As a seasoned analyst with over three decades of experience navigating various market cycles, I find the current economic climate intriguing yet challenging. The recent job report and its impact on global markets, as discussed by David Lin and Clem Chambers, is a clear indication that we’re living in interesting times.

On August 2, a video was shared featuring David Lin from “The David Lin Report” conversing with Clem Chambers, who is the CEO of Online Blockchain. They delved into the ongoing market slump and explored possible consequences.

Market Reaction to Jobs Report

The unemployment rate has ticked up to 4.3%, leading to significant market reactions:

- NASDAQ: Down by 2.43%

- VIX (Volatility Index): Spiked by over 94% in the past one month period

- Gold: Went down slightly on Friday, but is still close to its all-time high

- Bitcoin: Down 9% in the past seven-day period

As an analyst, I attribute the recent market fluctuations to the intricate dance between money inflows and central bank policies, with a keen focus on the maneuvers by the Bank of Japan.

Yen/USD vs. Stocks

Chambers lays out the idea behind carry trades, where investors borrow funds at relatively low rates (originally from Japan) and put them into assets with higher returns such as U.S. equities. However, since Japan has recently raised its interest rates, these investors must withdraw their investments, triggering a chain reaction in global financial markets. He suggests that this withdrawal of funds is a major contributor to the ongoing economic slump.

As an analyst, I find the Japanese Yen to U.S. Dollar chart particularly noteworthy in today’s global economic landscape.

— Ran Neuner (@cryptomanran) August 2, 2024

Will the Market Crash Continue?

In simpler terms, Chambers ponders over the potential for an extended market slump, yet seems more inclined towards a correction as opposed to a severe crash. He underscores the importance of the Federal Reserve in regulating the flow of money and points out that their recent actions hint at an effort to steady the economy.

VIX and Market Sentiment

As an analyst, I’ve observed a significant increase in the VIX, a metric often referred to as the “fear index.” However, upon closer examination, I believe this surge doesn’t necessarily indicate widespread fear but rather heightened uncertainty within the market. This uncertainty is a direct response to the unpredictable economic conditions we’re currently navigating.

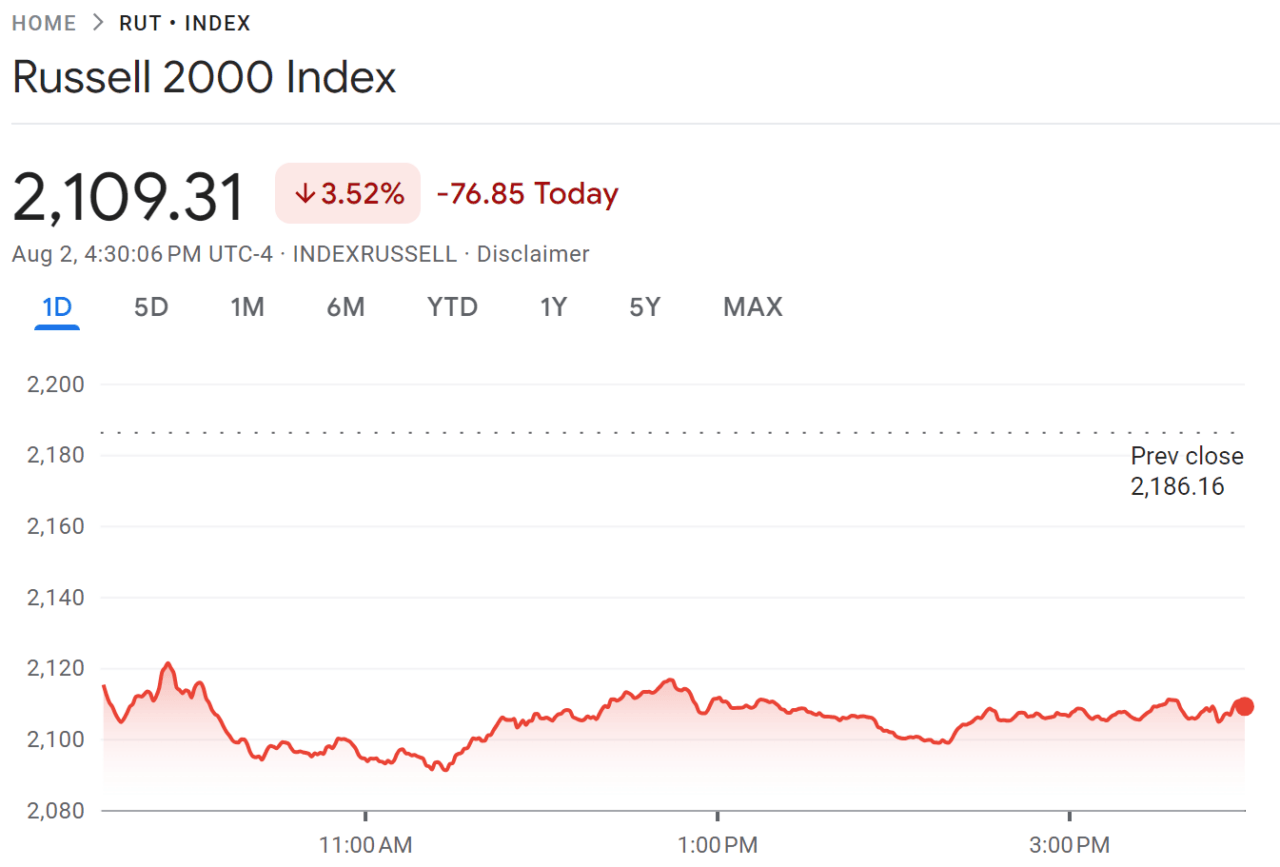

Russell 2000 and Market Rotation

According to Chambers, the Russell 2000 index, comprising small-sized companies’ stocks, initially profited as funds shifted away from large tech corporations. However, these initial gains have since been reversed. He believes this shift in investment is due to investors seeking out safer or more rewarding opportunities amidst the current market turbulence.

How to Play ‘Uncertainty’

As a diligent researcher, I wholeheartedly endorse the importance of comprehensively understanding one’s investment positions and strategies. This knowledge equips us with a robust foundation to navigate through turbulent market conditions. I emphasize the significance of having a well-reasoned approach for investments, as it empowers us to weather the current financial storm more effectively.

Rate Cut vs. Stocks

Recently, the Bank of England reduced interest rates, yet the FTSE 100 index kept falling. As per Chambers’ analysis, financial markets frequently consider anticipated future events, and a rate reduction could indicate potential economic hardships on the horizon, which might explain the unfavorable responses from the market.

Bitcoin

Bitcoin, like other financial markets, is influenced by broader economic movements. Although it’s had some encouraging news, such as the possibility of strategic U.S. reserves, its value continues to fluctuate significantly. According to Chambers, Bitcoin should be seen as a long-term investment with considerable potential, but one that necessitates a great deal of patience and a sturdy constitution for dealing with volatility.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-08-03 07:14