Oh my God, SUI is like the new It-Girl of the crypto world! 🌟 After being listed on Robinhood Legend, it’s seen a massive $300 million swoop by a publicly listed company. Talk about a hot ticket!

With transaction fees so low you might as well be paying in pocket change, and token volumes that could fill the Atlantic, SUI is looking like a real contender. But the big question on everyone’s lips is: can it actually break through that pesky $4.3 resistance level? 🤔

A Chain of Positive Fundamentals

In short, Sui blockchain (SUI)’s story is a mix of bullish vibes and some serious resistance. Like, what’s a girl gotta do to get over $4.3 these days? 😩

Recently, SUI Group Holdings announced they’ve bought another 20 million SUI, bringing their total stash to over 101.7 million (worth about $332 million at the time of the announcement). And if that wasn’t enough, Robinhood confirmed that SUI (alongside HBAR) is now available on Robinhood Legend, making it easier for retail investors in the US to get in on the action. 🎉

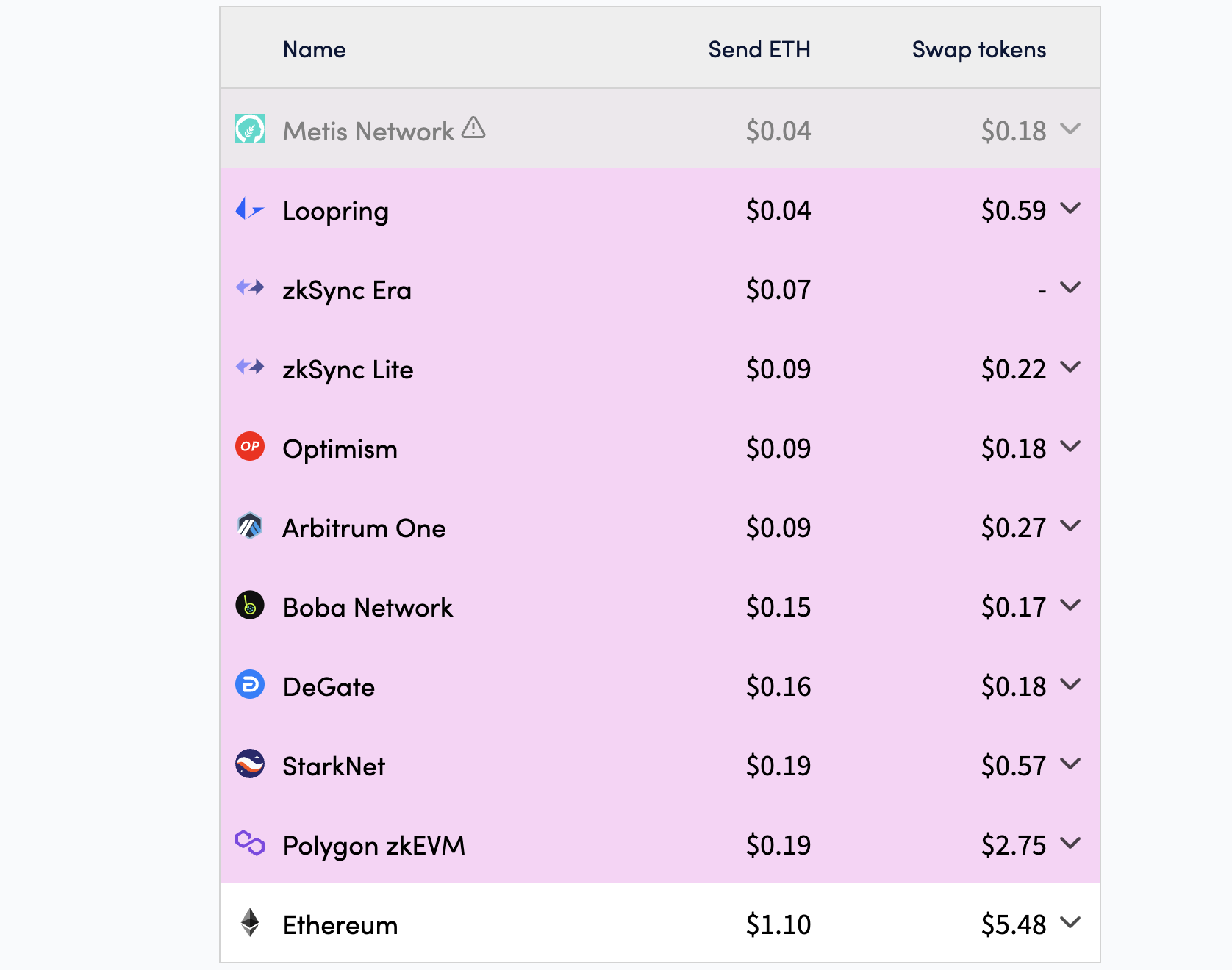

When it comes to the nitty-gritty, transaction fees are where SUI really shines. The average transaction in August cost a mere $0.00799. Compare that to ETH transfers on the Ethereum network, which cost around $1.1, and you’re looking at fees that are nearly 140 times cheaper. The team even blogged about how they designed the fee structure to stay stable, avoiding those annoying spikes during network congestion. 🚦

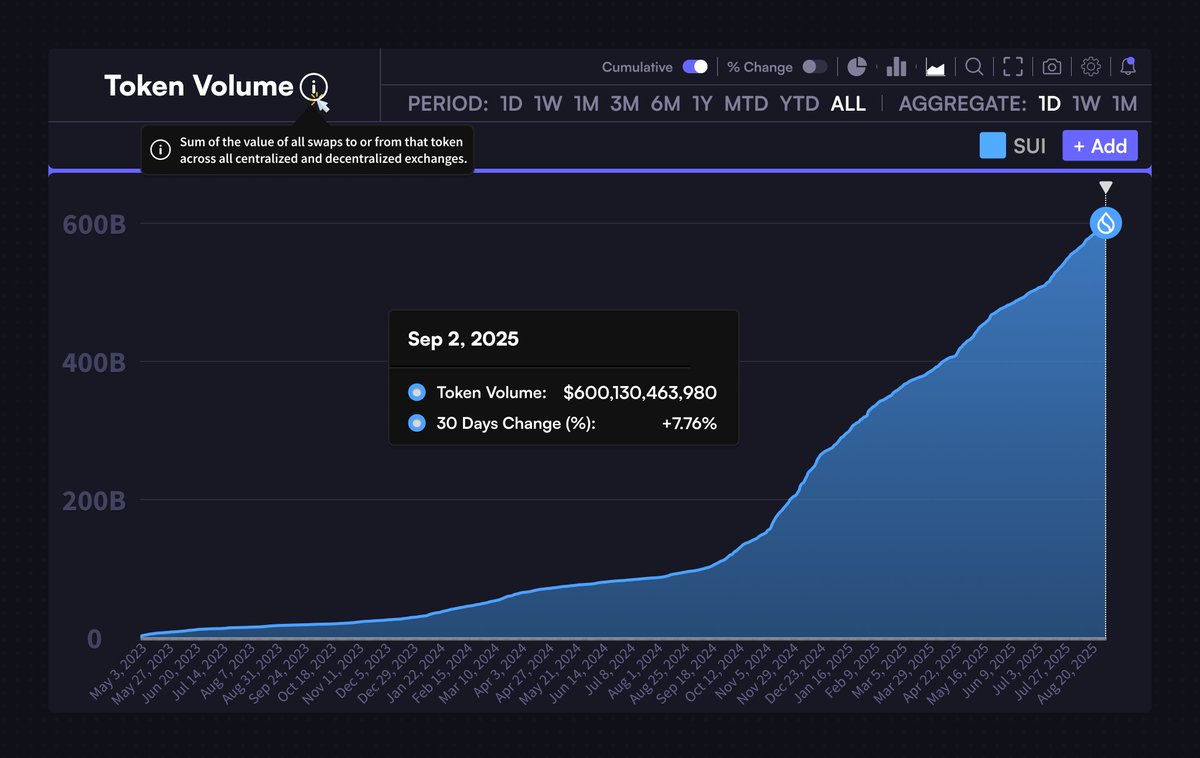

Low and stable fees mean a smoother user experience, perfect for high-throughput activities like gaming, DeFi, or micropayments. Sui’s total token volume has hit a whopping $600 billion, marking a +7.76% increase over the past 30 days. Not too shabby, eh? 🙌

