As a seasoned crypto investor who rode the waves of the 2017 bull run and weathered the subsequent bear market, these Q3 2024 Tesla Financial Results have me feeling like I just found a golden nugget while prospecting for bitcoin. The company’s growth trajectory is nothing short of impressive, with improved gross margins, increased vehicle deliveries, and record-breaking performance in its Energy division.

On 23 Oct 2024, Tesla Inc. (NASDAQ: TSLA) released its Q3 2024 Financial Results.

Financial Overview

In the third quarter of 2024, Tesla announced a total revenue of $25.2 billion, which represented an 8% increase compared to the same period the previous year. This growth was primarily driven by increased vehicle deliveries and stronger earnings from energy production, storage, and service sectors. The company also reported $2.7 billion in GAAP operating income, with net income reaching $2.2 billion. On a non-GAAP basis, net income was $2.5 billion. Notably, Tesla managed to boost its gross margin to 19.8%, up from 17.9% in Q3 of the preceding year, suggesting improved cost efficiency amidst economic challenges.

In Q3, Tesla’s free cash flow stood strong at approximately $2.7 billion, leading to a sequential boost of $2.9 billion in cash reserves, bringing the total to an impressive $33.6 billion. This financial strength is maintained as the company continues to prioritize cost savings, all while pouring resources into cutting-edge technology and manufacturing advancements.

Vehicle and Production Insights

During the last quarter, there was an annual rise in vehicle shipments, amounting to 462,890 units sent out. Notably, the Cybertruck deliveries spiked, making it the third most popular electric vehicle in the U.S., after the Model Y and Model 3. The production capabilities are growing at various sites, as Tesla reached its 7-millionth vehicle assembly milestone in October 2024.

As a researcher, I’ve observed an uptick in production for the revamped Model 3, largely due to lower production expenses. On the other hand, the Model Y has consistently excelled in Europe, even claiming the title of best-selling Electric Vehicle (EV) of all time in Norway. To add, the Shanghai factory’s cost per vehicle production has reached record lows, significantly enhancing overall profitability.

Energy Business and Technology Developments

In the latest quarter, Tesla’s Energy division set a new record with a gross margin of 30.5%. The Lathrop Megafactory hit a major milestone by manufacturing 200 Megapacks in a single week. Additionally, the deployment of Powerwalls reached unprecedented levels for the second quarter in a row. As the Shanghai Megafactory prepares to start shipping Megapacks early next year, Tesla is solidifying its leadership role in the energy storage industry.

In the third quarter, there was a strong emphasis on progress in artificial intelligence (AI) and software developments. Notably, Tesla boosted its AI training computational capacity by more than 75%, signaling a promising path for future software breakthroughs. One significant milestone reached during this period was the rollout of the “Actually Smart Summon” feature, enabling vehicles to move autonomously within parking lots on their own.

Future Outlook

Moving forward, Tesla intends to launch economical vehicle models during the first half of 2025, aiming at a wider range of consumers. The company continues to prioritize expanding its array of products and manufacturing capacity while maintaining cost-effectiveness. Furthermore, Tesla is preparing for its next stage of growth, fueled by developments in autonomous technology and novel product introductions.

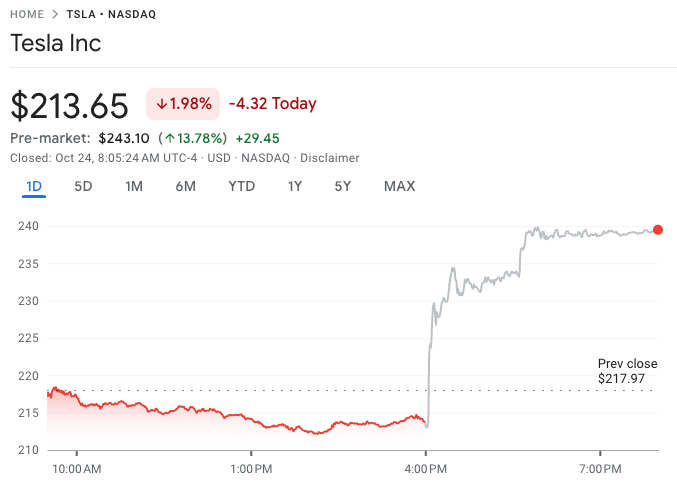

Despite macroeconomic challenges, Tesla’s focus on technological innovation, cost management, and expanding its vehicle and energy product portfolio has set a positive trajectory for the upcoming quarters. This outlook has generated investor optimism, reflected in the 13.48% rise in Tesla’s stock price in after-hours trading, reaching $242.46 per share.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-10-24 15:22