In the vast arena of commerce, amidst the colossal figures of the S&P 500 and Nasdaq Composite, one entity stands firm, its stature emblematic of resilience and opportunity: Taiwan Semiconductor Manufacturing Company (TSMC). Over the past triennium, its shares have ascended with a ferocity that might bewilder the casual observer, soaring 174%. Yet, beneath this apparent triumph lies the sobering truth: TSMC remains alluringly undervalued, a diamond ensconced within the mundane tapestry of the market.

As we delve deeper, we unearth the formidable forces that propel TSMC’s unrelenting advance, illuminating the often-ignored valuation methodologies that could elucidate why TSMC beckons the discerning investor with such fervor.

TSMC’s Growth: A Cascade of Opportunities

To grasp the essence of TSMC, we must situate it within the colossal edifice of the artificial intelligence revolution. Giants such as Nvidia, Advanced Micro Devices, and Broadcom revel in unprecedented growth, propelled by insatiable demand for GPU clusters and avant-garde data center networking tools. A nascent era, replete with the promise of efficiency and performance, has dawned.

Simultaneously, titans like Microsoft, Amazon, and Alphabet, encased within their highly integrated AI ecosystems, have experienced a meteoric rise, their domains expanding into realms of cloud computing and cybersecurity. These manifestations of growth permit only one conclusion: the sands of time shift favorably beneath TSMC, the architect behind the very chipsets that nourish this technological hunger.

It is TSMC, after all, that fabricates the intricate circuits found in the wares of the aforementioned tech behemoths. The exponential increment in capital expenditures translates into a hidden blessing for TSMC, an oft-overlooked benefactor basking in the shadows of its more illustrious client companions.

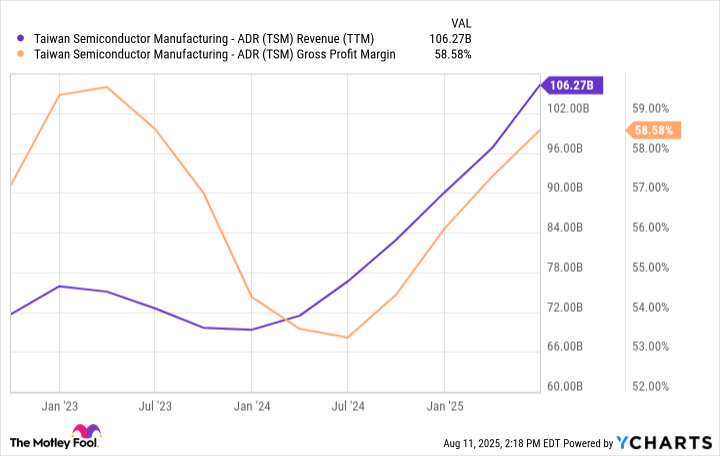

With solutions critical to the operation of these enterprises, TSMC commands considerable pricing power, thereby bolstering its revenue aggregates as margins ascend in tandem with its meteoric revenue growth.

The Sustained Growth of TSMC

Remarkably, TSMC’s transparency in financial reporting manifests itself in monthly revenue declarations, eschewing the conventional quarterly summaries that veil the invisible nuances of performance. A glimpse at the striking trajectory of its monthly revenues throughout 2025 reveals a vibrant portrait of resilience:

| Category | January | February | March | April | May | June | July |

|---|---|---|---|---|---|---|---|

| Revenue growth YoY | 35.9% | 43.1% | 46.5% | 48.1% | 39.6% | 26.9% | 25.8% |

During the second quarter, TSMC’s coffers swelled with $30 billion in revenue, fueled by relentless demand for the cutting-edge 5nm and 3nm chip technologies. While a dip in June and July growth may give pause, one must not be lulled into believing this signifies an enduring trend of stagnation.

Emerging architectures from titans such as Nvidia and AMD remain unsteady, in their infancy perhaps, but the inertia of AI infrastructure spending races ahead like a cascading river through a narrow gorge. TSMC, poised at the confluence of innovation and necessity, stands ready to reap the harvest of these expansive secular forces.

