As a seasoned researcher with decades of experience under my belt, I find myself constantly intrigued by the dance between economic indicators and financial markets. The latest “Personal Income and Outlays” report from the BEA provides yet another fascinating insight into this delicate ballet.

On November 27, 2024, the U.S. Bureau of Economic Analysis (BEA) published its “Personal Income and Expenditures” report for October. This report showed steady income expansion, moderate upticks in consumer spending, and persistent inflation surpassing the Federal Reserve’s desired long-term level. These statistics are crucial for predicting the Federal Reserve’s future decisions on monetary policy and their potential effects on financial markets.

In October, personal income saw a growth of approximately 0.6%, totaling an additional $147.4 billion, due to boosts in employee wages, investment returns, and government aid payments. Adjusted for taxes, disposable personal income (DPI) rose by about 0.7% or $144.1 billion. During the same period, personal consumption expenditures (PCE) increased by 0.4%, amounting to an additional $72.3 billion. This increase was primarily due to higher spending on services like healthcare and housing, while purchases of goods decreased slightly.

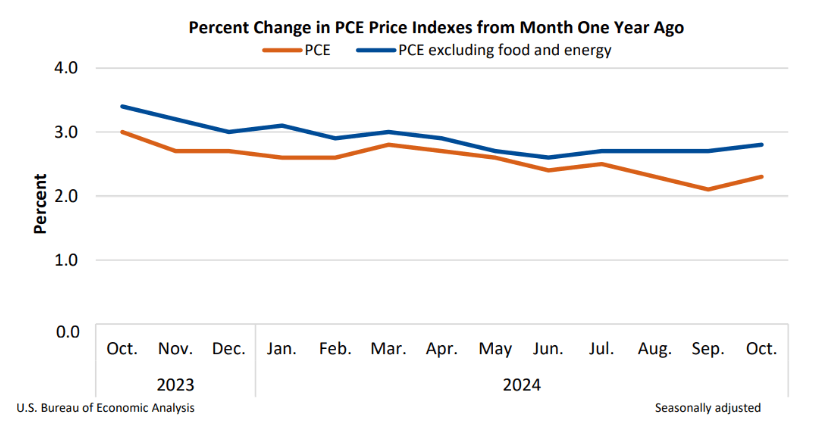

The inflation story remains critical. The PCE price index, the Federal Reserve’s preferred measure of inflation, rose by 0.2% in October and 2.3% over the past year. Core PCE, which excludes food and energy, increased by 0.3% for the month and 2.8% on an annual basis, both slightly higher than the September figures. Housing costs and service prices were significant contributors to inflation, while goods prices fell. Energy prices dropped by 0.1%, and food prices remained nearly flat.

As an analyst, I’ve observed a cautious market response to the recent data at 11:07 a.m. ET. The Dow Jones Industrial Average is showing a slight increase of 44 points (+0.10%), while the S&P 500 and Nasdaq Composite are experiencing declines by 0.37% and 0.97%, respectively. On the other hand, the Russell 2000 index is inching up 0.24%. The uptick in market volatility, as indicated by a 2.34% rise in the VIX to 14.43, underscores investor concerns about ongoing inflation pressures. These contrasting movements hint at investor apprehension regarding how these pressures might impact the Federal Reserve’s plans for future interest rate adjustments.

Traders who specialize in interest rates are increasingly predicting a reduction of 0.25% at the FOMC meeting scheduled for December 18. As per the FedWatch Tool by CME Group, as of November 27, the likelihood of such a rate cut has surged to 69.7%, an increase from 59.4% only the day before. This sudden rise in anticipation is taking place despite inflation levels that continue to exceed the Federal Reserve’s desired 2% level, indicating the central bank’s difficulty in maintaining both price stability and economic growth.

Despite a 0.4% increase in October consumer spending measured in current dollars, there were indications of a potential slowdown compared to September’s pace. After accounting for inflation, the real spending increase was minimal at 0.1%. Spending on goods didn’t move much, whereas services spending rose by 0.2%, driven mainly by increased expenditure on recreational goods and healthcare services. The personal saving rate dropped to 4.4%, reaching its lowest point since January 2023, hinting that households might be feeling economic strain despite robust wage growth.

The October inflation figures reveal a conflict between ongoing price increases and the Federal Reserve’s planned gradual decrease in interest rates. The increase in the annual core PCE inflation to 2.8% indicates that the Fed’s anticipated reduction in rates might not be as simple as market expectations suggest. Although the data has sparked anticipation for an interest rate cut in December, investors continue to exercise caution, reflected in the uneven performance of risky assets such as stocks.

Regarding the cryptocurrency market, there appears to be no immediate response to the recent news, as Bitcoin is currently being traded at approximately $95,534, representing a 2.24% increase over the last day.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

2024-11-27 19:25