As a seasoned analyst with over two decades of experience in the tech industry, I’ve seen my fair share of legal battles and market fluctuations. The Nvidia crypto lawsuit is certainly an interesting case to follow, given its complexity and the high stakes involved.

In my role as an analyst, I’m reporting that I’ve observed the U.S. Supreme Court declined Nvidia Corporation’s petition, thereby enabling a shareholder lawsuit concerning the company’s cryptocurrency earnings to move forward.

The lawsuit accuses the company of misleading investors about its dependence on cryptocurrency mining revenues ahead of a significant market downturn.

Nvidia Crypto Lawsuit Might Go to Trial in 2025

The court’s ruling is based on the November hearing, during which judges debated if the case contained significant legal matters that warranted Supreme Court involvement.

In this court case, shareholders allege that from 2017 to 2018, Nvidia’s CEO, Jensen Huang, failed to disclose the significant role that sales of GeForce GPUs for cryptocurrency mining played in the company’s exceptional revenue growth, instead suggesting it was primarily due to gaming sales.

As a crypto investor, I’ve noticed the recent development where Nvidia has raised concerns about the cryptocurrency lawsuit being too vague to progress to the evidentiary stage of the legal proceedings.

As an analyst, I can express that, following Bloomberg’s report, the shareholders’ legal counsel has hailed the ruling as a significant triumph for corporate responsibility. The ensuing litigation is set to proceed in a federal district court located in Oakland, California.

During 2018 when the crypto market experienced a major dip, Nvidia encountered considerable hurdles. In November of that year, the company publicly acknowledged that they fell short of their revenue expectations. As a result, Nvidia’s stock dropped by more than 28% in just two days. Huang explained this deficit as being due to a “crypto market aftereffect.

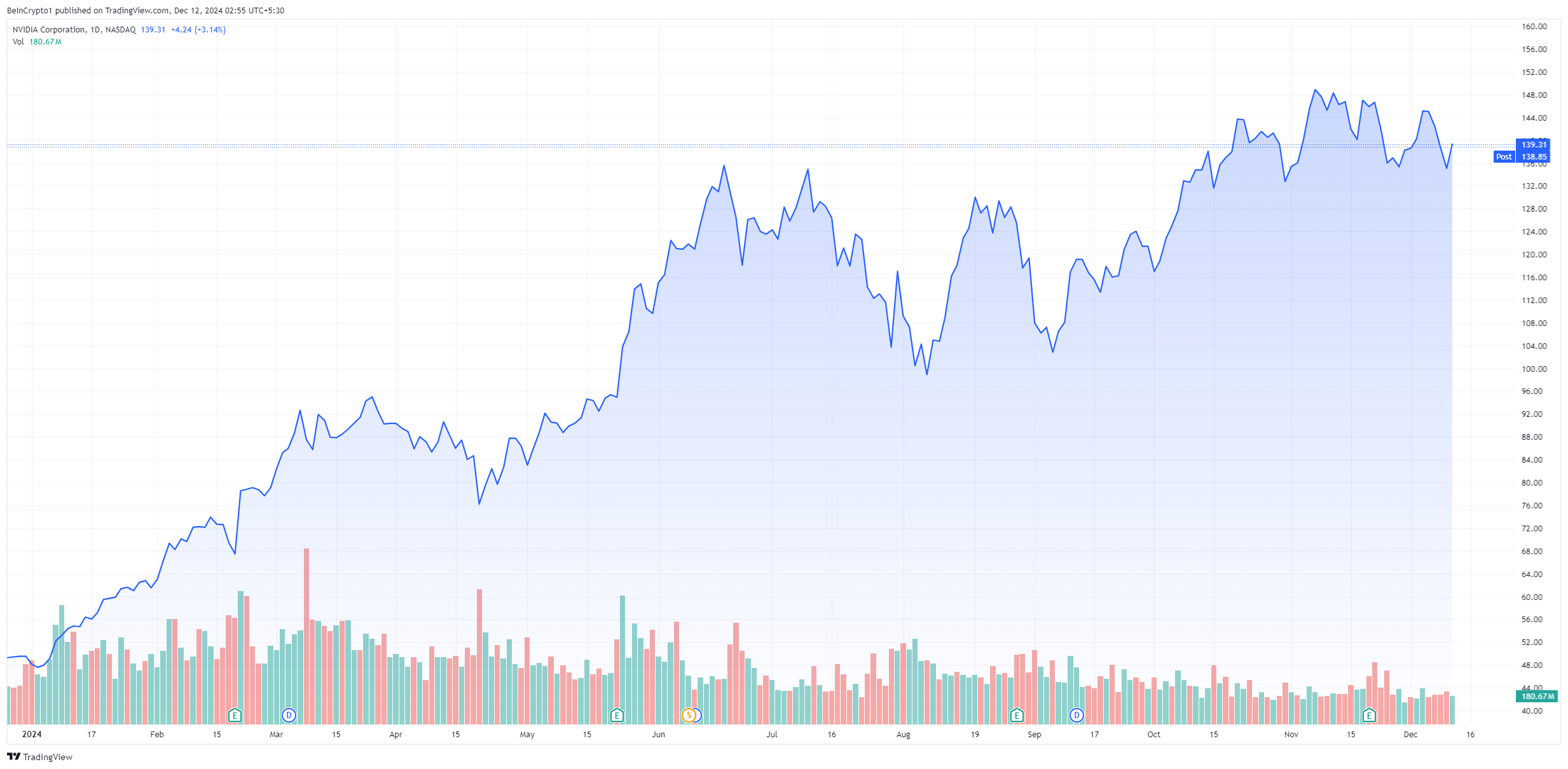

In spite of the legal hurdles, Nvidia’s shares have skyrocketed approximately 190% so far this year. This surge is primarily due to high demand for its GPUs used in Bitcoin mining. Notably, Nvidia’s 4000-series GPUs have outshone AMD in terms of profitability and have captured a substantial portion of the market.

According to the recently released financial statement, Nvidia revealed an impressive 95% rise in quarterly revenues for Q3, totaling approximately $35.1 billion. Moreover, the Data Center sector saw a significant growth of 111%, and the company anticipates revenue of around $37.5 billion in the upcoming Q4.

Back in the early part of this year, Nvidia reached a milestone by exceeding a market value of 3 trillion dollars. This remarkable growth allowed it to surpass Apple and establish a fresh record within the technology sector.

Additionally, Nvidia is expanding its reach beyond gaming and cryptocurrency mining. In fact, they unveiled a plan in July to offer infrastructure for cutting-edge humanoid robotics.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Where To Watch Kingdom Of The Planet Of The Apes Online? Streaming Details Explored

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-12 00:31