As a researcher with a background in finance and cryptocurrencies, I find Jack Mallers’ insights into Bitcoin’s potential trajectory and its broader implications for the financial world to be both intriguing and thought-provoking. His bold forecast of Bitcoin reaching $1 million is not without merit, given the potential financial instabilities within bond markets and the resulting liquidity injections that could fuel asset price appreciation.

As an analyst, I had the opportunity to listen in on a captivating conversation between David Lin and Jack Mallers, the visionary CEO of Strike. Throughout the interview, Jack eloquently expounded upon Bitcoin‘s anticipated future direction and the far-reaching consequences it may have for the global financial landscape.

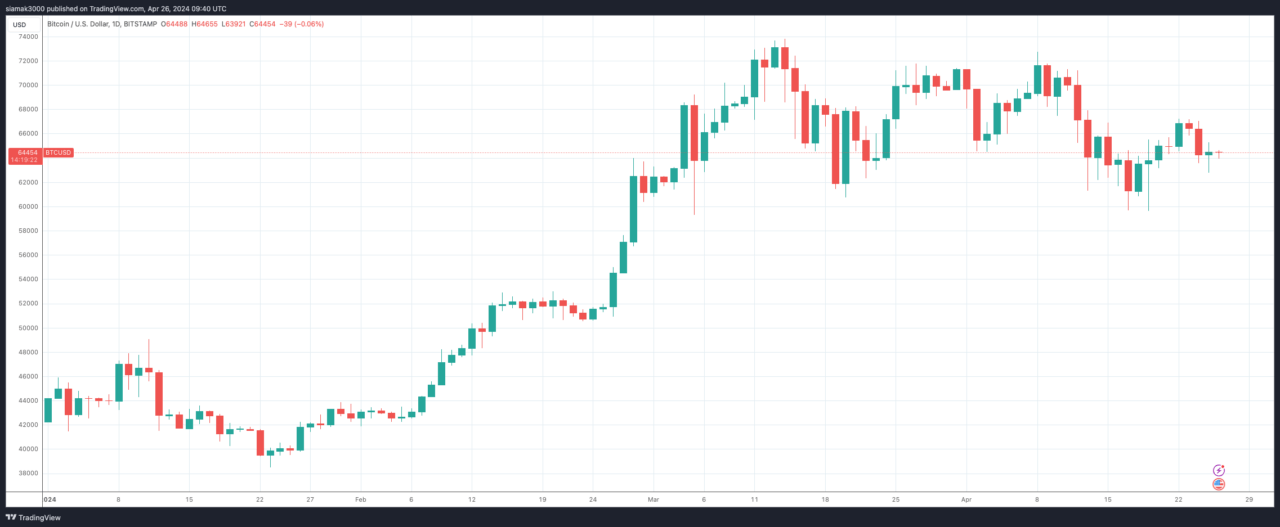

Jack Mallers initiated the conversation with a confident projection, implying that the value of Bitcoin could reach an astounding $1 million. This prophecy stems from Mallers’ analysis of the volatile bond markets, which have significant influence over banks. In his perspective, the potential necessity for a bailout to restore market stability could trigger substantial infusions of liquidity, consequently inflating asset prices, including Bitcoin. He underlined the rarity and finite nature of Bitcoin, which when coupled with heightened demand amidst financial turmoil, contributes to its remarkable growth.

As a researcher studying the digital currency landscape, I’ve come across Mallers’ perspective on Bitcoin being referred to as the “hardest” money ever created. He bases this assessment on Bitcoin’s limited supply, a feature that sets it apart from traditional fiat currencies which are susceptible to inflation. This inherent hardness makes Bitcoin an alluring option for those seeking a reliable store of value, surpassing even the appeal of conventional assets like gold whose quantity can still be expanded.

As an analyst, I’d rephrase it as follows: One of the key points of discussion was the Lightning Network and its significance in boosting Bitcoin’s functionality as a currency. According to Mallers, the Lightning Network tackles Bitcoin’s scalability concerns by enabling quicker and less costly transactions. Strike utilizes this technology to facilitate instant, cross-border Bitcoin transactions, highlighting its potential to process up to one million transactions per second. This feature, as Mallers points out, is revolutionizing Bitcoin into a more viable option for everyday transactions beyond being merely an investment asset.

A large part of the discussion focused on central banking systems and their impact on economies. Mallers argued against the power of central banks to devalue currency, consequently reducing people’s assets. He put forth Bitcoin as a groundbreaking solution, providing individuals with control through its decentralized and stable digital currency alternative to traditional fiat currencies.

I observed Mallers voicing doubts about the legitimacy of altcoins, including Ethereum, challenging their capacity to serve as genuine forms of currency. He contended that most altcoins are essentially technological projects instead of authentic monetary tools, frequently developed to exploit trends instead of providing meaningful monetary answers. Regarding Ethereum’s transition to proof-of-stake, he saw it as a deviation from being an unbiased, immutable monetary framework.

Moving forward, Mallers expressed bold intentions for Strike, intending to establish it as a front-runner in Bitcoin’s financial sector. He is convinced that Bitcoin will eventually assume the role of the global reserve currency. During the conversation, he highlighted Strike’s strategic growth into European markets and emphasized the importance of considering Bitcoin as genuine currency – a means to financial independence rather than merely a speculative investment.

Mallers revealed his unique financial method, consisting solely of holding Bitcoin and financing expenses via credit. By doing so, he keeps his investments limited to an asset that has been increasing in value, expressing his belief in Bitcoin’s future success.

At the time of writing (

Read More

2024-04-26 12:54