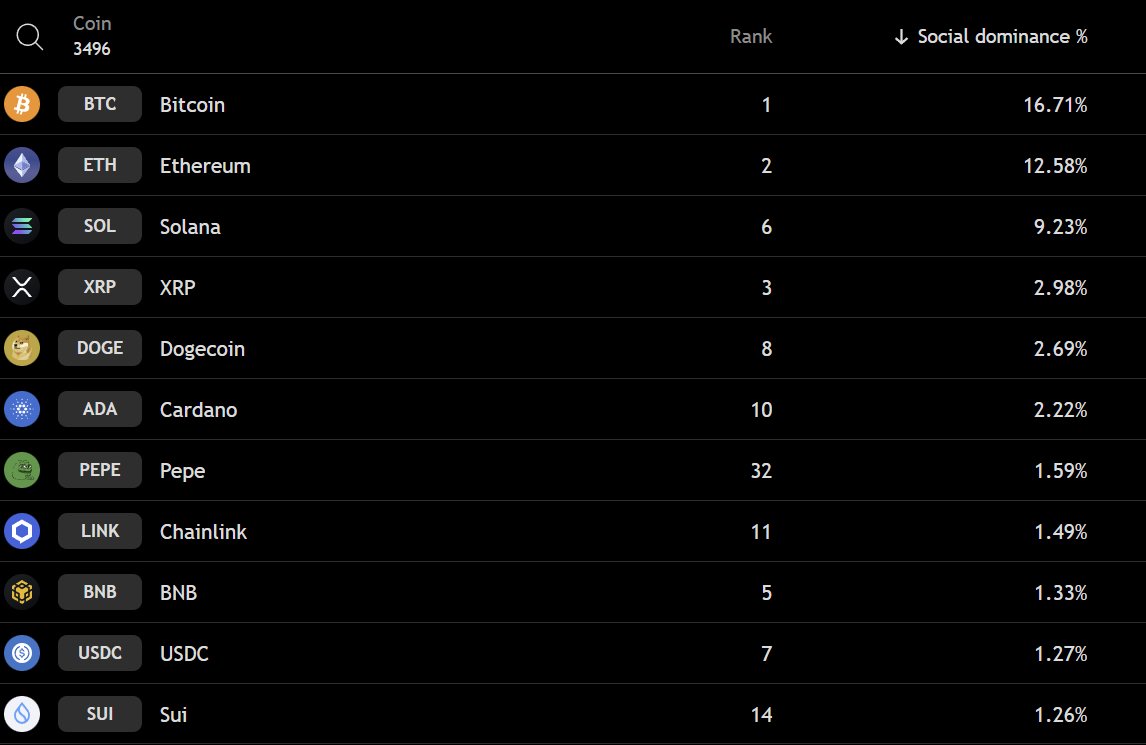

Market sentiment and brand visibility are also on the up. Data shows that SUI’s “social dominance” (basically how much people are talking about it) is climbing and is now edging closer to the top 10. It’s like SUI is the new celebrity everyone’s gossiping about! 📢

Breakout or Breakdown at $4.3?

According to BeInCrypto Market, SUI is currently trading around $3.3-$3.4, still 37% below its January 2025 all-time high of $5.35. So, it’s got a bit of a way to go. 💪

Technically speaking, things are a bit of a mixed bag. Some analysts are pointing to an Ascending Triangle with resistance near $4.3 on the weekly chart. If it can break through, we might see it aiming for the $10 mark. That’s the dream, right? 🌈

“The longer we stay below the $4.3 Resistance, the better, but it’s time to finally break out,” an analyst commented.

But then there are the pessimists who say SUI is stuck in a Descending Triangle on the 4-hour chart, showing weakness around the 50SMA. This could drag the price down to test $3.42 and even the $3 zone – the first central demand area. 🤷♀️

So, the market is holding its breath for the next big move. A weekly close above $4.3 would confirm a breakout, while dropping below $3.42 could send it back to the lower accumulation range. Fingers crossed, SUI! 🤞

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-04 11:47