In the grand theater of the financial world, where fortunes are made and lost with the flick of a wrist, Stellar (XLM) has taken a bold leap, surging more than 10% in the last 24 hours. This audacious attempt to recover from a 15% correction over the past month is akin to a phoenix rising from the ashes, albeit with a market cap now standing at a staggering $8.6 billion.

Ah, the technical indicators! They whisper sweet nothings of increased buying pressure, with the DMI and CMF both singing praises of growing accumulation. Yet, like a stubborn mule, XLM still faces key resistance levels. The question looms: can it sustain this momentum, or will it be destined for further consolidation? 🤔

XLM Chart: The Buyers’ Dance

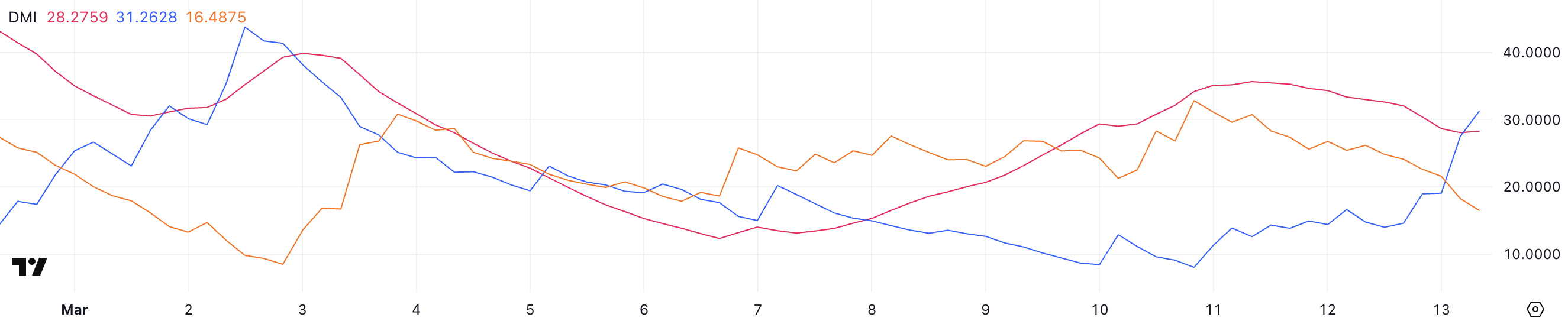

Behold the DMI chart of Stellar, where the Average Directional Index (ADX) has plummeted to 28.7, a fall from grace from 35.6 just two days prior. This ADX, a noble indicator of trend strength, reveals that values above 25 signal a strong trend, while those below 20 suggest a market in a state of confusion.

As the ADX declines, even while the price dances in a certain direction, it indicates that the strength of the trend is fading faster than a summer’s day. The drop from 35.6 to 28.7 hints at a weakening bearish trend, creating a tantalizing opportunity for a possible shift in momentum. 🐢

Turning our gaze to the Directional Indicators, we see +DI has surged to 31.2 from a mere 8, while -DI has dropped to 16.4 from 30.7. This dramatic shift in buying and selling pressure suggests that the bulls have regained control after a period of strong selling. 🐂

As Stellar attempts to transition from a downtrend into an uptrend, this increase in +DI is a positive signal. However, for the new trend to gain strength, the ADX must stabilize and turn upward, confirming the growing momentum. If the ADX continues its descent, XLM may consolidate before making a decisive move. But if it rises alongside +DI, we may witness a stronger breakout to the upside. 🎉

XLM CMF: The Money Flow Chronicles

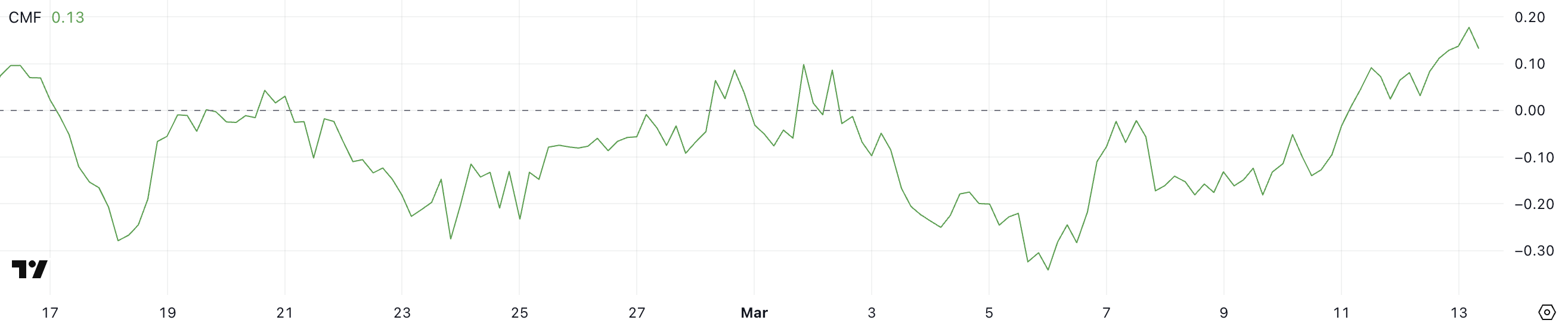

Stellar’s Chaikin Money Flow (CMF) indicator has risen to 0.13, a remarkable recovery from -0.14 just three days ago, after briefly peaking at 0.18 a few hours ago. The CMF, a wise sage that measures buying and selling pressure, analyzes both price movement and volume on a scale from -1 to 1.

A positive CMF value suggests that buying pressure is dominant, while a negative reading indicates stronger selling activity. Values above 0.05 signal accumulation, while those below -0.05 indicate distribution, making CMF a useful tool for assessing whether capital is flowing into or out of an asset. 💰

With Stellar’s CMF now at 0.13, buying pressure has clearly strengthened, reversing the prior bearish trend seen when CMF was negative. This shift suggests that investors have been accumulating XLM over the past few days, supporting its recent price recovery. However, since CMF peaked at 0.18 before slightly declining, one might wonder if some short-term profit-taking has occurred. 🤑

If CMF remains in positive territory and trends higher again, it will reinforce further upside potential. But beware! If it starts dropping back toward negative values, it could signal weakening demand and a possible price pullback. 😬

Will Stellar Surpass $0.35 In March?

Stellar’s EMA lines still indicate a bearish trend, with short-term EMAs positioned below the long-term ones. However, the recent upward movement in short-term EMAs suggests that momentum could be shifting, increasing the chances of a trend reversal.

If buying pressure continues, Stellar’s price could rise to test the resistance at $0.309, a key level that would determine whether the recovery can sustain itself. A breakout above this

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-03-14 02:32