My brother-in-law, bless his heart, is convinced cybersecurity is just a fancy way to sell people anxiety. He’s a plumber, so he deals in very real, very immediate crises. Leaks, backups, the occasional rogue garden hose. He thinks if something isn’t dripping or flooding, it’s not a problem. I tried explaining that vulnerabilities in a network are like hairline cracks in a pipe—unnoticeable until everything goes sideways. He just shrugged and asked if I’d seen the game. Anyway, this got me thinking about Tenable (TENB 1.68%), a company that, if nothing else, is very good at finding those cracks.

It’s a small cap, which already puts it at a disadvantage. Wall Street seems to have a pathological aversion to anything under a billion or two. It’s like they can’t see it on the screen. Tenable is currently valued around $2.5 billion, which, in the grand scheme of things, is less than the cost of a decent yacht. Compared to the behemoths like CrowdStrike (CRWD +0.60%) and Palo Alto Networks (PANW 0.11)—companies valued in the triple digits—it’s practically invisible. And its stock, well, it’s been having a bit of a moment. Down 65% from its 2022 peak. A steep drop, even for a company whose business involves preventing things from falling apart.

But here’s where things get interesting. Analysts, those optimistic souls, still largely rate it a buy. None are recommending you sell, which is… unusual. It’s like they’re politely suggesting it’s a good time to scoop up a bargain. The consensus price target suggests a decent upside. I’m not one for blindly following the herd, but it did make me take a closer look.

The Exposure Business

Tenable owns Nessus, a platform that scans networks for vulnerabilities. It’s basically a digital metal detector, searching for weaknesses before the bad guys find them. It’s surprisingly accurate, which is reassuring. It’s also become a gateway drug to their more sophisticated products. Like a free sample at Costco. You start with the scanner, then suddenly you’re signing up for a membership.

They launched Tenable One in 2022, a comprehensive exposure management solution. It’s a fancy name for bundling everything together. And now it’s infused with AI. Of course it is. Everything is infused with AI these days. It’s supposed to make things more efficient, but I mostly find it makes error messages more cryptic. Apparently, it helps cybersecurity managers compile data and uncover hidden risks. Which sounds exhausting, even with the AI doing some of the heavy lifting.

During the fourth quarter of 2025, Tenable One accounted for 46% of all new business. A record. People are clearly willing to pay for peace of mind, or at least the illusion of it. It’s a good business, if you can stomach the constant fear-mongering.

The Numbers, Briefly

Tenable generated $999.4 million in revenue in 2025, up 11% from the previous year. They beat expectations, which is always nice. They also have a growing number of large clients – 2,161 with annual contracts over $100,000. Big organizations with big budgets. It’s a good sign.

Operating expenses were also up 11%, matching revenue growth. They’re still losing money on a GAAP basis, but their adjusted profit was up 22%. Accounting is a funny thing. You can make the numbers say almost anything you want.

So, a Bargain?

Analysts have an average price target of $30.72, implying a 42% upside. Some are even more optimistic, suggesting a potential climb of 85%. I’m not one to chase unrealistic gains, but it’s worth considering.

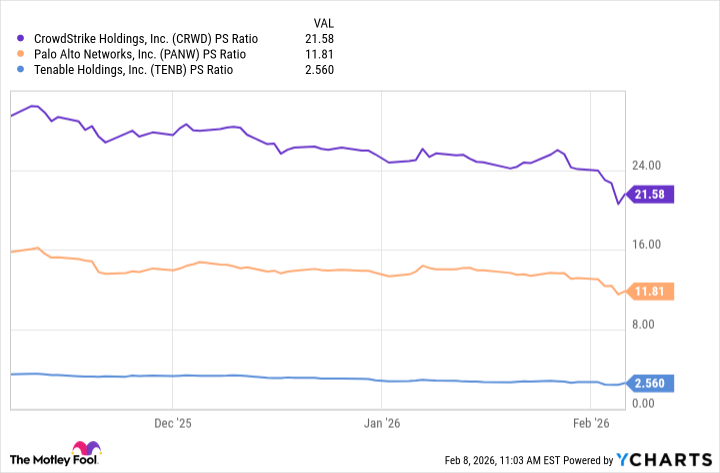

The stock trades at a price-to-sales ratio of just 2.5. That’s a significant discount to CrowdStrike and Palo Alto Networks. I’m not saying Tenable deserves to trade in line with those giants. They’re bigger, faster-growing. But a discount of this magnitude seems… excessive.

CrowdStrike’s revenue increased by 22% last quarter. Palo Alto’s by 16%. Faster growth usually commands a premium. But a discount of 88%? That feels like a bit much. Even if Tenable only hits Wall Street’s consensus price target, its price-to-sales ratio would still be a reasonable 3.6.

I’m not advocating a full-blown investment frenzy. But Tenable’s current valuation seems to be overlooking a fundamentally sound business. It’s not going to set the world on fire, but it might just be a quiet, steady performer. And sometimes, that’s exactly what you need in a portfolio. Like a good plumber, it might not be glamorous, but it keeps things from leaking.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-12 15:54