So, the Supreme Court, in a move that felt less like jurisprudence and more like a particularly passive-aggressive note left on a refrigerator, has essentially told the previous administration that you can’t just decide to impose tariffs. Apparently, there’s this quaint little concept called “congressional authorization.” Who knew? It reminded me of the time I tried to return a slightly used toaster oven to Bed Bath & Beyond with a receipt from 2018. The look on that cashier’s face… it was remarkably similar to the one Justice Kavanaugh was sporting in the photos.

“Liberation Day,” they called it. April 2nd. Honestly, it felt more like opening a particularly unpleasant bill in the mail. The market, predictably, had a bit of a wobble. I remember my brother-in-law, a man whose financial advice should be taken with several grains of salt (and a full bottle of antacids), insisted it was the perfect time to “buy the dip.” He hasn’t spoken to me since.

The whole thing hinged on this obscure act, IEEPA – the International Emergency Economic Powers Act. It sounds like something out of a spy novel, but it basically gives the President a lot of leeway when things get…panicky. Apparently, it doesn’t specifically mention tariffs. Which is like building a house without a roof. You can put up the walls, but good luck keeping the rain out.

The Court, in its infinite wisdom, ruled that clear congressional authorization was needed. Which, you know, makes sense. But it leaves this rather large question hanging: what about all the money already collected? The estimates are staggering – over $175 billion in potential refunds. That’s enough to make even the most seasoned accountant break out in hives. Kavanaugh, bless his heart, predicted a “mess.” That’s putting it mildly. It’s the sort of mess that requires industrial-strength cleaning supplies and a very strong drink.

The thing is, these tariffs were supposed to offset a lot of other spending. The “One Big Beautiful Act,” as they called it, is projected to add trillions to the national debt. The tariffs were the supposed safety net. Now, that net has a rather large hole in it. And the “bond vigilantes,” those shadowy figures who haunt the financial pages, are starting to circle. They don’t like uncertainty. They like things neat and predictable. Which, let’s be honest, is a lot to ask in this day and age.

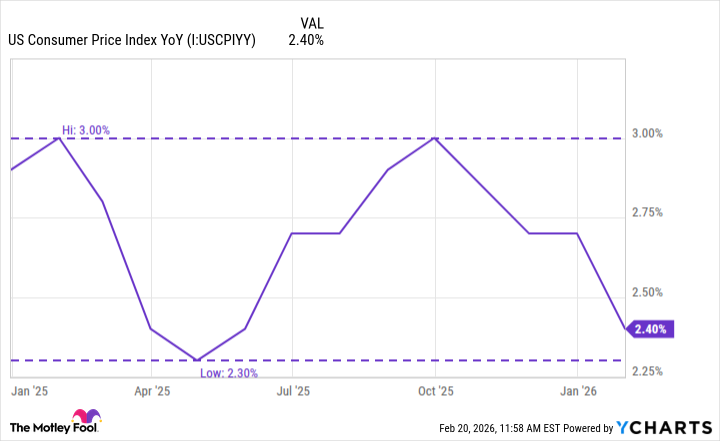

There’s a small chance this could actually be good for inflation. Tariffs, as it turns out, tend to push up prices. Consumer prices did dip briefly after “Liberation Day,” but then, predictably, shot back up. And then, of course, there was the government shutdown at the end of the year. It’s all so…layered. Like a particularly complicated onion. Or my mother’s fruitcake.

Ultimately, I suspect nobody really knows what’s going to happen. The refunds, the backup plans, the looming debt…it’s all a bit much to process. I keep expecting someone to announce that it was all a very elaborate performance art piece. But probably not. It’s just the market, doing what it does best: being unpredictable and vaguely terrifying. And me, trying to figure out if I should finally listen to my brother-in-law.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- ‘Peacemaker’ Still Dominatees HBO Max’s Most-Watched Shows List: Here Are the Remaining Top 10 Shows

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

2026-02-20 20:42