Target (TGT) resembles a beleaguered carnival ride: creaking, swaying, yet somehow still drawing a line of hopeful spectators. Investors, ever the polite spectators, have backed away, leaving the stock two-thirds below its November 2021 high. Meanwhile, the S&P 500 galloped ahead, doubling the fortunes of those less squeamish about risk.

The pressing question for a contrarian with a twinkle in his eye: will Target stumble into oblivion, or is there a hidden alley where fortunes quietly accumulate?

Target’s Tribulations

The company’s woes are not conjured from thin air. Elevated inventories from the supply chain debacle earlier this decade still rattle the shelves, while a flirtation with, and then retreat from, diversity policies managed to irritate admirers on every side. Politics, it seems, is the ultimate commodity that cannot be stored on a pallet.

Adding to the spectacle, COO Michael Fiddelke ascended to CEO in February. Investors, who secretly hoped for a dashing outsider, greeted this promotion with polite skepticism. Fiddelke now faces the dual challenge of charming both shareholders and the public-a task reminiscent of convincing a cat to swim.

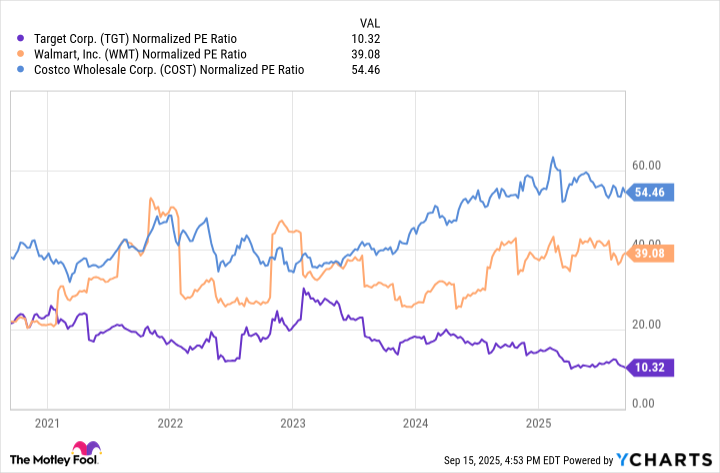

Sales are lukewarm, trailing behind competitors like Walmart and Costco. Fiscal 2025’s first-half net sales of $49 billion slipped 2% from last year, while the cost of doing business declined at a more leisurely pace. Depreciation and amortization, those insidious gremlins of accounting, climbed, leaving earnings just shy of $2 billion-a modest 8% decline from the previous year.

Forecasts whisper of a “low single-digit decline” for the year, while analysts cling to a 2% rise for fiscal 2026. Yet the shadow of fallen giants like Sears and JCPenney hovers, reminding the cautious that retail is a graveyard littered with the bones of the overconfident.

Reasons for a Bold Optimist

Yet, the alarm bells may be premature. Target’s footprint-nearly 2,000 stores sprinkled across all fifty states-remains a formidable fortress. More than 75% of Americans live within a brisk stroll of a Target, exceeded only by Walmart’s omnipresent shadow. Expansion plans hint at 300 more stores, a tempting morsel for any contrarian with a nose for overlooked potential.

The dividend, too, sings a reassuring tune. A $4.56 annual payout yields 5.1%, quadrupling the S&P 500 average of 1.2%. Fifty-four consecutive years of hikes confer the lofty title of Dividend King, ensuring that any interruption would spark investor mutiny and stock sell-offs of Shakespearean proportions.

Target’s cash flow keeps the crown secure: $2.9 billion in free cash flow against $2 billion in dividend payouts-hardly a perilous tightrope. And with a P/E of just 10, the stock presents an absurdly modest price tag compared to its over-earnest peers.

The Five-Year View

In five years, Target could well be a phoenix dressed in red and khaki. Its path is cluttered with obstacles, from skeptical shareholders to wary shoppers, yet its scale, strategic expansion, and aristocratic dividend suggest the company is far from resigned to mediocrity.

Fiddelke’s charm offensive may take time, but for the patient contrarian, patience is merely a form of cunning. In-store and online synergies, coupled with a dependable income stream at a bargain multiple, hint that the stock is positioned not just to recover, but perhaps to ascend quietly, while the crowd frets over headline dramas.

For the discerning investor, this is less a gamble and more an elegant heist of opportunity-Target, it seems, still has its secrets. 🕵️♂️

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

2025-09-19 11:41