Cryptocurrency rallies are like spotting a Kardashian in the wild—rare, fascinating, and inevitably followed by a long discussion about what any of it means. SUI, in particular, has apparently decided that subtlety is for fiat currencies, leaping nearly 20% in a mere two days. Spontaneous wealth! 🚀 Just don’t trip over your own optimism.

If SUI were a person, it’d be the type who has just discovered kombucha and can’t shut up about it. Investors, meanwhile, have flocked with the same enthusiasm as bargain-hunters on Black Friday, setting up the sort of suspenseful, possibly regrettable scenario that keeps therapists well-paid.

SUI Traders: Optimism or Just Bad at Math?

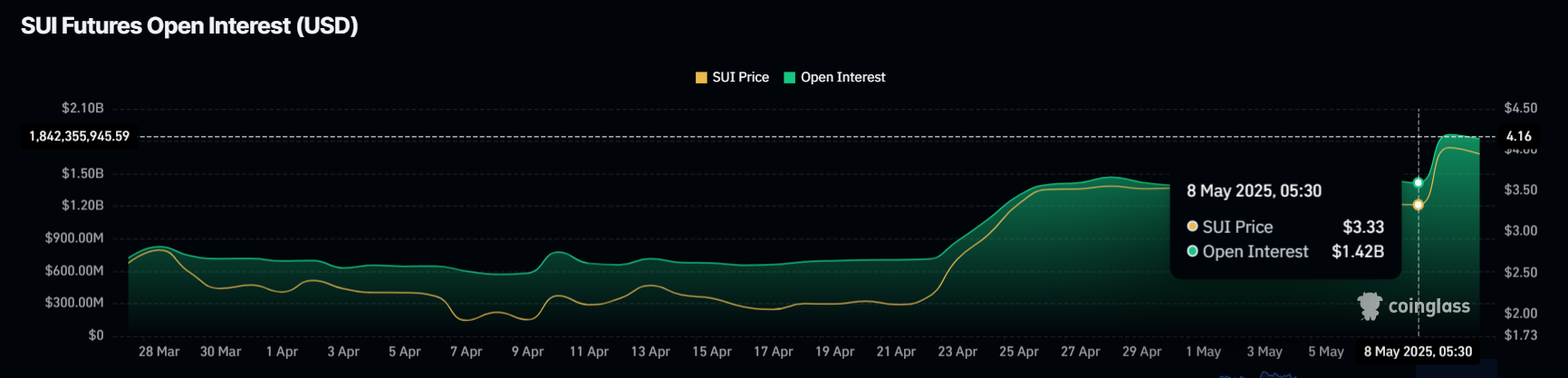

Open Interest in SUI shot up 28% in the last 48 hours, from $1.42 billion to $1.82 billion—because apparently, everyone collectively decided “YOLO” is a valid trading strategy. That’s a $400 million bump—money that could buy you a modest McMansion or, you know, more disappointment in a volatile market.

The funding rate is so positive you’d think it was on mood stabilizers. Long positions are steamrolling over short ones like it’s the running of the bulls, except with fewer warning signs and more possibility that your portfolio wakes up in a cold sweat. Apparently, everyone’s betting on SUI going up, because what are consequences, anyway?

As more cash flies into SUI, optimism’s running higher than a barista after three espresso shots. Traders keep stacking long positions, hoping to trigger a FOMO feedback loop that only ends when someone accidentally presses the “sell everything” button.

