As a seasoned crypto investor with over a decade of experience navigating the ever-evolving digital asset landscape, I must admit that the recent surge of SUI has piqued my interest. While I have witnessed numerous altcoins rise to prominence and subsequently fade into obscurity, the resilience and consistency demonstrated by SUI are truly impressive.

The value of SUI has experienced an extraordinary spike lately, touching a fresh record high and rising approximately 74% over the past month. This upward trend suggests growing enthusiasm towards this asset, which is being driven by expanding adoption and heightened market engagement.

In addition to its impressive performance in terms of pricing, the Total Value Locked (TVL) of SUI has also set new highs, reaching an astounding $1.65 billion momentarily, albeit experiencing a slight dip since then.

SUI TVL Is Breaking Records

The value locked in SUI (Total Value Locked) has reached record-breaking levels, peaking at an impressive $1.65 billion on November 15. But over the past few days, it has experienced a slight decrease and has been relatively stable around $1.62 billion.

This shift shows a cooling period after the strong growth trajectory observed earlier in the month.

Keeping tabs on SUI’s Total Value Locked (TVL) is essential because it indicates the platform’s success in attracting capital and earning user confidence. Since surpassing $900 million on October 28, SUI has consistently shown its ability to secure substantial value, reaching its first major milestone of $1 billion in TVL on September 30.

However, the recent dip in growth momentum may suggest a pause in this uptrend.

SUI Current Uptrend Isn’t That Strong Anymore

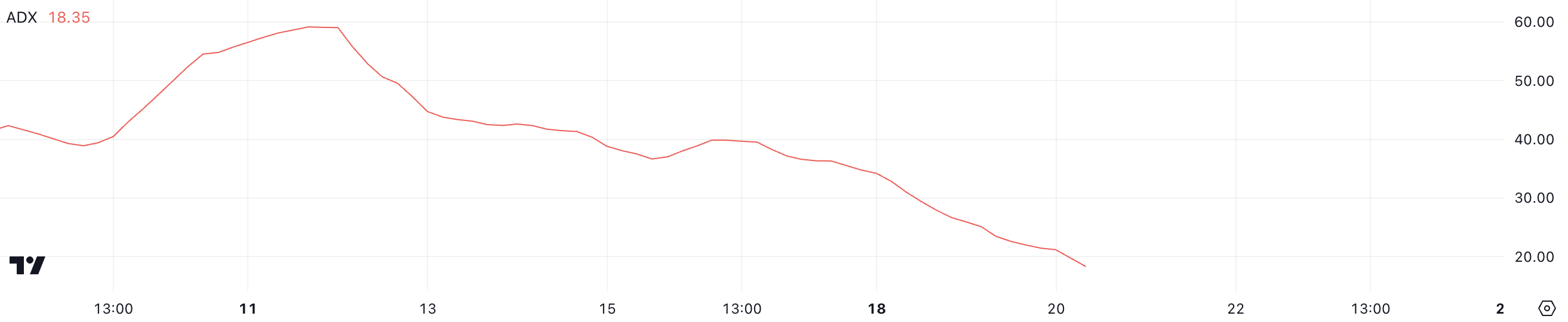

The Simple Moving Average Directional Index (ADX) of SUI has noticeably decreased, now at 18, as opposed to over 30 it was two days back. This decrease suggests that although SUI continues its upward trajectory, the intensity of this trend seems to be lessening.

When the Average Directional Index (ADX) decreases, it usually indicates a weakening trend, which could mean that Suisse’s (SUI) latest price fluctuations may not have the strength or intensity observed during the initial phase of the ongoing rally.

The ADX (Average Directional Movement Index) quantifies the intensity of a market trend, irrespective of its direction, using specific thresholds to denote varying levels of momentum. When values fall below 20, it implies a feeble or absent trend; on the other hand, readings above 25 indicate a robust trend that is picking up speed.

When SUI ADX falls beneath a certain level, it indicates that the upward momentum might be slowing down. If this downturn continues, there’s a possibility that the SUI price may experience periods of stagnation or potential decreases in the near future.

SUI Price Prediction: Can It Break Above $4 Soon?

As a crypto investor, if the ongoing bullish trend of SUI gathers more momentum, it’s plausible that it might challenge the resistance at around $3.94 – a price point that previously set its all-time high. Should this level be breached, it could open up opportunities for additional growth, with the significant hurdle at $4 coming into focus next.

In this situation, it could indicate a resurgence of optimistic trading trends, enticing investors who want to profit from the upward trend.

Conversely, if there’s a shift towards a downward trend, the Swiss Franc (SUI) might test its closest support at $3.1. If this support doesn’t prevent a drop, the value could potentially fall even lower, possibly to $2.2.

This indicates a possible drop by 39%, suggesting a high risk of substantial losses if the market’s attitude becomes pessimistic.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-11-20 19:35