As a researcher with years of experience in the tech and finance industries, I must say that the Telegram report is nothing short of fascinating. The company’s ability to navigate through turbulent times, particularly amidst its founder’s legal issues, is truly impressive. It’s clear that they have a solid strategy in place, focusing on scaling their advertising and subscription revenue streams while leveraging favorable market conditions for their crypto assets.

The detailed report provides an uncommon view of the day-to-day activities at the messaging company, particularly during a difficult time when its creator, Pavel Durov, has encountered numerous legal hurdles.

Located in Dubai, Telegram’s digital assets saw substantial expansion, offering essential financial security following Durov’s arrest by French authorities in August. The arrest stemmed from tentative accusations that the platform had not adequately addressed illegal activities.

Despite Durov’s legal issues, the company assured investors that these troubles had not disrupted Telegram’s regular operations. In a statement issued on October 22, 2024, Telegram clarified that the accusations were aimed at the founder and not the company, stressing that there was no significant influence on its business operations.

Telegram Revenue Soars 190% in 2024

In the first half of 2024, Telegram saw a massive revenue increase of $525 million – that’s a whopping 190% growth compared to the same period in 2023. Approximately half of this income, around $225 million, stemmed from a unique deal with Toncoin, a cryptocurrency created by Telegram. However, due to regulatory issues, the project was eventually turned into an open-source platform. As part of the agreement, small businesses were required to only use Toncoin for their advertising needs.

Beyond Toncoin, it’s revealed that Telegram made approximately $353 million by selling digital assets during the initial months of the year. A significant chunk of this sum was generated from Toncoin sales, with around $348 million worth being sold since then. This revenue stream significantly improved Telegram’s financial status, leading to a post-tax profit of about $335 million in the first half of 2024. This stands in stark contrast to the losses reported by the company in 2023.

The significant surge in the crypto market for the company, notably via Toncoin sales, has played a crucial role in preserving its financial stability. Yet, Telegram is under growing scrutiny from regulatory authorities, largely due to allegations concerning inappropriate content on their platform.

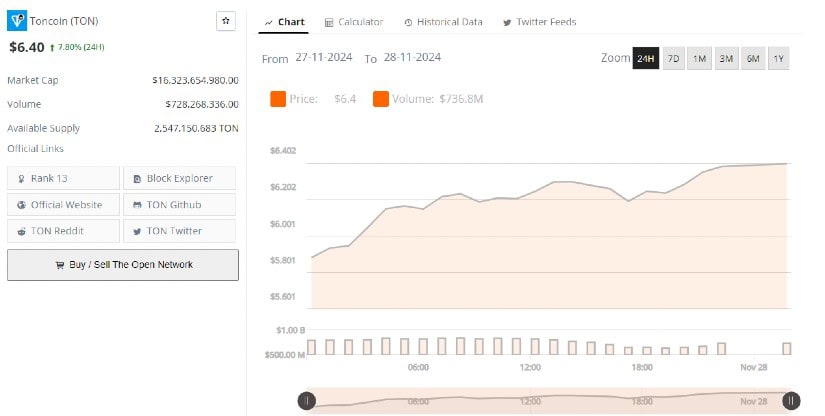

As a researcher, I’ve noticed that Telegram, being one of the significant holders of TON, is susceptible to market swings in the TON ecosystem. The arrest of founder Pavel Durov led to a 25% drop in TON’s value, plummeting it to $5.24. However, the asset quickly recovered, igniting a broader rally within the cryptocurrency markets. By November 27, the price of this cryptocurrency had climbed to $6.40, representing a 7.80% increase over the past 24 hours, as per Brave New Coin’s TON Price Index.

Telegram’s Advertising Revenue Surges to $120 Million

Concerns have been voiced by experts that Telegram might find it challenging to generate ad revenue due to its association with illegal content such as child sexual abuse material and terrorist activity. These issues have led to increased scrutiny from governments globally. To address these concerns, Telegram has pledged to enhance its content moderation policies. They plan to grow their moderation team and maintain cooperation with authorities while adhering to French laws.

Telegram stated that they fully support their content moderation policies, which are strictly in line with the relevant French laws, and emphasized their cooperation with legal authorities.

In spite of encountering significant hurdles, Telegram’s advertising income soared to a historic high of $120 million during the first six months of 2024. Moreover, premium subscriptions generated an extra $119 million, marking a substantial increase from the $32 million earned in the same period the year before.

Telegram continues to uphold a two-pronged approach for generating revenue, which involves both ad sales and premium subscriptions, much like prominent social media giants such as Meta and X. As stated by Durov, who remains the sole owner of the company, there’s a possibility that Telegram might opt for an initial public offering (IPO) as early as 2026, with aspirations to broaden its income-generating avenues even further.

Telegram’s Long-Term Strategy

While it’s true that Telegram has gained financially by selling some of its cryptocurrency assets during favorable market periods, this move does not align with its long-term business plan. Instead, Telegram primarily concentrates on expanding its advertising and subscription income sources. Interestingly, the increase in crypto holdings has served as a financial cushion, allowing Telegram to navigate Durov’s legal issues and continue growing even under unpredictable market circumstances.

Telegram’s bonds experienced ups and downs earlier this year, dropping as low as 87 cents in August. However, they have since recovered and are currently valued at 95 cents on the dollar for maturity in September 2024. The decision to repurchase $124.5 million worth of these bonds was a tactical step aimed at bolstering the company’s financial standing.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2024-11-28 13:00