Ah, Steven A. Cohen, the enigmatic figure of our financial epoch-a billionaire whose very name conjures visions of Wall Street grandeur while simultaneously inspiring indifference from the typical investor. Founder of Point72 Asset Management and owner of the New York Mets, Cohen has always been a curiosity, a character perhaps too grand for even the most extravagant of novels. Rumor has it that he was the muse-if one can dare to say it-behind Bobby Axelrod of Showtime’s Billions.

But let us not indulge in idle gossip. Cohen is a man of few interviews; his thoughts on the inner machinations of his firm slip away like fog in the morning sun. Much to the delight of everyday investors, his quarterly 13F filings provide a tantalizing glimpse into the mind of one of finance’s sharpest-but peculiar-wits.

In the latest filing, a delightful tableau unfolds: Point72 has completely stepped away from SoundHound AI (SOUN) whilst eagerly embracing semiconductor darling, Nvidia (NVDA). A curious choice, we shall explore the inkling behind such murmurs.

The Curious Case of SoundHound AI

On the surface, one might see SoundHound AI as a splendid companion for a hedge fund poised to ride the AI wave. Its ventures-voice-recognition and conversational AI-grace platforms ranging from your beloved car’s dashboard to IoT wonders. Oh, how charming!

Yet, dear reader, the scene is less whimsical when exposed to the harsh light of competition. Giants like Apple with Siri, Amazon with Alexa, and both Alphabet and Microsoft gallantly constructing their voice-enabled empires leave little breath for smaller entities like SoundHound.

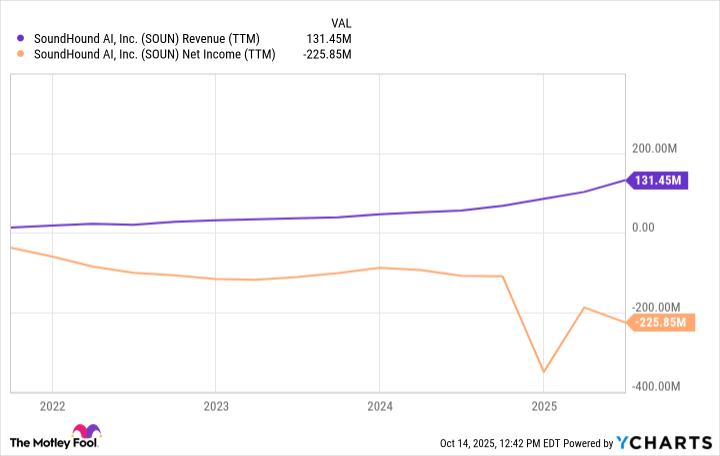

It would appear, in the grand theatre of investment, Cohen viewed SoundHound’s market position as being rather less than stellar. Despite its commendable technology and partnerships sprouting like unwanted weeds, SoundHound’s inability to develop profits raises questions. Where, indeed, would the funds for their future flourish come from?

In an industry akin to the desperate chase for a mirage, where customer acquisition costs soar and barriers to entry are ludicrously thin, Cohen, ever the practical gentleman, seems to have shifted his funds toward those with stronger foundations. SoundHound’s stock-a tragicomedy in price movements-has fluttered on bursts of excitement that certainly trump consistency or tangible earnings.

Thus, one could conclude that Point72 deemed SoundHound merely a fleeting dalliance, diverting any gains towards entities with resilient fortifications and predictable growth paths.

Cohen’s Grand Affair with Nvidia

In stark contrast, Nvidia presents itself as a shimmering phoenix in comparison to the lifeless bird of SoundHound. Its ascent seems nothing short of unstoppable. As the backbone of the AI renaissance, Nvidia supplies the very GPUs that breathe life into everything from complex algorithms to the marvels of autonomous vehicles.

In the delightful second quarter, Cohen chose to inflate Point72’s Nvidia holdings by an impressive 207%, procuring approximately 4.3 million shares. How utterly charming! And with a careful smattering of options-both call and put-Cohen exhibits the sophisticated finesse only a master financier could charm out of a sluggish market.

But what exactly drives his newfound bullish fervor?

The New Gold Rush: AI Infrastructure

The madly ambitious cloud hyperscalers-one’s usual suspects, Microsoft Azure, Google Cloud Platform, AWS, and the delightful Oracle-are poised to invest a staggering $500 billion into capital enhancements next year. Simultaneously, the U.S. government, in its infinite wisdom, aims to contribute an additional half-trillion dollars to AI technology as it saunters into the realm of strategic necessity. By 2030, total data center investments may reach an astounding $7 trillion! How positively scandalous! Such indulgence ensures Nvidia’s rightful place as an invaluable supplier in this intricate drama.

Stock-Split Delight

Savor, if you will, the delightful aftermath of Nvidia’s stock split last June-shares have risen approximately 50%. This delightful maneuver appears to have sparked a revival of enthusiasm among buyers, spurring the company’s rather admirable rally.

A Wrestle Between Innovation and Revenue

Nvidia’s forthcoming chip architectures-Blackwell Ultra and Rubin-will flaunt their prowess alongside the CUDA software ecosystem, thereby establishing formidable barriers that extend far beyond mere silicon. This exhilarating blend of hardware genius and recurring software income gives Nvidia a rare and enviable duality-one that discerning portfolio managers likely recognize as the essence of sustainable growth and profit margin expansion.

The Unfolding Narrative: Speculation to Substance

Thus, Cohen’s latest flirtation with Nvidia seems to signal a thoughtful pivot from whimsy to weight-a transition from chasing fancies to investing in the very infrastructure that will power an AI-infused future. Instead of gambling on quaint, niche operations, Cohen appears to have taken a fancy to the foundational elements sustaining the entirety of the AI ecosystem.

For investors, herein lies a crucial lesson: in today’s capricious bull market, the virtues of scale, dominance, and elegant execution far surpass the thrill of novelty. Hedge funds like Point72 seem to be tactfully repositioning, reallocating capital from speculative follies to the core strongholds poised to foster growth well into the forthcoming decade.

How utterly delightful! 🍸

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- USD COP PREDICTION

2025-10-19 01:28