In a dazzling display of enthusiasm, akin to a ballroom dance gone somewhat awry, the distinguished bulls find themselves wrestling valiantly with a stubborn resistance at the staggering price of $0.66. Oh, the irony! Various indicators weave tales of strength and vigor, yet those same bulls have yet to transform key levels into unwavering support. With bated breath, market participants peer through the mist of rising volatility, wondering if our dear OP can hold on above the mystical threshold of $0.64. 🧐

Bearish Setup Forms with the Grace of a Dying Swan 😩

As if scripted in the grand theatre of finance, the illustrious OPUS/USDT 5-minute chart, brought forth by the insightful analyst known as @JeremyofCrypto, reveals a brilliantly defined short-term resistance nestled between $0.6581 and $0.6614. Here lies the supply zone, a fortress that has seen more price rejections than a desperate suitor at a ball. With each failed attempt, the bullish structure weakens, as traders defend their lofty stronghold with all the zeal of knights in armor.

A charming short position has emerged just below $0.6581, with a conservative stop-loss perched atop the resistance ceiling at $0.6614. Such meticulousness suggests a cautious tango amidst repeated rejections at the elevated barrier—who knew trading could be so dramatic? 💃

The price target for this delightful short trade has been whimsically set at $0.6424, near a previous swing low, that glorious zone where buying interest once flourished. As OP continues its dance with resistance without a spirited leap higher, a short-term bearish bias gathers strength like an orchestra tuning up for an epic finale. The formation of a red risk zone above the entry deftly underlines the trader’s desire for defined parameters and a careful waltz through the treacherous waters of risk-reward management.

Duck and Cover: Consolidation Persists Amidst Volume Shenanigans 🦆📉

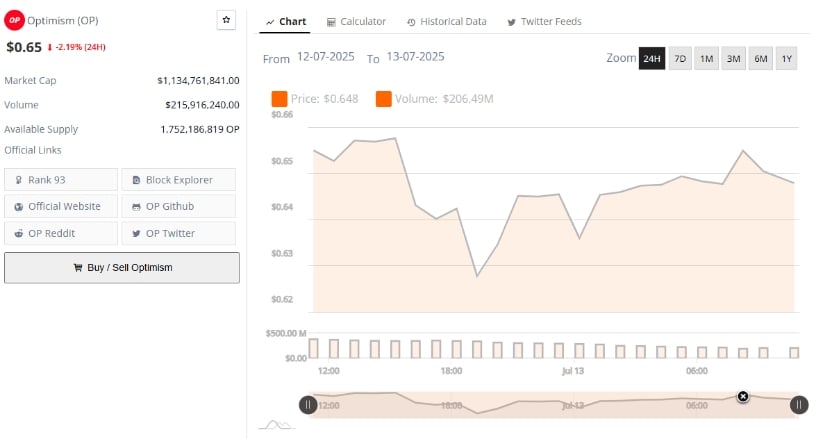

Data from the audacious BraveNewCoin tosses some thrilling details into the mix, revealing a 24-hour price range swinging between the ever-confusing notes of $0.62 and $0.66, with our beloved OP last gliding at $0.65—a comical 2.19% daily loss! The asset had the audacity to flirt briefly with $0.658 before retreating towards $0.64, crafting a pattern of lower highs as though it were trying its hand at poetry.

Despite occasional recoveries worthy of a soap opera, the overall trajectory resembles a hesitant sprinter lingering at the starting line, hesitating near the upper resistance bands. Meanwhile, the volume keeps a steady beat, with the session’s high reaching an impressive $206.49 million—active yet circumspect market participation indeed!

With a circulating supply of 1.75 billion tokens dancing about and a diluted market cap that rests at around $1.13 billion, OP finds itself ensconced at the respectable position of #93 among the digital assets in this grand bazaar of market capitalizations. The supply profile and stable trading volume show continued engagement from intrepid traders, though alas, not robust enough to spark the long-awaited breakout.

Unless OP can muster the will to turn the $0.66 level into a support sturdy enough to support a high tea with the Queen, price action may continue to meander between the $0.63 and $0.66 range, like a guest who just can’t decide on a dance partner.

Daily Chart Indicators: A Whisper of Tentative Recovery 💬📈

On the stage of TradingView, the OPUS/USDT daily chart paints an intriguing picture! Following a pleasant recovery from prior dismal lows, the price recently achieved closure at $0.659 after languishing at a pitiful $0.457 earlier in its cycle. The chart showcases a gradual buildup of bullish candles since late June, with $0.60 functioning as a sanctuary of accumulation. Resistance near $0.67 looms as the next technical hurdle—a fickle specter that has played both friend and foe in the past.

Momentum indicators tell a story full of cautious optimism. The Awesome Oscillator (AO), with a dramatic flourish, has flipped green, showcasing a value of 0.053, a sign of increasing positive momentum—a standing ovation for those involved! Simultaneously, the Chaikin Money Flow (CMF) makes its entrance at +0.06, confirming a hopeful capital inflow after several weeks of outflow. These readings suggest sentiment is on the mend, but alas, further triumphs depend on OP’s ability to close above the esteemed $0.67 threshold accompanied by solid volume support.

As the curtains draw on this performance, while short-term setups remain as mixed as a salad at a potluck, the grander tale of OP hinges upon its gallant capability to conquer the current resistance structure and solidify a glorious bullish continuation! 🎭✨

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-14 02:09