The electric vehicle sector, one observes, has become frightfully crowded. A veritable scrum, in fact. Yet, amidst the jostling, Tesla – a name once synonymous with aspiration, now merely with quarterly reports – appears, for the moment, to retain a distinctly advantageous position. One should not mistake this for enduring strength, merely a temporary respite granted by the failings of its competitors.

A Pyrrhic Victory

Much fuss was made over a slight dip in deliveries. A mere 8.6% decline, if one consults the figures. As if a single quarter could definitively indict a company. The temporary disruption, stemming from the Model Y refresh (still, remarkably, the best-selling of its kind), proved a minor inconvenience. The market, predictably, overreacted. It always does.

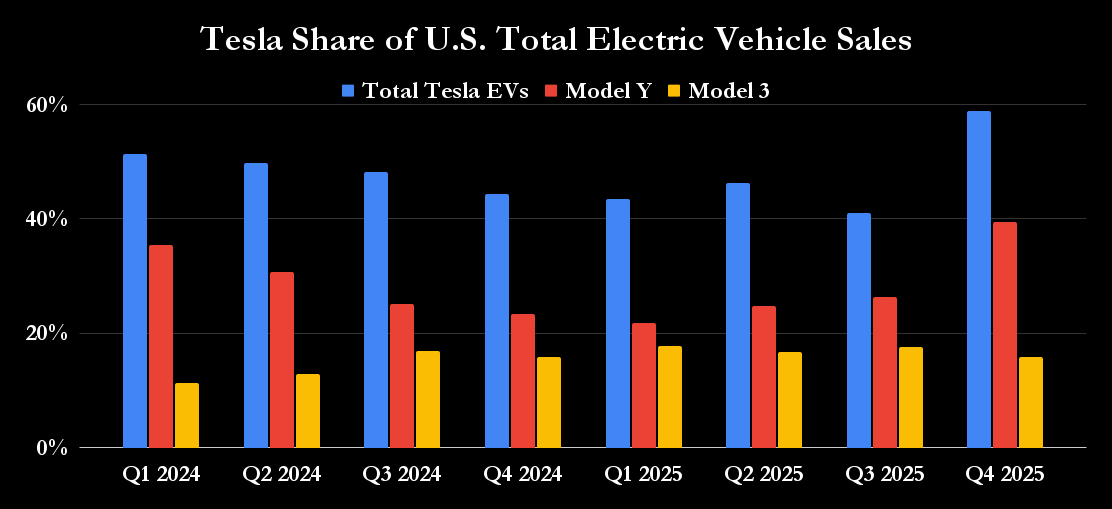

The Kelley Blue Book reports, those meticulously compiled pronouncements of consumer whim, indicated a temporary ebb in the Model Y’s dominance. A brief setback, swiftly rectified upon the arrival of the refreshed model. One suspects the market rewards novelty more than genuine improvement.

The expiry of federal tax credits, a rather clumsy intervention in the free market, did provide a temporary boost. Tesla, being already established, suffered less from the withdrawal of artificial support than those still struggling to gain a foothold. A predictable outcome, really.

The Cost of Ambition

One observes a disturbing pattern amongst the challengers. A willingness to sustain crippling losses in pursuit of market share. Ford, for instance, has committed a sum equivalent to the GDP of a small nation to its Model e venture, and yet remains stubbornly in the red. A philanthropic gesture disguised as business acumen, perhaps? It cannot endure.

Tesla, by contrast, remains profitable. A quaint notion, in this age of subsidized dreams. Its scale allows for efficiencies, and a gradual reduction in per-unit costs. A rather pedestrian advantage, but a decisive one nonetheless.

The Supercharger network, while hardly a marvel of engineering, does provide a degree of infrastructure that its rivals lack. A convenience, admittedly, but a significant one in a market obsessed with range anxiety.

The Robotaxi Gambit

The recent removal of safety drivers from Tesla’s robotaxi fleet in Austin, Texas, is a curious development. Reports suggest these unsupervised vehicles are still shadowed by monitoring cars, a rather unconvincing display of autonomy. Nevertheless, it is a step forward. A gamble, certainly, but one that could yield substantial rewards.

The potential revenue stream from a fleet of robotaxis, or “Cybercabs” as one might term them, is considerable. The prospect of transforming existing Tesla vehicles into autonomous units, through software updates, is even more intriguing. A subscription model, naturally. One must always extract maximum value from the consumer.

The expansion of robotaxis will also serve as a demonstration of Tesla’s Full Self-Driving capabilities. A marketing ploy, if one is being cynical. But a potentially effective one.

A Fleeting Advantage

Tesla currently dominates the market. But dominance is a fragile thing. Rivals cannot sustain losses indefinitely. And the robotaxi rollout, while promising, is fraught with risk. A temporary monopoly, one suspects. A pause before the inevitable reckoning. A prudent investor would proceed with caution.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- The Best Single-Player Games Released in 2025

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Brent Oil Forecast

2026-01-28 11:55