According to Matt Hougan, the head of Bitwise Asset Management, investors should not let the current dip in Bitcoin‘s value unduly worry them.

In essence, the perceived vulnerability has opened up a chance for investors to either increase their holdings or invest freshly in the top-ranked cryptocurrency globally, as he pointed out during his latest conversation with Yahoo Finance.

2025 continues to show a robust momentum for cryptocurrency, with an abundance of favorable factors propelling its growth, causing Hougan to maintain a positive outlook on Bitcoin (BTC), even amidst recent price fluctuations.

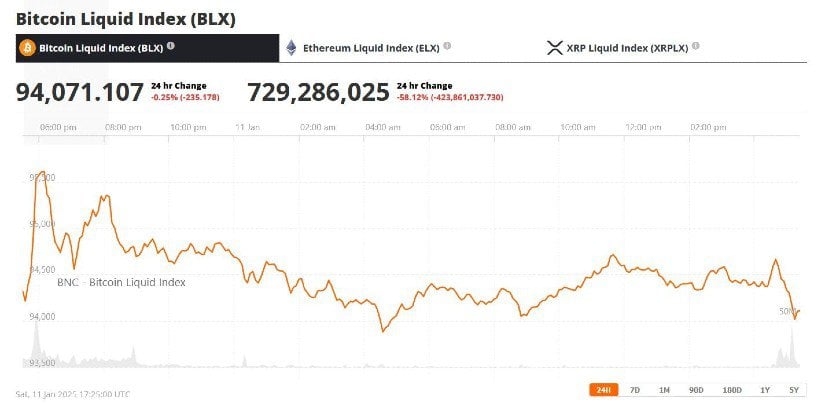

Bitcoin is going for $95,000 at writing – down more than 10% versus its all-time high in December.

Financial advisors are allocating more to Bitcoin

2021 marks a year since the Securities & Exchange Commission agreed to support the introduction of Bitcoin Spot ETFs within the U.S. market.

Collectively, these financial instruments have managed to pull in more than $100 billion from institutional investors so far. However, Matt Hougan predicts that the flow of money into Exchange-Traded Funds (ETFs) will pick up pace substantially by the year 2025.

The individual is optimistic about Bitcoin as the number of financial advisors investing in cryptocurrencies has more than doubled, going from 11% to 22%, based on a recent Bitwise survey conducted in 2024.

Over 99% of the advisors who took part in the yearly survey have indicated a desire to keep their current investment level or even boost it this year, which is crucial to note.

Hougan anticipates that their allocation will significantly bolster Bitcoin due to these investors managing collectively a substantial amount of around tens of trillions of dollars in assets. Furthermore, with institutional investments continuing to flow, crypto is set for an exceptionally robust bull market, one not seen in the past ten years or so, according to him.

What else could unlock further upside in BTC in 2025?

Since Donald Trump’s victory in the U.S. elections of 2024, Bitcoin has experienced a significant surge. Before the elections, it had difficulty consistently surpassing $70,000, but is now close to $100,000 due to writing. This upward trend can be attributed to Trump’s pledge to transform America into a leading force in cryptocurrency.

If his words successfully sparked this extraordinary surge in the world’s biggest cryptocurrency, consider the potential gains when he begins to carry out his plans over the coming months, Hougan suggested during his conversation with Yahoo Finance.

If a bill concerning stablecoins is passed in Congress within the initial 100 days, it would demonstrate their strong commitment to establishing the U.S. as the global leader in cryptocurrency.

It’s worth mentioning that Donald Trump also intends to advocate for a strategic Bitcoin reserve, which might contribute to the stability of the cryptocurrency market and make it even more appealing to international investors.

Matt and his colleagues from Bitwise have forecasted that the value of Bitcoin could reach up to $200,000 by the year 2025, which is a very optimistic projection according to conventional expectations.

Bitcoin Adoption is Early

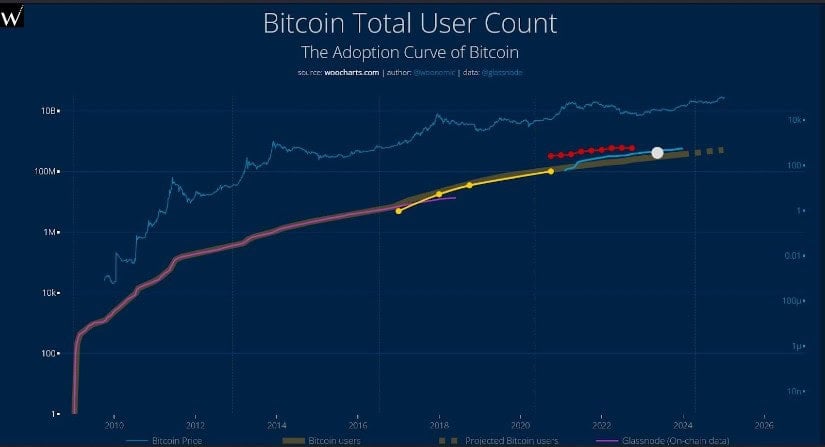

Many other investors, much like Matt Hougan, view the current drop in Bitcoin’s price as a potential long-term investment opportunity.

In a recent interview, Andy Baehr from CoinDesk Indices shared his view that the surge in Bitcoin acceptance is merely starting to pick up speed.

Already, countries such as El Salvador and the Central African Republic have made Bitcoin a valid form of currency within their borders. Moreover, a variety of well-known U.S. corporations, like Starbucks, Home Depot, AMC, and AT&T now accept Bitcoin as payment for goods and services.

Tesla Inc, the automotive giant led by billionaire Elon Musk, intends to accept Bitcoin as a form of payment for their products in the future.

Is it Too Late to Invest in BTC?

Looking ahead to 2025, it appears that the groundwork is being laid for a strong Bitcoin surge. This means there’s still time for me to invest in Bitcoin, positioning myself for potential future growth.

Key elements like growing institutional interest, broader public acceptance, and a welcoming legal landscape are coming together to boost the appeal of Bitcoin. Notably, major businesses and some governments see Bitcoin’s promise as a form of long-term savings and tactical resource.

With technological progressions and rising public consciousness, these favorable conditions are shaping up to greatly boost the cost of Bitcoin, along with other institutional cryptocurrencies like Ripple (XRP) by 2025. For crypto enthusiasts seeking investment opportunities, it’s wise to prioritize Bitcoin initially, followed by XRP as a potential second choice.

According to analyst Geoff Kendrick at Standard Chartered, he predicts Bitcoin could reach $200,000 by the end of this year. This forecast represents an increase of over 100% compared to its current price, making it an enticing investment opportunity.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Persona 5: The Phantom X Navigator Tier List

2025-01-12 12:50