As a seasoned analyst with over two decades of experience navigating complex financial landscapes, I find the Strive Bitcoin Bond ETF an intriguing development. Having witnessed the rise and fall of various investment trends, I appreciate the innovative approach that Strive is taking to democratize access to Bitcoin bonds, traditionally exclusive instruments for high net worth individuals.

This “Strive Bitcoin Bond ETF” aims at offering both individual and institutional investors an effortless way to invest in financial assets that mirror Bitcoin’s performance.

A New Approach to Bitcoin Investing

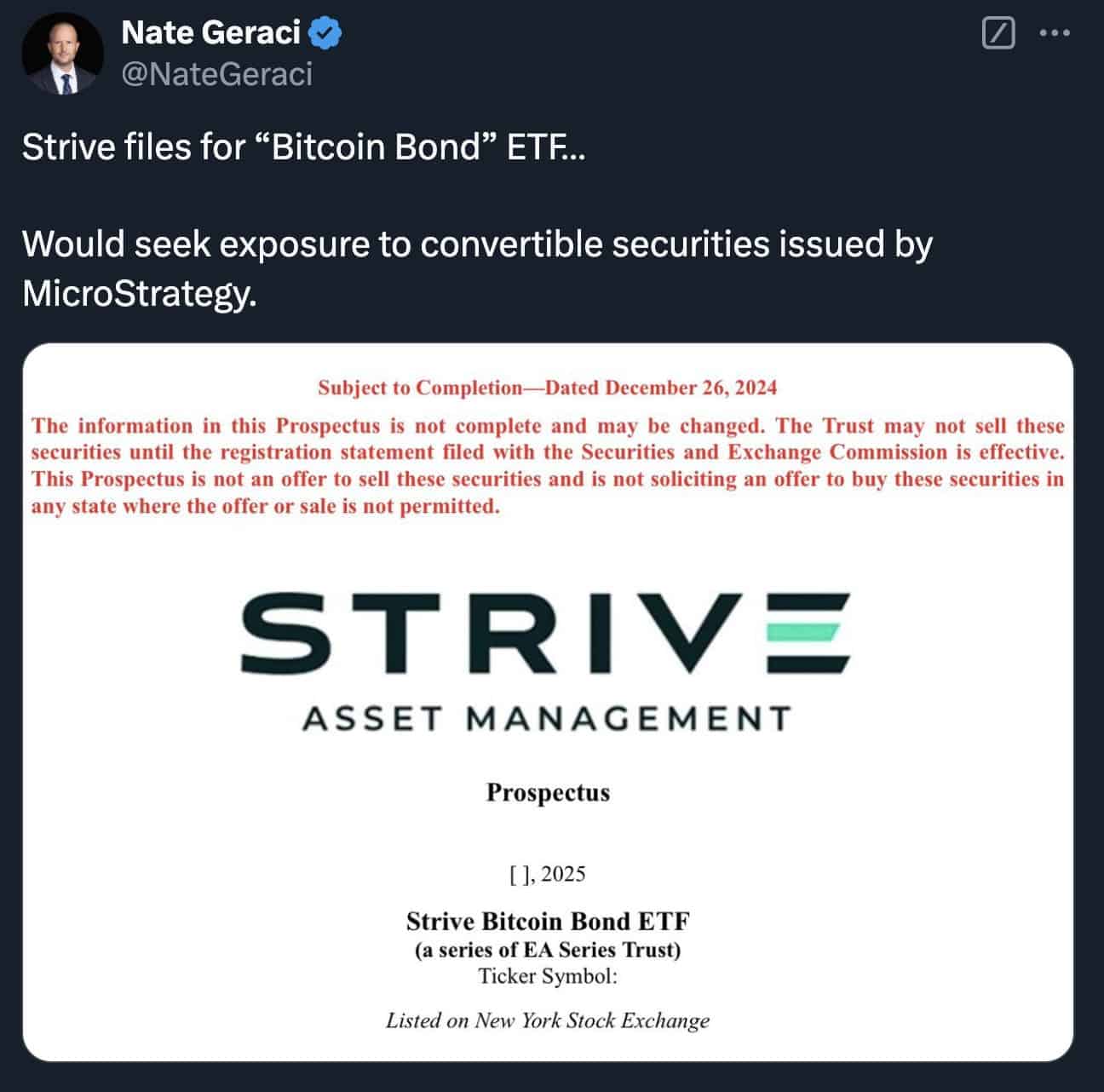

On December 27th, I announced via social platform X that Strive Asset Management is set to unveil our initial offering in a series of Bitcoin solutions. Our aim is to democratize access to Bitcoin bonds, making these high-potential financial instruments accessible to everyday investors.

Bitcoin corporate bonds, used to finance the purchase of Bitcoins, are known for their distinctive risk-reward characteristics. Unfortunately, these types of investments are typically hard for ordinary investors to access because of their complexity and limited availability. However, Strive’s ETF seeks to alter this situation by providing a simplified route for investing in financial products tied to Bitcoin.

The ETF will primarily invest in stocks from pioneering companies such as MicroStrategy, a company known for its early adoption of Bitcoin. Led by Executive Chairman Michael Saylor, MicroStrategy has amassed approximately $27 billion worth of Bitcoin since 2020. This accumulation was achieved through equity raises and convertible bonds, which are debt instruments that can be converted into shares under certain conditions.

How the ETF Will Work

As per the SEC filing, the Strive Bitcoin Bond ETF is designed to be actively managed and aims to gain exposure to bonds that are linked to Bitcoin. This can be achieved through direct investments or indirect methods such as swaps and options. To maintain liquidity and collateral, the fund will additionally invest in top-tier short-term assets like U.S. Treasuries and money market instruments.

As I delve into the world of Bitcoin-focused ETFs, it’s crucial to note that while the specific management fees for this particular fund remain undisclosed, it’s generally understood that actively managed funds can be more costly compared to their passive counterparts. This higher expense ratio is a reflection of the intricate knowledge and skill needed to maneuver through the labyrinth of Bitcoin bonds and associated derivatives.

Strive’s Strategic Vision

Established in 2022, Strive Asset Management has emerged as a forward-thinking investment company, focusing on addressing global economic issues such as inflation, debt crises, and geopolitical risks. The firm considers Bitcoin to be an effective long-term strategic investment for managing these pressures, referring to it as “an exceptionally compelling choice for risk reduction.

Strive’s recent effort in creating an ETF for Bitcoin aligns with its overarching goal to foster Bitcoin integration within varied investment portfolios. This new approach aims to make it easier for both individual and institutional investors to explore the idea of incorporating cryptocurrency as a cornerstone element in their financial plans by offering accessible Bitcoin bonds.

The Bigger Picture: Ramaswamy’s Leadership

Ramaswamy, renowned for his capitalist problem-solving style, has utilized his position as a businessman and political figure to advocate for inventive financial strategies. Although his 2023 presidential bid concluded with him endorsing Donald Trump, Ramaswamy’s impact increased following his appointment as co-head of the Department of Government Efficiency (D.O.G.E.), an initiative by the Trump administration aimed at minimizing government waste, in collaboration with tech titan Elon Musk.

Strive’s Bitcoin Bond ETF is another move by Ramaswamy towards transforming both the financial and political terrain, providing investors with a distinctive avenue to participate in the rapidly changing crypto market.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-28 13:08