SUI to the Moon? 🚀🌕

Ah, Sui [SUI], that upstart blockchain, daring to record the highest stablecoin inflows in the past 24 hours. A net increase of $6.1 million, they say. A pittance! But compared to the exodus from Ethereum, Solana, and BNB Chain, it appears almost… heroic. Or perhaps merely opportunistic, like a rat fleeing a sinking ship. 🐀

Such “strong” stablecoin movement towards SUI, they claim, hints at growing demand. Demand, I say! More like desperate hope clinging to a flickering candle in the encroaching darkness. 🔥

Stablecoin inflows, they whisper, are dry powder, ready to be deployed. Deployed, yes, into the maw of speculation, adding “potential” upside pressure. Potential, like a lottery ticket holds the “potential” to make one a millionaire. A fool’s errand! 🤡 This “liquidity surge,” they dare to suggest, reflects investor “confidence.” Confidence? Or blind faith in the face of impending doom? 💀

Why is Open Interest rapidly rising? (Or: How to Inflate a Bubble 🎈)

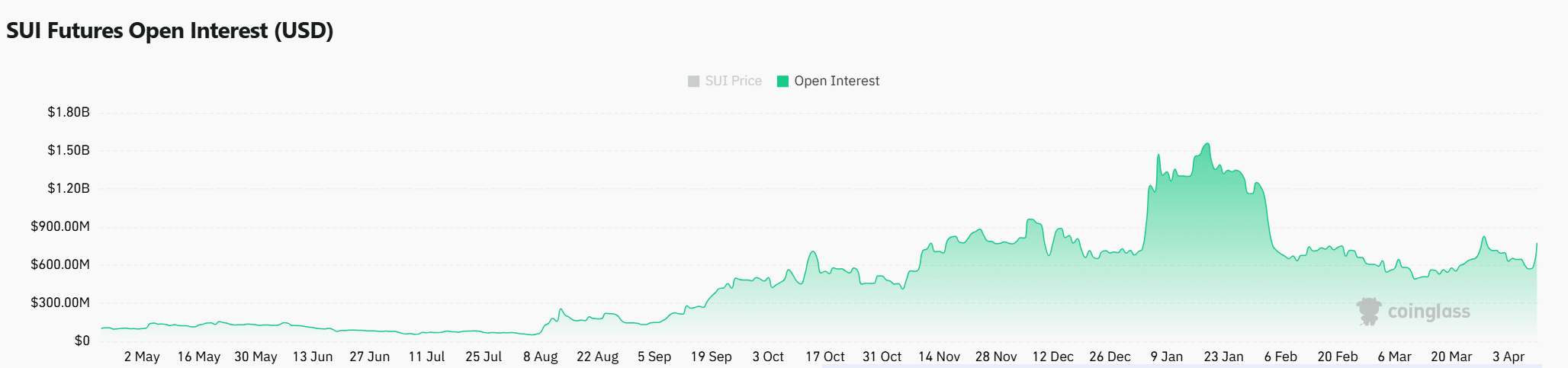

Open interest on SUI surged by 30.64%, bringing the total to $785.35 million. A dizzying sum! This “sharp increase” highlights “aggressive positioning” in the derivatives market. Aggressive? More like reckless! Traders preparing for “potential price volatility.” Volatility? In this market? Unheard of! 😂 Unlike spot inflows, Open Interest reflects speculative intent. Intent, yes, to gamble, to wager, to lose one’s shirt! 👕

However, when combined with rising stablecoin inflows, it “typically leans bullish.” Bullish? Or merely top-heavy, ready to topple at the slightest breeze? The “synchronized jump” in both metrics, they say, could mean that traders expect a “decisive move” from SUI. Decisive, yes, perhaps a decisive plunge into the abyss. 🕳️

Price action eyes key resistance after bullish push (Or: Gazing Longingly at Fool’s Gold 💰)

SUI recently formed a “classic cup and handle pattern” on the daily chart, a setup “often associated with bullish continuation.” A cup and handle! As if the market cares for such quaint, childish notions. At the time of writing, SUI was trading at $2.16, up 12.82% over the last 24 hours. A fleeting victory! The handle portion of the pattern seemed to be shaping within a descending wedge, with a breakout point clearly marked at $2.23. Charts and patterns, futile attempts to impose order on the chaos! 🤪

However, buyers are “yet to secure a strong candle close above this level.” Yet to, yes, and perhaps never will. If momentum holds and the price breaks out, the “next significant target” would sit at $2.80. Another mirage on the horizon! Therefore, this pattern, combined with growing momentum, “could position SUI for a potential trend reversal.” Potential, yes, like a snowman in July has the potential to survive. ☃️

Are liquidations and funding rates aligning with bullish momentum? (Or: Delusions of Grandeur 👑)

Over the last 24 hours, Sui saw $860.6k in long liquidations, compared to just $269.3k in shorts. This “imbalance” suggested that “overleveraged bulls were flushed out,” especially on major exchanges like Binance and OKX. Flushed out, yes, like the refuse of the market! 🚽

However, liquidation events “often act as reset buttons,” clearing excessive leverage and setting the stage for a “more sustainable move.” Sustainable? In this volatile circus? A laughable notion! If bullish momentum returns post-liquidations, it “could support a healthier price recovery.” Could, yes, but more likely, it will simply pave the way for another round of carnage. 🔪

Meanwhile, Sui’s OI-weighted funding rate turned slightly positive at 0.0087% on 10 April. This suggested that traders have been paying to hold long positions, “reinforcing the presence of bullish sentiment” despite recent volatility. Sentiment, yes, the fickle mistress of the market! 💋

Additionally, funding rate recovery after a liquidation sweep “often reflects renewed confidence among market participants.” Confidence? Or the desperate gamble of those who refuse to learn from their mistakes? Therefore, if both funding and inflows remain elevated, the altcoin “may be positioning itself for another leg up.” May be, yes, but more likely, it is simply delaying the inevitable plunge. 📉

Conclusion (Or: A Final Dose of Hopium 💊)

At the time of writing, SUI “seemed to be showing several promising signs” that hinted a breakout “may be forming.” Promising signs, yes, like a condemned man receiving a slightly better meal before his execution. The combination of strong stablecoin inflows, rising Open Interest, recovering funding rates, and a “bullish cup and handle pattern” pointed to “growing market confidence.” Growing, yes, like a weed in a neglected garden. 🌿

However, the price is “yet to confirm a move above $2.23” – A “critical resistance level.” Critical, yes, like the last line of defense before the barbarians breach the gates. Therefore, while the setup “might be constructive,” confirmation is key before calling a definitive breakout. Confirmation, yes, but in this market, confirmation often comes too late, after the opportunity has vanished like smoke in the wind.💨

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-04-11 10:22