In a move that can only be described as the epitome of subtlety, Strategy (once known as MicroStrategy) seems poised to embark on yet another grand Bitcoin escapade.

The air was thick with conjecture following the enigmatic tweet by the co-founder, Michael Saylor, which was as clear as mud in the social media sphere.

The Crypto World Ablaze with Speculation Over Saylor’s Enigmatic Chart

On the 23rd day of February, Mr. Saylor, with the air of a man who knows too much, shared a Bitcoin tracker on X (the newfangled name for Twitter), a pastime that has so often heralded substantial Bitcoin purchases. His inscrutable message implied that his recent Bitcoin endeavors had not yet been accounted for in the tracker.

“I don’t think this reflects what I got done last week,” Saylor mused on X, as if discussing the weather or the latest fashion.

In light of his history of such chart-sharing precedents, the crypto enthusiasts were quick to surmise that Strategy was once again preparing to dip its toes into the Bitcoin pond.

“Michael Saylor posted his BTC purchase tracker again, meaning Strategy will announce another Big Bitcoin purchase tomorrow,” quipped Nikolaus Hoffman, as if he were revealing the plot of the latest novel.

Conjectures are rife that Strategy may set aside a princely sum of up to $2 billion for the procurement of Bitcoin, in harmony with its recent venture to amass funds through convertible bonds.

These bonds, devoid of interest yet capable of metamorphosing into company stock, are expected to reach maturity in the year 2030, and will stand as unsecured senior obligations. A rather sophisticated way of asking for a loan, one might say.

This capital campaign is but a chapter in Strategy’s “21/21 Plan,” which aims to amass a fortune of $42 billion for BTC investments. The company proposes to gather $21 billion through equity sales and an equal amount via fixed-income securities. A plan as ambitious as a Regency-era ball!

Once a purveyor of software, Strategy has transformed into the most prodigious corporate accumulator of Bitcoin. This strategic pivot has not only piqued the interest of investors but has also secured its stock a place in the esteemed Nasdaq-100.

Their last foray into Bitcoin acquisition occurred on the 10th of February, when they procured 7,633 BTC for the modest sum of $742.4 million. Presently, Strategy boasts a collection of 478,740 BTC, valued at approximately $47 billion, with an overall investment of $31.1 billion. A sum that would make even the most prudent of dowagers swoon!

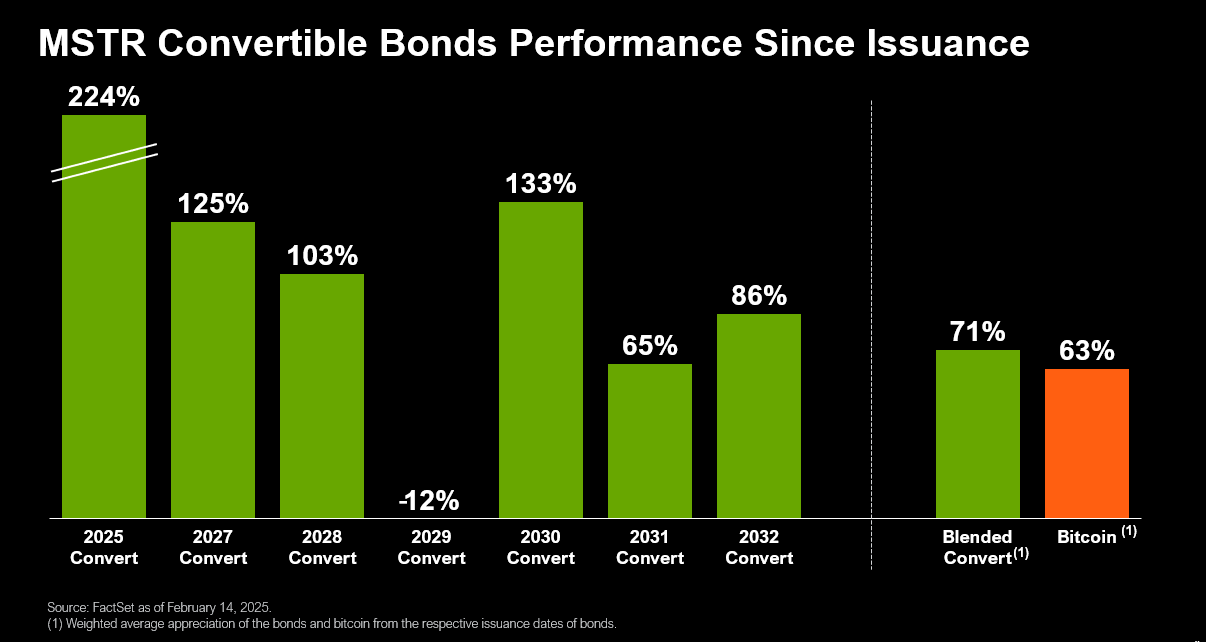

In a twist of fate, Strategy has highlighted that its MSTR convertible bonds have returned a remarkable 71% since issuance, outshining even the shiny Bitcoin itself.

Moreover, Strategy’s brazen BTC-first approach has ignited a trend among other companies. According to HODL15 Capital, over 70 publicly traded firms worldwide have now succumbed to the allure of Bitcoin, all under the influence of Saylor’s grand Strategy. A testament to the power of one man’s vision!

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-02-23 20:52