Strategy (MSTR) experienced a challenging 2025, with its share price declining by 48%, significantly outpacing the 5% decrease observed in Bitcoin. While the company maintains a substantial position as the largest corporate holder of Bitcoin, a critical assessment of its financial performance and strategic positioning is warranted. The question is not whether a recovery is possible, but whether the current valuation adequately reflects the inherent risks associated with this highly correlated, yet amplified, investment vehicle.

Correlation & Divergence: Examining Historical Performance

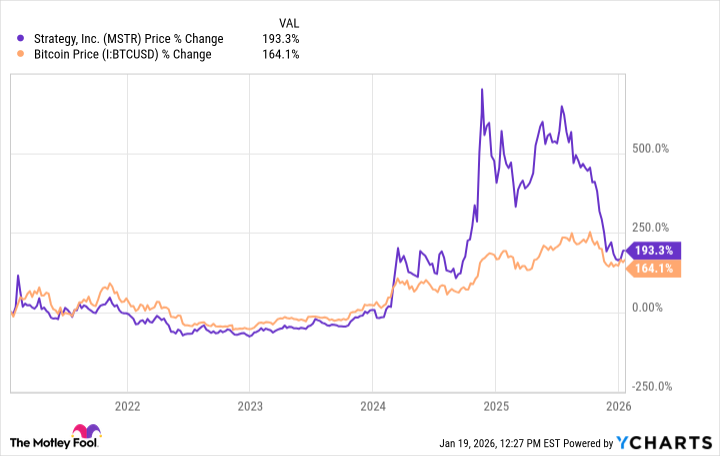

Over the past five years, Strategy’s stock performance has demonstrated a strong correlation with Bitcoin’s price movements. However, this correlation is not symmetrical. While Bitcoin experienced modest gains in 2025, Strategy’s decline was disproportionately severe. This divergence underscores the company’s inherent volatility, effectively magnifying both potential upside and downside risks for investors. The 2024 rally, which saw Strategy increase by 359% against Bitcoin’s 119% gain, serves as a precedent for this amplified effect.

Year-to-date figures as of January 19th and 20th continue to illustrate this trend, with Strategy outpacing Bitcoin’s gains. While this may appeal to bullish investors, it is crucial to recognize that the stock’s performance is inextricably linked to the volatile cryptocurrency market. Predicting Bitcoin’s trajectory, therefore, becomes a prerequisite for estimating Strategy’s future performance—a task that, while not necessarily more complex, introduces a significant degree of speculation.

Fundamental Considerations: A Business Built on Digital Assets

Investing in Strategy is, fundamentally, a bet on Bitcoin. While the company generates revenue from its enterprise analytics software, this component represents a diminishing portion of its overall financial performance. The primary driver of profitability remains the unrealized gains and losses associated with its digital asset holdings. In the most recent quarter, unrealized gains of $3.9 billion eclipsed the $129 million in revenue generated from core business operations.

Strategy’s self-proclaimed identity as “the world’s first Bitcoin treasury company” further reinforces this dependence. The company’s stated objective – to accumulate Bitcoin – effectively transforms the stock into a speculative investment vehicle. This is not inherently negative, but it necessitates a clear understanding of the associated risks. A decline in Bitcoin’s value will, inevitably, translate into a corresponding decline in Strategy’s share price, potentially exceeding the losses incurred by direct Bitcoin ownership.

Outlook for 2026: Contingencies and Valuation Concerns

Strategy’s performance in 2026 will be inextricably linked to the trajectory of Bitcoin. The initial gains observed in early 2026 have since stalled, raising concerns about potential downside risks. A lack of anticipated interest rate cuts, coupled with deteriorating economic conditions, could further exacerbate these concerns. Historical precedent – the 65% decline in Bitcoin and 74% decline in Strategy shares during the economic uncertainty of 2022 – serves as a cautionary tale.

Despite the recent decline, Strategy’s market capitalization of $50 billion remains elevated, particularly given its underwhelming core business and lack of sustainable competitive advantages. The stock appears to represent a riskier, more volatile iteration of Bitcoin itself. Investors may, therefore, be better served by directly investing in the underlying cryptocurrency, mitigating the added layer of complexity and potential dilution inherent in Strategy’s share structure.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-20 23:12