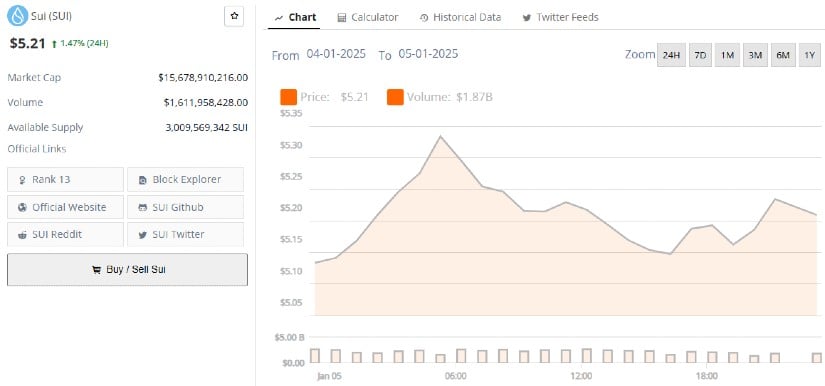

The swift surge in the value of this token has catapulted its market worth to an impressive $15.98 billion, placing it among the top 12 cryptocurrencies worldwide, surpassing notable rivals such as TON and Chainlink.

Key Drivers Behind SUI’s Surge

In 2025, a notable increase in SUI’s value coincides with important advancements within the network. Specifically, on January 1st, 2025, the Sui blockchain made available 82 million SUI tokens, equating to 0.82% of the total supply. This planned release has fueled a significant interest in the token, thus playing a role in its recent upward trend.

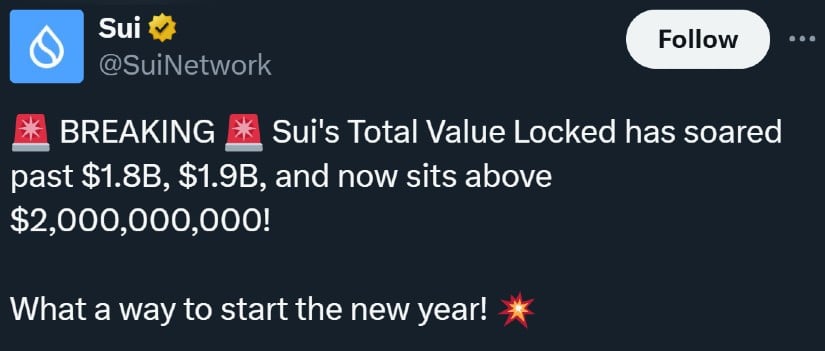

Furthermore, it’s worth noting that the value locked within the Sui network has surpassed $2 billion, signifying an increasing trust among investors in the chain’s DeFi ecosystem. This upward trend can be attributed to significant DeFi platforms like Suilend Protocol, NAVI Protocol, Cetus, Scallop Lend, and Aftermath Finance, which have played a crucial role so far.

Record Trading Volume and Open Interest

The trading activity for SUI’s token has been remarkable and unparalleled. Lately, the token value skyrocketed to $5.31, and within the last 24 hours, its trading volume hit a whopping $2.6 billion. What’s more, the interest in SUI futures contracts has significantly increased by 37%, reaching an all-time high of $1.22 billion, indicating that investors are increasingly showing enthusiasm for this token.

The bullish trajectory of SUI has strengthened its market standing even more, as analysts foresee unabated growth and increased value. Should it breach significant resistance levels like $5.50, this could propel the price to unprecedented heights, potentially reaching around $10 within the upcoming months.

Strategic Partnerships and Ecosystem Growth

Sui’s network has grown by forming strategic partnerships and making technological progress. Notable collaborations include those with VanEck, Grayscale, and Franklin Templeton. The significance of Grayscale’s Sui Trust, currently managing over $14 million in assets, demonstrates increasing institutional attention towards the platform.

Furthermore, the debut of Deepbook V3, which is unique to Sui, has noticeably boosted trading action. With its total trading volume surpassing $1 billion and DEEP token market cap standing at $375 million, Deepbook V3 now serves as a fundamental pillar within Sui’s DeFi infrastructure.

Challenges and Opportunities Ahead

Currently, SUI is performing positively; however, its future trajectory remains uncertain due to several influencing factors. Key resistance levels, such as $5.50, are approaching and could act as significant psychological hurdles for the token’s further price increase. If this level doesn’t hold up, it might indicate a potential reversal or consolidation phase instead.

In terms of regulation, this agreement could pave the way for a potential SUI ETF from Sui and Grayscale, subject to the U.S. Securities and Exchange Commission’s stance on crypto ETFs. Favorable regulations may enhance the attractiveness of the network for institutional investors.

Sui’s persistent progress hinges on ongoing expansion of its ecosystem, strategic collaborations, and beneficial market trends. For those pondering which cryptocurrency to invest in at present, there are numerous promising choices. The XRP token from Ripple holds significant allure and the possibility for substantial returns by 2025, just as Dogecoin, the most prominent meme coin by market cap, does.

Yet, backed by its solid DeFi foundation, remarkable performance metrics, and growing institutional interest, SUI continues to stand as a formidable competitor within the crypto market.

As the network gets closer to a market capitalization of 16 billion dollars, both investors and experts will keep a close eye on its progress, focusing especially on whether it can exceed significant benchmarks and sustain its competitive advantage.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-06 16:02