Now, the tech sector, as anyone with a passing interest in the financial pages will tell you, has been behaving with a distinct lack of decorum lately. Shares of Microsoft, for instance, took a bit of a tumble – a most unseemly drop of ten percent, if you please – on the very same day they announced profits had jumped a jolly sixty percent. And Apple, despite exceeding expectations, decided to join the downward dance. It’s enough to give one a touch of the vapors, what!

The late John Bogle, a chap of considerable financial acumen, had a solution, and a rather sensible one at that. He advocated “buying the haystack,” as he put it, rather than wasting one’s time attempting to locate the elusive needle. A thoroughly sound principle, really. This Mr. Bogle, founder of the Vanguard Group, was a firm believer in simplicity and diversification – a bit like a well-chosen outfit, really. It just works.

It may strike some as counterintuitive, but spreading one’s investments far and wide, embracing a multitude of companies, can yield surprisingly handsome returns. After all, the S&P 500 index – tracking the performance of five hundred of America’s largest enterprises – has grown by a rather astonishing 667% this century. A most agreeable performance, wouldn’t you say?

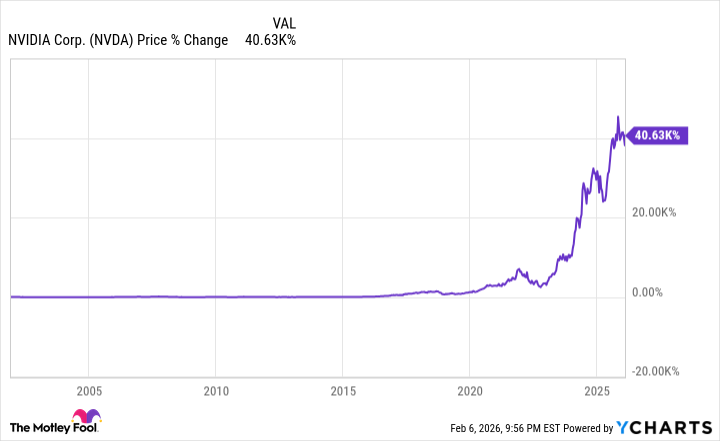

Naturally, there will be a few duffers in the mix. One can’t have everything, after all. A stock might plummet, but then again, others have the potential to soar to dizzying heights. It’s a bit of a gamble, naturally, but a calculated one. Take Nvidia, for example. Back in November 2001, a shrewd investor buying the S&P 500 would have found themselves pleasantly surprised by Nvidia’s subsequent rise of a staggering 40,630%! Replacing Enron, no less – a cautionary tale, that one.

Of course, the S&P 500 encompasses companies from all walks of life. But for those with a particular fondness for the technological sphere, one might consider the Vanguard Information Technology ETF (VGT 0.43%). A perfectly respectable option, I assure you.

A Mere Fleabite in Fees

The Vanguard Information Technology ETF offers a broad swathe of exposure to the information technology sector. Its largest holdings include Nvidia (17.5% of funds), Apple (14.89%), and Microsoft (12.19%). Not a bad bunch, what?

Despite these substantial positions, the fund holds a grand total of 320 information technology stocks. And the cost of all this? A mere 0.09% expense ratio. That’s nine dollars for every ten thousand invested. A positively minuscule sum, especially when compared to the average index equity ETF’s 0.15% in 2023.

For the long-term investor, this arrangement has proven rather fruitful. Since its inception in 2004, the fund’s average annual return of 13.96% has transformed every ten thousand dollars into a rather handsome one hundred and seventy-seven thousand two hundred and thirty-six dollars. A most agreeable outcome, wouldn’t you agree?

For those who appreciate simplicity, diversification, minimal fees, and the potential for substantial long-term gains as the tech boom continues its merry dance, this fund is, without a doubt, a rather spiffing investment.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-11 12:03