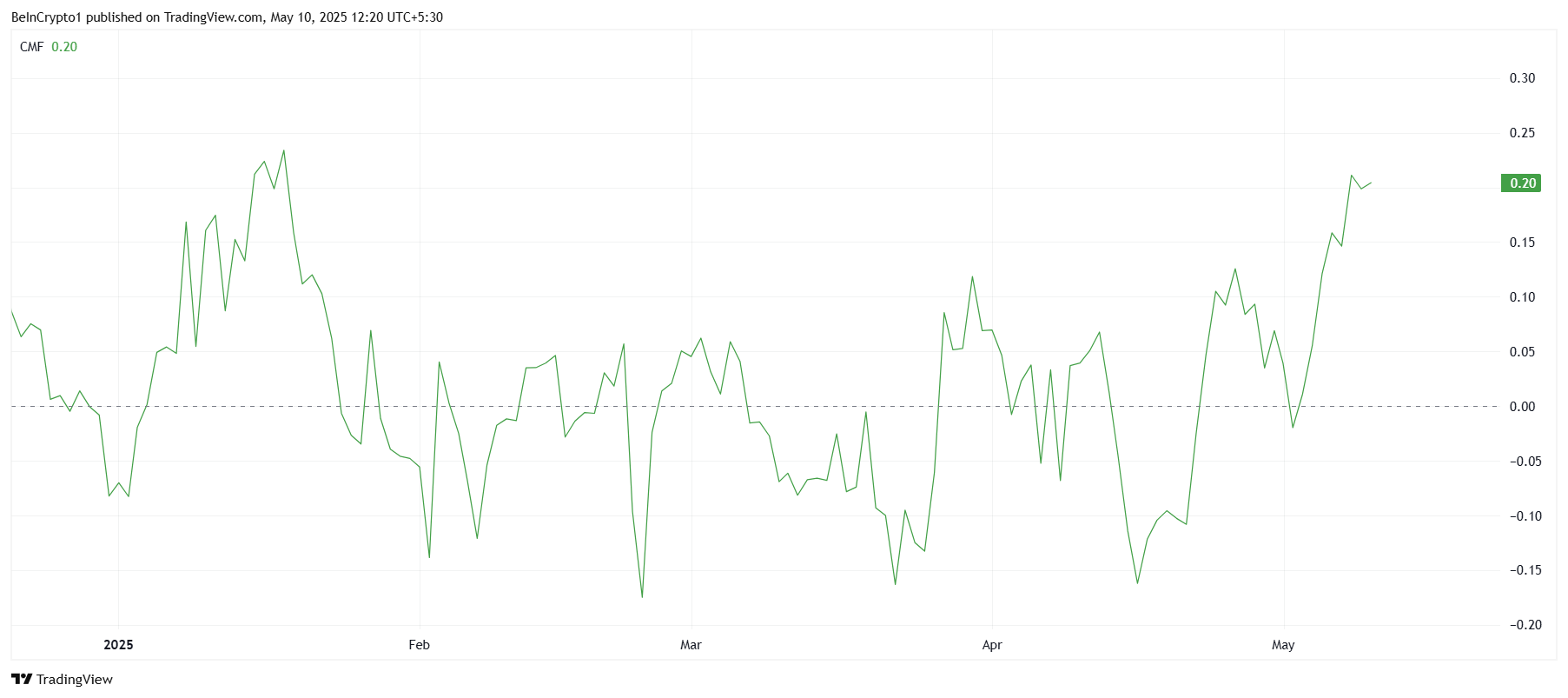

The technical indicators (for those who pretend to understand them) are also chiming in. Chaikin Money Flow (which sounds made up, if we’re honest) is at a four-month high, meaning more people are throwing money in than dragging it out. It’s the sort of “inflow” that makes you wonder if everyone’s just bored or genuinely knows something you don’t.

Anyway, the gist: buying begets more buying, and hope springs eternal, at least until it gets margin called.

SUI Price: Going Up, Maybe Forever, Unless It Doesn’t

The latest SUI bull run took it to $3.96, with all eyes set on the mythical $4.05 level—a number that feels arbitrarily sacred, like elevator buttons labeled “Penthouse.” If SUI manages to stay above this, people start talking about $4.79, or even $5.00. No word yet on whether this is based on actual logic or just a group hallucination.

A breach past $4.05, and things could get cheerfully out of hand. They’ll order bottle service at $4.79, and by the time it hits $5, someone’s probably buying a boat they’ll regret next earnings season.

Of course, the party could end as suddenly as it began. If SUI flops at the $4.05 doorman, it could slink back to $3.59. Any further stumble, and it’s $3.18—where enthusiasm dries up and only regret is left to keep you warm.

SUI is either moon-bound or prepping for a tragic sitcom-style reversal. Either way, refresh those charts and prep some snacks—because whatever happens, it’s bound to be messy. 🍿

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 10 Shows Like ‘MobLand’ You Have to Binge

- All 6 ‘Final Destination’ Movies in Order

2025-05-10 11:42