One might say the stock market’s recent record-breaking performance has left investors in a state of delightful perplexity, rather like a gentleman discovering his waistcoat buttons have sprung while delivering a toast at the annual shareholders’ ball. [shortcode:market_sentiment]

According to the estimable MDRT’s December report, some 80% of Americans regard the economic horizon with the caution of a man approaching a suspiciously placid pond, while 44% of investors maintain the optimism of a debutante at her first garden party. [shortcode:investor_poll] These contradictory impulses are perfectly natural, my dear fellow – akin to worrying about the weather while simultaneously hoping for a splendid sunset.

Now, while no one can predict the market’s next pirouette (not even the chaps in pinstripes with their fancy algorithms), history offers both cautionary tales and silver linings. Let us first don our raincoats for the bad news, then polish our spectacles for the brighter prospects ahead.

The Inevitable Cloud Over the Picnic

Consider the Buffett Indicator – that venerable contraption Warren Buffett once compared to a cricket scoreboard for stock market valuations. When this ratio of total market cap to GDP approaches 200%, he warned, it’s rather like seeing ominous clouds gathering over the village green. [shortcode:buffett_wisdom]

“When this little gadget dips below 70%, buying shares is as safe as a well-tied cravat,” Buffett reportedly declared to Fortune magazine during the tech bubble’s heyday. “But should it approach 200% – as it did in 1999 – one might as well be juggling lit candles in a powder magazine!”

At present, this financial barometer stands at 234% – a figure that would make even the most stoic City banker raise an eyebrow. Yet we must remember: indicators are like weather vanes; they point the direction but cannot predict sudden gusts.

The Sun Behind the Clouds

True, 2026 might bring market turbulence akin to a vicar’s bicycle ride through a hailstorm. But history demonstrates that even the stormiest weather eventually clears. [shortcode:market_cycles]

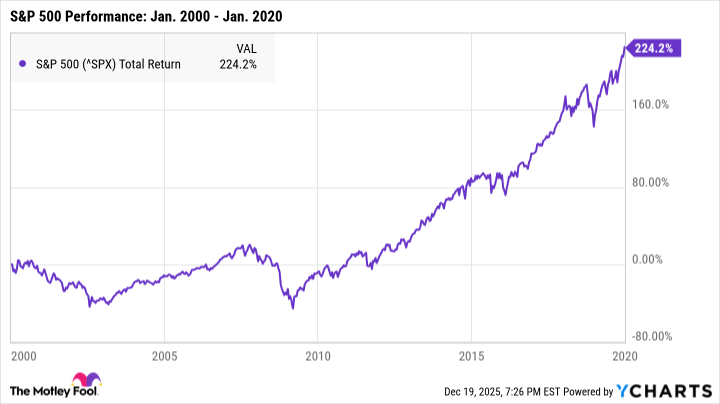

Take the S&P 500’s adventures at the turn of the century – a period that tested investors’ resolve like a poorly cooked breakfast kipper. Those who held fast through the dot-com bust and Great Recession would have seen their patience rewarded with 224% total returns by 2020. [shortcode:historical_data]

Crestmont Research’s analysis confirms this Jeeves-like resilience: over 20-year periods, the market has never failed to turn a profit. It’s rather like trusting your butler to rescue the dinner party – eventually, the soup will be warmed and the guests properly seated.

So while 2026’s script remains unwritten, remember: activist investing demands neither crystal balls nor rainmaking charms. By acquiring quality stocks (the financial equivalent of well-tailored tweed) and exercising strategic patience (that essential accompaniment to afternoon tea), one positions oneself beautifully for whatever surprises the market maestro has in store.

After all, as my Aunt Hortense always says while navigating her motorcar through country lanes: “Better to keep driving calmly than to panic-brake into a hedge.” 📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-12-21 19:23