Valuing TSMC: The Paradox of Perception

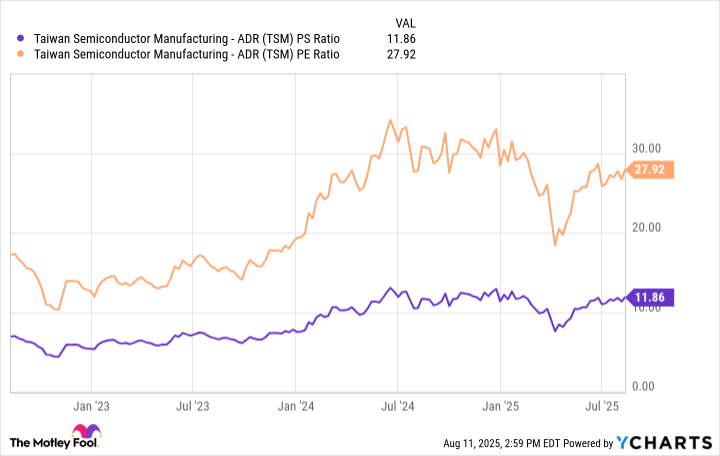

Traditional valuation paradigms often rely on ratios like price-to-sales (P/S) or price-to-earnings (P/E). While these instruments serve a purpose, they can become mere facades when disassociated from the underlying realities indicative of an entity’s true worth.

A cursory glance at the charts below reveals the propensity of TSMC’s ratios to ascend in tandem with the AI wave, creating a veneer of inflated value and prompting speculative whispers among investors. It would be easy to conclude that such a rise signifies an overexposed stock, yet, this perception is dangerously simplistic.

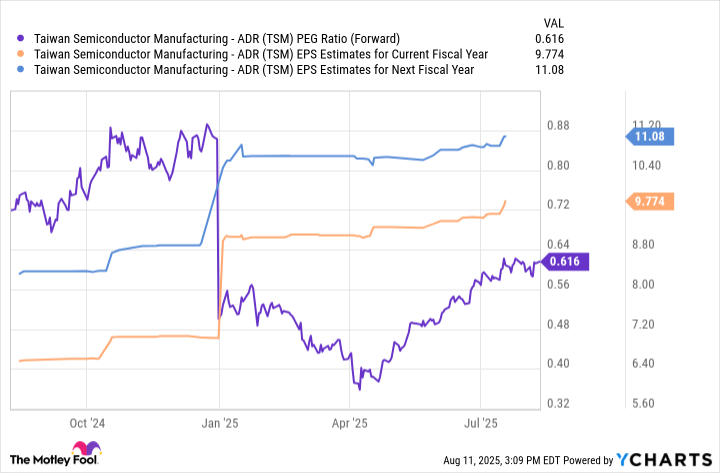

A more profound and indicative framework for valuation emerges from the price/earnings-to-growth (PEG) ratio, heralded by the venerable investor Peter Lynch. This metric harmoniously intertwines the P/E ratio with the quest for sustained earnings growth, delineating value more precisely. Typically, a PEG ratio below 1.0 indicates an undervalued asset-an oasis among desolate valuations.

As illustrated, TSMC boasts an impressively low PEG of 0.6, a figure which reveals the dissonance between market perception and financial reality. The compression of this ratio can be attributed to the anticipation of escalating earnings, bolstered by the momentum of AI’s inexorable march forward. Wall Street’s optimism seems at odds with reality-earnings revisions outpace the ascendance of TSMC shares, crafting an intriguing ambiguity without the backdrop of substantial stock sell-off.

Moreover, myriad macroeconomic uncertainties-each rooted deep within the geopolitical labyrinth of tensions surrounding China and the cyclical nature of the semiconductor market-may have unfairly constrained TSMC’s valuation. The coupling of a compressed PEG ratio amidst a positive outlook paints a compelling portrait of a company ripe for growth-a beacon for investors in search of value amid tumult.

At this juncture, one must recognize that TSMC’s current price represents an anomaly, a veritable steel door ajar for those with the foresight to seize this moment. For the long-view investors, the opportunity to embrace a company poised to flourish within the AI infrastructure renaissance is rare. While many of its peers dwell in inflated realms, TSMC stands, somewhat paradoxically, as a bastion of value amid a landscape rife with exuberance and speculative fervor.

Thus, I declare, TSMC remains, in my estimation, profoundly undervalued, a silent warrior prepared to endure and triumph over the tempests that may besiege it. 🌌

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- USD PHP PREDICTION

2025-08-15 17:02