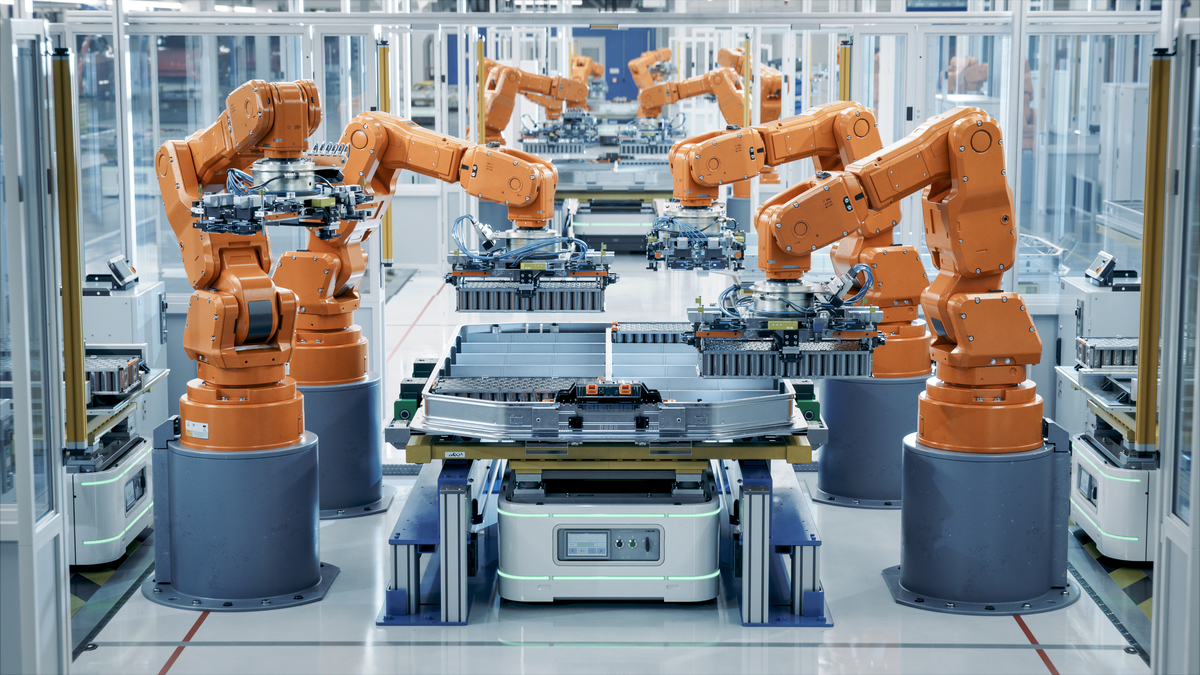

Behold, the robotaxi! A marvel of modern alchemy, Tesla’s autonomous taxi service has taken root in Austin, Texas, like a mushroom after rain. Elon Musk, that archbishop of innovation, envisions a million such carriages roaming America’s streets by 2026-a vision as grand as a samovar’s steam. Analysts, those modern-day prophets, foresee a $1 trillion addition to Tesla’s empire, while Cathie Wood, that fiery oracle, dreams of a $10 trillion market.

Yet the road to this utopia is lined with obstacles as numerous as the flies in a summer’s barn. Reuters, that chronicler of truth, warns that scaling from dozens to millions of self-driving carriages is no simple task. It is a multi-decade endeavor, as arduous as building a cathedral with a spoon. Tesla’s Austin trial, with its stumbles and missteps, is but a prelude to the grand opera of the future.

To the long-suffering investor, Tesla’s stock is a gamble as risky as a duel with a drunk opponent. For those who believe in the robotaxi’s promise, it is a beacon; for others, a mirage. The company’s prowess in production, its access to capital, and its decades of investment in autonomy are its shields, yet the path remains as uncertain as a fortune-teller’s glass.

In summation, Tesla is a tale of two horses: one galloping with the vigor of a young Cossack, the other tethered by the weight of its own ambition. The market, that fickle mistress, shall decide which shall prevail. 🚗

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

2025-09-22 12:19